DSAGO, also known as DAGO, DoSAGO, DGO, DSGO, is an additional motor third party liability insurance for the driver.

This is a voluntary type of insurance that significantly increases the maximum possible payment for compulsory motor third party liability insurance (OSAGO).

Features of DoSAGO

The DoSAGO policy will come in handy when the maximum OSAGO payments do not compensate for all the damage caused (400 thousand rubles for property for each victim, 500 thousand rubles for health and life).

This happens to every fifth victim, and insurance companies tend to underestimate OSAGO payments by an average of 20-25%, given the wear and tear of the car.

Additional insurance of one's liability for property and/or health damage caused to third parties expands the CMTPL limit established by the state to the amount determined by the insured.

This type of insurance has its own characteristics:

- voluntary type of insurance;

- possible only with a valid OSAGO policy. The validity period of DSAGO is equal to the validity period of OSAGO;

- the maximum amount of coverage is chosen by the insured (from 300 thousand to 30 million rubles, most often - 1 million rubles);

- tariffs are set by each insurance company independently, taking into account the age and driving experience of the insured, the power of his car, etc.;

- the insurance payment is made after the payment of OSAGO, in the amount necessary to fully cover the damage caused, but not exceeding the sum insured under the contract;

- if the insured event occurred due to the fault of persons not specified in the contract, then insurance is not paid. since this is liability risk insurance of a certain person, and not the policyholder's car;

- usually, the contract establishes a deductible (unpaid sum insured) equal to the limit of payments for OSAGO.

A visual explanation of how DSAGO works is in the video.

Who needs

The DSAGO policy will be useful to those who do not exclude the possibility of driving into someone else's luxury foreign car and smashing it into the trash.

Such insurance is useful:

- residents of large cities with heavy traffic;

- those who often travel on highways;

- novice drivers;

- drivers with a careless driving style.

What is the price

The cost of the service for concluding a DoSAGO agreement depends on:

- tariffs established by the insurance company (taking into account the brand and year of manufacture of the car, engine power, age and experience of the driver, regional coefficient, etc.);

- the amount of coverage chosen by the insured under the contract (the larger the amount, the more expensive the policy);

- availability of additional services (departure of an emergency commissioner, technical assistance on the road, car evacuation, ambulance);

- accounting (cheaper) or not accounting for depreciation;

- the presence of a franchise in the amount of the OSAGO limit (cheaper);

- the number of drivers included in the policy (the more, the more expensive).

On average, a DoSAGO policy costs about 0.5–2% of the total sum insured for which the contract was concluded. An annual DSAGO policy with a limit of 1-1.5 million rubles will cost 1800-3600 rubles, and with the maximum possible payment of 30 million - about 18 thousand rubles.

It is better to arrange DoSAGO as a package with OSAGO in one insurance company. Some insurers actively promoting products with telematics, for example, Soglasie, now offer the DSAGO policy only in a package with a hull policy.

IMPORTANT! When buying a DoSAGO policy with an insurance amount of 1.5 million rubles or more, an inspection of the car will be required from an insurance company.

When concluding a DoSAGO agreement, you must:

1. Check whether the insurance organization has a license on the website of the Bank of Russia.

2. To avoid fraud by false agents and brokers presenting fake agency contracts and powers of attorney, you can check the contract and the OSAGO policy on the website of the Russian Union of Motor Insurers.

3. Choose DoSAGO insurance without depreciation, with an insurance amount of at least 1 million rubles. Otherwise, the degree of protection is significantly reduced, and the savings on the price of insurance are minimal.

4. Clarify that the contract states that payments excluding depreciation also apply to small amounts (of which it will be possible to cover the depreciation and amortization of the affected car excluded from the CMTPL payment and legal costs if the victim goes to court, as well as payment of an independent expertise and services of a lawyer).

5. Understand and check that this is fixed in the contract, how the payment will be made:

- whether the limits for OSAGO and DSAGO are summed up if the amount of damage requires it;

- or the OSAGO limit, which is already in force, is deducted from the DSAGO limit, and the amount of all payments under compulsory and additional insurance cannot exceed the sum insured under the DoSAGO agreement.

6. Find out if there is

- penalties for the number of accidents during the term of the policy;

- division of the sum insured into compensation for damage to health and damage to property (that is, what part of the sum insured can be used as much as possible to repair the damaged car).

IMPORTANT! Federal Law of April 25, 2002 N 40-FZ (as amended on November 28, 2015) “On Compulsory Insurance of Civil Liability of Vehicle Owners”, art. 4 paragraphs 5 and 6 provides

- the right of vehicle owners to additionally voluntarily insure for full compensation for harm caused to the life, health or property of the victims.

