When purchasing a car, the driver will certainly be faced with the need to take out a compulsory motor liability insurance policy. Decipher the abbreviation, and it becomes clear that this agreement is mandatory, and it implies liability insurance. By concluding it with the car owner, the insurance company provides protection for people and their property if they are injured in an accident caused by the insured person. Thanks to insurance, a person will not have to compensate for the damage on his own.

There are desperate people who allow themselves to drive their new car onto the road when the permitted 10 days have already passed. The reasons are different for everyone, but no matter what, the driver faces a fine. And this penalty for lack of insurance (MTPL) is the maximum. The traffic police inspector may hint at evacuation, even about removing license plates, but this is just a way to intimidate the driver. Such drastic measures were canceled back in November 2014. So, what happens if you drive without insurance?

What does the law say?

The presence of a compulsory motor liability insurance policy is recognized as mandatory:

- Traffic rules;

- Federal Law No. 40;

- Code of Administrative Offenses of the Russian Federation and is regulated by them.

And what do the new rules of 2019 say about those who face a fine for such a violation?

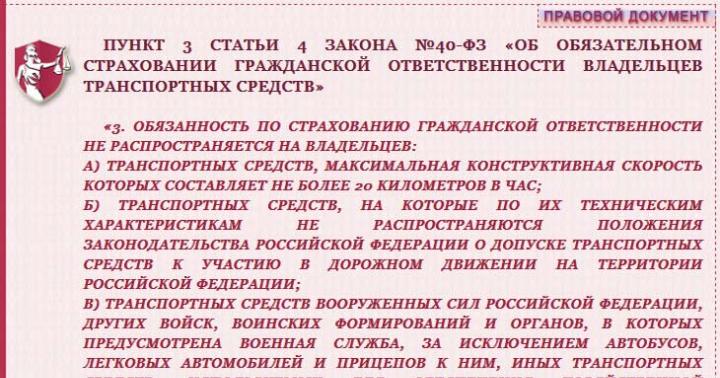

Paragraph 3 of Article 4 No. 40-FZ contains a list of those categories of owners who are not subject to administrative liability:

- car owners whose vehicle reaches a design speed of a maximum of 20 km/h;

- car owners who are not allowed to participate in road traffic on Russian territory;

- legal entities with military transport on their balance sheet, which is involved in meeting the needs of the army, except for equipment serving the economic units of military units;

- car owners whose vehicle is registered abroad and have international Green Card insurance;

- owners of passenger trailers;

- owners of tracked, sled and other non-wheeled vehicles.

This relaxation should not serve as a reason for a complete abandonment of compulsory motor liability insurance.

Important! Car liability insurance still remains the responsibility of the car owner.

Article 12.37 of the Code of Administrative Offenses of the Russian Federation talks about the driver’s responsibility for driving without insurance in the following cases:

- when the policy is issued, but you don’t have it with you - it is forgotten at home or not printed;

- when the car owner drove the car during a period not covered by the policy (we are not talking about expired insurance);

- when there is no insurance at all (the policy was not issued at all or is expired).

Fines for driving without compulsory motor liability insurance in 2019 - let's look at specific cases

I don’t have the policy with me

In this case, we are talking about a valid document in which the driver is entered, a contract that actually exists, but, by chance, was forgotten at home.

Punishment for such an offense, according to Part 2 of Article 12.3 of the Administrative Code, can be reduced to a verbal warning, but they can also be fined 500 rubles.

In any case, the punishment will be such only if you are able to prove to the inspector that you really have insurance. This can be confirmed by:

- MTPL policy number;

- name of the insurance company;

- Telephone number of an insurance agent who can confirm your assurances.

If the traffic police inspector still did not check and issued a fine for a large amount, the driver has the right to complain to the head of the traffic police, attaching a copy of the current policy. As soon as a positive decision is made on his application, the amount of the punishment will be reduced.

Driving a car during a period not covered by the policy

In most cases, the MTPL agreement is concluded for a whole year. But in 2019, any driver has the right to reduce this period, and therefore the period of use of the vehicle itself.

For some, for example, such a need arises only during the summer season, so a six-month policy would be quite appropriate. This circumstance, moreover, reduces the cost of the service. But driving a car is also possible in certain seasons. But if a summer resident leaves in his car at the “wrong” time, according to Part 1 of Article 12.37 of the Administrative Code, he will be subject to a fine of 500 rubles.