- Those whose risk of liability is not insured are obliged to compensate for the damage caused in accordance with the current wording of Ch. 59 of the "Civil Code of the Russian Federation" dated January 26, 1996 No. 14-FZ.

Payouts

Payments under the DoSAGO policy begin only after the exhaustion of OSAGO resources, and is paid with and without deduction of OSAGO limits.

For example, if the insured has a DoSAGO with a limit of 1 million rubles in case of an insured event in which the damage to the victim’s car is estimated

- 1 million rubles. CMTPL pays 400 thousand rubles. The amount of insurance compensation under the DoSAGO policy will be 600 thousand rubles;

- 1.5 million rubles. For OSAGO - 400 thousand rubles. Compensation under DSAGO will amount to 1 million rubles. The remaining 100 thousand rubles the insured must pay on their own.

The conditions for making payments are detailed in the contract. It is important to comply with them in a timely and accurate manner.

Usually, to process a payment, you need:

- application for an insured event;

- passport of the person responsible for the accident;

- OSAGO and DSAGO policies of the person responsible for the accident;

- certificate of registration of the vehicle and vehicle passport of the vehicles of the perpetrator of the accident and the victim;

- a protocol and a decision on an administrative violation, as well as a document from the traffic police in the form No. 748; expert opinion on the amount of insurance payment.

DSAGO does not replace OSAGO, but only effectively complements. For an optimal result, it is necessary to carefully approach the conclusion of an insurance contract, selecting and fixing the key factors in the text (excluding depreciation, with a list of additional services and a detailed explanation of all controversial points).

What is CASCO?

CASCO is a voluntary motor vehicle insurance.

You insure your car against any troubles that may arise on the road and during parking.

In simple terms, CASCO insurance is:

- Your car was stolen, the insurance company will pay you the cost of the car.

- You have an accident, the insurance company will repair your damaged car.

- You lost control and drove into a ditch, the insurance company will repair your car.

- Ice has fallen on your car from the roof, the insurance company will repair it.

- In the parking lot, your mirror was stolen or your car was scratched, the insurance company will repair your car.

- A stone on the road broke your glass or cracked your headlight, the insurance company will repair your car.

- Etc.

Advantages of CASCO

- You paid once to the insurance company, and the whole year it pays for you.

- In the event of an accident on the road, it DOES NOT MATTER whether you are at fault or not.

- By purchasing CASCO insurance, you get a sense of security and peace of mind.

Disadvantages of CASCO

- Very expensive insurance cost for the most popular cars.

- Insurance companies do not want to insure "old" (more than 3 years old) cars.

- It is necessary to record each insured event with the police or the traffic police, and obtain supporting certificates.

- Insurance companies often delay payments in case of theft and take a long time to agree on the cost of repairs with the repair organization.

CASCO is bought by those who do not want to have any problems. CASCO is the repair of your car by the insurance company in any case (even if you are the culprit of the accident, or you yourself damaged your car without an accident). CASCO is a compensation for the cost of a car in the event of its theft or complete destruction.

What is a CASCO franchise?

The CASCO insurance deductible is a certain amount of damage caused to you, which the insurance company does not pay for each insured event.

For example: When concluding a CASCO agreement, you agreed on a franchise of 10,000 rubles.

Accordingly, if you got into an accident and the cost of repairs is 53,000 rubles, then the insurance company will pay 43,000 rubles for you, and you pay 10,000.

What does the CASCO franchise give you?

The CASCO franchise makes the CASCO agreement itself cheaper, the larger the franchise, the lower the cost of the CASCO agreement.

How much does CASCO cost?

CASCO is an expensive "pleasure". The cost of CASCO is determined by each insurance company independently. Insurance companies, regardless of anything, set their own tariff scale. Also, the insurance company has the right to refuse to conclude a contract if you do not meet any mandatory requirements - for example, insufficient security equipment is installed on the car or you have an old car. The insurance company also determines the method of compensation in the contract - transferring cash to your address or putting your car for repair at a service station.

What to do if your insurance company - fell apart?

This moment needs to be thought out in advance, since PCA is not responsible for CASCO. It is necessary to buy CASCO from a reliable, proven and well-established insurance company. That is, focus not only on the cost of insurance.

If, nevertheless, this happened and the insurance company collapsed, then the issue can theoretically be resolved only through the judiciary. In practice, unfortunately, these cases are rare.

OSAGO

OSAGO - Compulsory Motor Third Party Liability Insurance, the object of insurance of which are property interests associated with the risk of civil liability of the owner of the vehicle for obligations arising from causing harm to life, health or property of the victims when using the vehicle in the territory of the Russian Federation.

In simple terms, the OSAGO policy is:

By purchasing an OSAGO policy, you insure yourself against the following situation: you got into an accident through negligence, you were found guilty, you crashed an expensive car, in this case, under the OSAGO policy, the insurance company will pay money to the victim for you. And you won't pay anything.