The driver is not listed in the insurance

This situation happens quite often. All of a sudden, you need to get behind the wheel of someone else's car instead of a driver who is unable to drive his own vehicle, and there is no time to reissue the policy. You will have to pay a fine for a driver who... It is the same 500 rubles.

By the way, the car owner may try to shift responsibility to the person who was driving.

If the owner of the car transferred control to another person, and he did not have a driver’s license with him, he will not get off with an insurance fine alone. You will also have to pay 3 thousand rubles for the fact that control of the vehicle is transferred to a person who does not have a driving license (under Part 3 of Article 12.3).

And this is not all the troubles that this situation threatens. If an accident occurs, the insurance company will compensate for the damage to the victim, but, at the same time, will also bring a claim to the owner of the car for compensation for losses incurred.

Lack of compulsory motor liability insurance

Some drivers deliberately do not sign a car insurance contract. In this case, the penalty is 800 rubles.

And it will be applied when the 10 days allotted by law for registering a vehicle with the traffic police expire. And during this period, it is enough to present the purchase/sale agreement to the inspector, and you are free.

An MTPL insurance policy whose term has already expired is considered missing and is punished with the same amount - 800 rubles (see Part 2 of Article 12.37).

So, let's briefly repeat everything again in the video:

Possible discount when paying fines

Car owners will be interested to know that they can count on a 50% discount when paying fines for driving without a compulsory car insurance policy.

If the fine is paid in the first 20 days from the date of the decision on the administrative offense, then the violator can, instead of 500, pay 250 rubles, and 400 - instead of 800 rubles.

Responsibility for repeated violation

Important! The Administrative Code does not prescribe separate punishments for drivers who are repeatedly detained without a compulsory motor liability insurance policy.

So every time, stopping a car and not finding a valid policy on the driver, the traffic police inspector will issue another fine, and its size depends on the reason why the document cannot be presented.

The law does not provide

If the driver drives without compulsory motor insurance, these types of punishments are illegal in 2019:

- detention of a vehicle;

- his evacuation to the impound lot;

- removing license plates from a car.

All car enthusiasts know whether it is possible to drive without an MTPL policy. But many of them do not take seriously the fines provided for by the Law for those who allow driving without insurance. But in vain. Who knows how many times a driver will find himself in a similar situation. And you have to pay every time. So easily the amount of fines can grow to a decent size and cover the cost of the policy itself.

Important! If there is no compulsory insurance, even if the car owner has purchased an expensive CASCO policy, a fine is inevitable anyway.

To avoid unpleasant situations, it is better to insure your own vehicle in a timely manner and monitor the validity period of the document.

The fine for driving without MTPL insurance in 2019 can range from 500 to 800 rubles. You may only receive a warning.

In this material we will consider in what cases and what the driver faces.

In 2015, the cost of compulsory motor liability insurance was significantly increased, in 2019 the cost increased again for many drivers, as a result, drivers began to massively ignore the requirement to insure their civil liability. Accordingly, the question arose about what fine you will have to pay if you are stopped by an inspector. The first thing he will require is the documents that you must provide in accordance with paragraph 2.1.1 of the Traffic Rules.

A fine for lack of compulsory motor insurance is the most harmless thing that can happen. In practice, there are cases when apartments had to be exchanged in order to pay for an accident.

The likelihood of getting into an accident only increases with the number of cars. OSAGO is not something worth saving on.

Queues in offices and the imposition of “extras” are already a thing of the past. You can receive or renew your policy within 15-20 minutes by simply filling out the form below. All that remains is to choose the insurance company with the best price offer.

Get an MTPL policy online

Requirements of the Traffic Rules for presenting an MTPL policy

2.1. The driver of a motor vehicle is obliged to:

2.1.1. Carry with you and, upon request, hand over to police officers for inspection:

- insurance policy of compulsory civil liability insurance of the vehicle owner or printed on paper

information on the conclusion of such compulsory insurance agreement

in the form of an electronic document in cases where the obligation to insure one’s civil liability is established by federal law.

The insurance policy or information about the electronic policy is required to be submitted to the inspector.

But what to expect when there is no compulsory motor liability insurance policy? Read the article to the end to avoid becoming a victim of a scam by unscrupulous inspectors.

If you issue an electronic policy, it is enough for the inspector to present a printed copy of the electronic document.

First, let's define what the abbreviation OSAGO is - Mandatory Insurance AutoCivil Liability. Please note that the driver does not insure property, but his own liability. Those cases when he will be financially responsible to another person. At the time of the insured event, the driver must have a valid MTPL agreement with the insurance company, issued in his name and corresponding to the vehicle that the driver is currently driving. Or a policy without restrictions.

Situations when there may be no compulsory motor liability insurance policy

There are various reasons why the driver is not able to transfer the insurance policy to the inspector. Depending on the specific situation, the fine for driving without insurance will be different amounts or you may only receive a warning.

- Absence of an insurance contract in principle, an illegally purchased policy not in the database;

- An expired policy, a policy in which another person is included, a policy in which another vehicle is included;

- If you do not have the insurance contract with you, it is forgotten, lost, or other reasons that do not allow it to be handed over to the inspector on the spot.

Each case provides for a separate fine - this is important to know, since the inspector can impute any of these cases.

What is the fine for driving without MTPL insurance?

Liability for the first case is provided for in Part 2 of Article 12.37:

Failure by the owner of a vehicle to fulfill the obligation established by federal law to insure his civil liability, as well as driving a vehicle if such compulsory insurance is known to be absent, -

a fine of 800 rubles.

The second case is more loyal to the driver and is described in Part 1 of Article 12.37:

Driving a vehicle during the period of its use, not provided for by the insurance policy of compulsory insurance of civil liability of vehicle owners, as well as driving a vehicle in violation of the conditions stipulated by this insurance policy for driving this vehicle only by the drivers specified in this insurance policy -

entails the imposition of an administrative a fine of 500 rubles.

In the third case, you may be left without a fine at all on legal grounds and receive only a warning. Part 2 of Article 12.3 is about this:

1. Driving a vehicle by a driver who does not have registration documents for the vehicle, and in established cases, documents provided for by the customs legislation of the Customs Union, with marks from customs authorities confirming the temporary import of the vehicle -

entails warning or imposition of administrative a fine of 500 rubles.

Can a car be towed for lack of compulsory motor insurance?

No, they do not have the right, this security measure is regulated by Part 1 of Article 27.13 of the Code of Administrative Offenses of the Russian Federation and the above articles are not mentioned in it.

Can they rent rooms for lack of compulsory motor insurance?

No, they do not have the right, this security measure was regulated by Part 2 of Article 27.13 of the Code of Administrative Offenses of the Russian Federation and was excluded on November 15, 2014.

If I am not at fault for an accident and I do not have compulsory motor liability insurance, am I entitled to payments from the insurance company?

Yes, you will. As we noted at the beginning of the article, it is not property that is insured, but liability. If there is no fault in an accident, the culprit is liable to you and the insured event occurs only to the culprit. You will only receive a fine under one of the above articles. There is no civil liability to the guilty participant in an accident.

You can draw a simple and logical conclusion: to avoid a fine for not having MTPL insurance, you just need to purchase an insurance policy. In 2018, online services for obtaining insurance are already operating stably. Using the form below, you can issue an MTPL policy within 15-20 minutes without leaving your home.

One of the questions that may haunt the minds of motorists during the period when the period of validity of compulsory motor liability insurance is nearing its end is the following - what is the fine for violators for expired insurance? This is not surprising, since the law on compulsory motor insurance is being adjusted and changed with enviable frequency.

Some administrative measures that were in force previously are no longer relevant.

At the same time, there are cases when certain concessions from the legislation no longer apply, and many drivers, acting in the same way, unknowingly end up on the hook for administrative sanctions.

The driver has the right to drive a car and travel on the roads of the Russian Federation only if he has certain mandatory documents with him.

One of these irreplaceable papers is the MTPL insurance policy. . All drivers are aware of the purpose of this agreement with the insurance company, but it would be useful to remind you that compulsory motor liability insurance is not only a guarantee of compensation for damage to the injured party. This insurance is also your guarantee against significant financial costs if you suddenly find yourself at fault for an accident.

Car insurance is valid for 12 months. After this period, the contract with the insurance company must be concluded again. Car insurance must be valid and not expired. If the document has expired and you are overdue, then you need to re-issue it. Otherwise Driving with expired insurance will be an administrative offense . This will inevitably lead to problems with the traffic police and financial costs. In this situation, many drivers who do not have updated car insurance information fall into a trap.

The fact is that Until 2009, there was a legal provision that allowed car owners to drive vehicles for 1 month , or rather 30 days, even after the insurance policy period has expired . In the same year, this norm was abolished, but those who did not follow the changes in the field of compulsory insurance were left in the dark about what would happen to driving without insurance if it ran out. That is why many drivers now get behind the wheel without a second thought, thinking that they can still drive with expired insurance for a month.

However, there is some good news for those who like to drive with non-renewed car insurance. The fact is that until November 15, 2014, such an administrative offense was punishable by the immediate removal of the car’s license plates, which meant one thing - a ban on the operation of the vehicle.

Then Article 27.13 of the Code of Administrative Offenses (CAO) of the Russian Federation was amended, and the corresponding paragraph in it became invalid.

That's why at the moment, if you overstay your compulsory motor liability insurance, traffic police officers cannot remove license plates for such an offense . Likewise, the penalty of towing a car to a penalty area for non-renewal of insurance does not apply.

When dealing with the question of what administrative sanctions an expired MTPL policy faces, it is worth noting that fines are not assessed for the very fact of delay.

When dealing with the question of what administrative sanctions an expired MTPL policy faces, it is worth noting that fines are not assessed for the very fact of delay.

Punishment is imposed specifically for driving with out-of-date insurance.. Only for driving a vehicle without a valid insurance policy can you be punished by a traffic police officer.

If the compulsory motor liability insurance has expired, and your car is in the garage and not in use, then there is no administrative offense.

Now let's look at the next question - how much fines will be charged to the offender. The answer to this is stipulated in Article 12.37 of the Administrative Code. This article consists of two parts, each of which stipulates a certain situation related to violation of the use of the MTPL policy.

The article discusses fines for:

- the vehicle is used for a period that is not specified in the compulsory motor liability insurance policy;

- the vehicle is driven by a driver who is not specified in the insurance policy;

- The vehicle is driven without MTPL insurance.

For each listed item there is administrative responsibility , which is limited to material penalties, no more. The only difference is that in some cases the amount of administrative punishment will vary slightly.

To begin with, let’s look at the point that is most suitable for answering this topic of the article - what fine for expired compulsory motor liability insurance is due to violators.

Part 2 of Article 12.37 of the Administrative Code

Let's start with part 2 of Article 12.37 of the Code of Administrative Offenses, which states that if the owner of a vehicle does not fulfill the duties that the law “On Compulsory Motor Liability Insurance” imposes on him, as well as if he drives a car Knowing that he does not have an MTPL insurance policy, the fine in this case will be 800 rubles . Since the car insurance has expired, it is no longer valid. It is natural to conclude that this is equivalent to its absence.

So, if you get behind the wheel of a car with insurance that is expired even by a day, then any traffic police officer who stops you will write you a fine of 800 rubles.

Since the law prohibits driving a car without compulsory insurance, any traffic police officer, having re-monitored the documents, will issue you an administrative penalty for the second time.

You can do this until you find it cheaper to buy insurance., or until the traffic police officers sue you as a persistent offender.

Part 1 of Article 12.37 of the Code of Administrative Offenses

Part 1 of this article states that if the car is driven by a driver who is not included in the MTPL insurance policy, and also if this vehicle is operated during a period that is not specified in the insurance, then this is an administrative offense for which the corresponding penalty of 500 rubles .

Regarding the period that is not included in the policy- here we are talking about car insurance, which has a limited period of use. This policy is purchased for a year, but it cannot be used in certain months.

For example, there is OSAGO with limited use for the winter months. By using this insurance, some vehicle owners can save money. This is relevant for motorcyclists or summer residents who go to field work in warmer seasons. If suddenly one of these summer residents decides to drive a car in winter with such an MTPL insurance policy and he is stopped by representatives of the traffic police, then they will definitely write him a fine worth 500 rubles.

A fine of 800 rubles for driving a car without a valid insurance policy is not the worst thing that can happen. It is much more unpleasant if the offender gets into an accident. Let's look at the options for how events could unfold and how it could turn out for someone who decided to try their luck in this way. In the first case, a driver without insurance gets into an accident through no fault of his own.

In this case, the insurance company of the person responsible for the accident will compensate for the damage, but during the investigation the absence of an insurance policy will certainly emerge. This will naturally lead to fine of 800 rubles .

The consequences of the second case will be much more noticeable and severe. . In this case, let’s imagine that the owner of a car, without third-party liability insurance, gets into an accident due to his own fault. The fact that the insurance has expired and there is no policy will be recorded when completing the appropriate documentation, and accordingly, there will be no compensation for the insurance.

All costs of compensation for damage will fall on the shoulders of the person responsible for the accident. The injured party will conduct an independent examination to realistically assess how much damage will be caused.

The guilty party will be notified of this. All attempts to avoid payments do not end with good results. On the contrary, they will aggravate the situation, since refusals to pay monetary compensation will force the injured party to resolve the case through the court. In such a scenario, you will have to pay not only money for the damage caused, but also pay all the associated costs of legal proceedings.

Some citizens, in an effort to save some money, embark on various kinds of adventures, without thinking at all about the consequences. This also applies to the use of a falsified OSAGO document. But everyone has probably heard that Ignorance of legal norms will not allow you to avoid punishment for violating them

.

Some citizens, in an effort to save some money, embark on various kinds of adventures, without thinking at all about the consequences. This also applies to the use of a falsified OSAGO document. But everyone has probably heard that Ignorance of legal norms will not allow you to avoid punishment for violating them

.

Therefore, it is important to mention the responsibility for those drivers who deliberately resorted to using false documents for compulsory insurance.

Article 327, Part 3 of the Criminal Code of the Russian Federation states that if a citizen of the Russian Federation deliberately uses a false document, then if an offense is detected, this may result in one of the following punishment options for him:

- a fine of up to 80,000 rubles or salary for up to 6 months;

- up to 480 hours of compulsory work;

- up to 2 years of correctional labor;

- up to 6 months of arrest.

Thus, we examined what administrative punishment is imposed for operating a car with an expired MTPL policy or during a period not included in the insurance. We also learned about the penalty for driving a car by a driver who is not included in the insurance policy.

For those who violate the law in search of financial gain, criminal liability is provided!

Video

is a document that must always be with the driver. However, there are often situations when car owners, through forgetfulness or carelessness, neglect this rule, driving without insurance, with an expired policy or with an invalid document. According to the norms, such actions are punishable by a fine and a number of penalties. Let's take a closer look at what awaits drivers for driving without insurance.

If the driver’s data is not included in the OSAGO policy

If the vehicle is managed by a person whose details are not noted in the policy, this is a violation of the rules of the contract under compulsory motor liability insurance and is regarded as an administrative offense. According to part 1 of Article 12.37 of the Code of Administrative Offenses of the Russian Federation, for such an action the driver faces a fine of 500 rubles.

In addition, a traffic police inspector who has detained a car whose driver is a person who is not included in the compulsory motor liability insurance has the right to remove the offender from driving the vehicle. In this case, the car will be redirected to the impound lot, and only the owner will be able to pick it up, who will also have to pay a fine and reimburse the costs associated with transporting and storing the car at the impound lot.

This punishment can be avoided, but only if the owner of the car or another person included in the MTPL policy manages to arrive at the place where the car was detained before the tow truck. In this case, the violator will still have to pay a fine, but the car will not be towed.

Read also: How long can you drive under a car purchase agreement without insurance?

The amount of the fine in the absence of compulsory motor liability insurance in 2019

If the owner of a vehicle neglects to take out compulsory motor third party liability insurance, that is, he does not have a compulsory motor liability insurance policy at all, he faces a fine of 800 rubles. If the owner and driver of the car are different persons, then, according to Part 2 of Article 12.37 of the Code of Administrative Offenses of the Russian Federation, a fine will be imposed on both of them. The owner of the car will have to pay a fine for not having compulsory motor third party liability insurance, and the driver will have to pay a fine for driving without a policy.

Under certain circumstances, the driver who was driving the car at the time it was detained by the inspector can avoid penalties. However, to be acquitted, he will have to prove that while driving the vehicle, he did not know about the absence of a compulsory motor liability insurance policy.

Read also: Registration of an electronic MTPL policy via the Internet

If the MTPL policy is expired

The legislation equates driving a car with an expired MTPL policy to not having one. Accordingly, the driver is subject to the same penalties in the amount of 800 rubles.

The standard MTPL term is 1 year, but many auto insurance companies offer their clients alternative contract options. The validity period of such contracts is also 1 year, but the driver can receive insurance with a validity period of several months. This type of insurance is cheaper than a standard policy, and it is ideal for those car owners who use vehicles seasonally, for example, for trips to the country or travel. Just keep in mind that, having such a policy in hand, you will be able to drive a car only during the period of validity of the insurance. Otherwise, you will have to pay a fine of 500 rubles.

Civil liability insurance or, as it is called, MTPL insurance, how important is this document for the driver of a vehicle (vehicle) in 2019? Many of those who drive a car believe that having insurance in hand is a measure of a recommendatory nature or that having insurance is not necessary; its absence will not affect the road user in any way. So, what are the consequences of not having MTPL insurance in hand when meeting with a state traffic inspector on the road? What are the risks of underestimating the situation?

For an objective assessment of the situation, it would be useful to turn to Russian legislation in the part that regulates legal relations with vehicle owners. The Administrative Code (CAO) clearly prescribes the procedure for providing documents during control by a state traffic inspector on the road, During the inspection you must provide:

- Driving license (or substitute documents established by law).

- Registration certificate for transport.

- Civil liability policy (OSAGO).

It becomes clear that there is a legal requirement that the driver must have an insurance policy, and violation of the provisions of the Code of Administrative Offenses serves as the basis for holding the driver accountable. Therefore, the opinion about the advisory nature of having insurance in hand is incorrect.

Driving a vehicle without an insurance policy in 2019 entails two types of sanctions: a warning and a fine. If your car is insured in compliance with all requirements, but the insurance policy itself, for various reasons, was not in hand at the time of inspection by the controlling persons, then you can get off with a warning or a minimum fine of 500 rubles.

However, the significant fact is that the number of such fines is not limited. If the same driver who paid the fine is stopped for inspection by another inspector a minute later, the fine will need to be paid again.

The amount of fines ultimately to the location of your policy may be limited only by the length of the journey, taking into account the communication between traffic police officers.

If there is no insurance policy or if it is overdue, which in fact is the same as the absence, the fine will be 800 rubles. A warning is excluded in this case, since driving an uninsured vehicle contains an element of a serious offense. With a fairly accurate fine of 800 rubles, drivers often have a question: how does the inspector determine when to impose a fine of 500 rubles and when to impose the maximum amount?

If the car is insured, but you do not have a policy, then when signing the protocol you must indicate your disagreement with the amount of the fine and explain the reason for your disagreement. This procedure is prescribed by law, as is the deadline for violation. As of 2019, it will be 10 days from the date of the decision on an administrative violation.

If the decision for driving a vehicle without an MTPL policy is unlawful, you will need to appeal the decision to a higher authority of the State Road Safety Inspectorate, and also go to court.

If a copy of the insurance certificate valid at the time the protocol is issued is attached to the application, the decision will be in favor of the driver.

A situation often arises when a vehicle driver has the right to drive, but his name is not included in the insurance policy. According to the law, in 2019, if a person is not indicated in the insurance policy when driving a vehicle, he may be subject to a fine of 500 rubles.

You can, of course, challenge it in this situation, but if you don’t have insurance on hand at the time of the check, or the driver is not included in it, the fine will be 500 rubles and the law will not be on the side of the violator. At the moment, there is no information about an increase in the amount of the fine if the driver is not on the list of persons in the insurance policy. Therefore, the presence of a contract for driving transport and the absence of the driver’s name in the policy entails an inevitable fine.

In a single case when an urgent trip is required, this is understandable, but if it is necessary to drive a vehicle on an ongoing basis, it is advisable to complete all documents in accordance with legal requirements. This will save you from unnecessary problems and allow you to be a conscientious road user.

Russian legislation provides for certain categories of drivers who have legal grounds for driving without a compulsory motor liability insurance policy.

Without insurance, road users may be:

- Vehicles with limited ability to accelerate to 20 km/h.

- TS of the Armed Forces of the Russian Federation.

- Vehicles not allowed to participate in road traffic.

- Vehicles insured by international insurance companies outside the territory of the Russian Federation.

- Non-wheeled transport.

When driving a vehicle that falls under the above categories, a fine is inappropriate. It remains to be clarified what period is stipulated by law for issuing an insurance policy in 2019? The moment of acquiring ownership and registration of the vehicle gives the driver a countdown of 10 days to get the insurance documents in order.

Having a copy of the application to the insurance company for registration of compulsory motor liability insurance will allow you to exclude explanations regarding the absence of a policy for the period established by law.

As can be seen from the article, it is quite easy to prevent all issues and risks of problems related to driving a vehicle and issuing a compulsory motor liability insurance policy if you have information about the legislative norms governing this issue. Good luck on the road!

How much does it cost to drive without compulsory motor insurance?

Post Views: 27