An insured event is recognized causing damage to the life, health or property of the victim as a result of a road traffic accident during the period of validity of the compulsory insurance contract by the owner of the vehicle, which entails the obligation of the insurer to make an insurance payment. Difficult? Very! Each of us asks himself the question - “Why not explain everything in human language? Why do lawmakers, like doctors who write “lower limb” instead of the simple and understandable “leg”, stuff us with a mass of unnecessary and incomprehensible terms? Yes, because, behind the ornate and confusing proposals, there are a lot of “pitfalls” about which, like doctors, they are in no hurry to inform you and me.

Most modern people, including, paradoxically, motorists, have no idea about such everyday concepts today as insurance in general and OSAGO and CASCO in particular. That is why it was decided to write this article. Let's start in order.

What is OSAGO?

OSAGO- this is really Compulsory Motor Third Party Liability Insurance. This is not a veiled wording. These four words contain the meaning of the whole concept. That is, by buying OSAGO insurance, you protect yourself from big problems in case If you are at fault for the accident that happened to you. In this case, the insurance company from which you bought the policy will pay for the damage caused by you. In the case of the exact opposite situation, if your car was broken, the insurance company of the person who drove into you will pay for the repair.

Summing up what has been said, we can say that when buying OSAGO insurance, You insure not your car, but yourself, that is, their own money. To put it simply - if you drive into you - you will receive money, if you drive into someone you - you will not receive anything, but you will not pay yourself either. There is a third option, the so-called "round" (both drivers are guilty of an accident). In this case, the amount of payment is determined by the ratio of the degree of responsibility and the actual amount of damage. As a rule, in the case of a "reciprocal" insurance companies pay each of the two participants in the accident 50% of the damage caused. Some cases drag on and end in court, where the degree of responsibility of each participant in the accident is determined.

How much does OSAGO cost?

Looking ahead, let's say right away that the cost of OSAGO is the same everywhere! It does not matter which insurance company you will be insured with - in the "cool" or "around the corner" (unfortunately, such companies still exist in our city). Since OSAGO auto insurance is implemented in accordance with the legislation of the Russian Federation, the tariffs are also developed by the Government of our country. By the way, I want to add that a similar practice exists in all civilized countries of the world, and is not the "intrigues" of only our state. Returning to the tariff, I want to clarify that the price of OSAGO insurance consists of several indicators:

- Type of vehicle - cargo or passenger, an individual or legal entity is the owner, etc.

- Territorial binding. Each region of the country has its own tariff, also established by the law on OSAGO.

- The experience of the insured (that is, your experience). Experience is made up of age and the number of years you drive the machine.

As well as a number of other indicators. It takes into account how powerful your car is, for how long you insure your liability, and whether you had any accidents before and who was the culprit. In fairness, I must add that if you have not broken anyone over the past year, that is, as the insurers say, your ride was accident-free, you will receive a 5% discount annually. True, if you buy a new car, the insurer (even the same one) will not remember your “impeccable” reputation and everything will start anew. But, no one said that the OSAGO law is impeccable.

How is OSAGO paid if you are at fault in an accident?

If you are the culprit of the accident, the calculation is made as follows - the victim in the accident applies to the insurance company and instead of you it pays for car repairs, having previously estimated the amount of damage. You repair your car at your own expense.

How is the payment made if you are not at fault for the accident?

If you are not the culprit of the accident, the calculation is made as follows - you apply to the insurance company and it, having estimated the amount of damage, makes a payment to you.

There are two caveats to this:

- The amount of damage will be calculated taking into account the wear and tear of your car, that is, the older the car, the greater the wear. Depreciation is calculated as a percentage using a standard formula that takes into account the age and mileage of the car.

- According to the law, the maximum payment for OSAGO is the amount of: 400,000 rubles. That is, if the cost of restoring your car is more than 400,000 rubles, then you have the right to recover the difference between the actual cost and 400,000 rubles from the person responsible for the accident through the court.

What is a “direct settlement” under OSAGO?

Direct settlement of losses is a situation in which the victim in an accident needs to apply for payment to your insurance company.

Prerequisites for direct claims settlement:

- Two vehicles are involved in the accident.

- There were no casualties in the accident (no damage to health).

- Both participants in the accident have valid OSAGO policies.

In other cases, the victim in an accident should contact to the culprit's insurance company.

What to do if the insurance company - fell apart?

If the insurance company responsible for the accident is at the stage of bankruptcy, or its license has been revoked, or it has already ceased to exist at all, you have the right to apply: either to the PCA (Russian Union of Motor Insurers), which is responsible for the obligations of insurance companies that do not have the ability to make payments under OSAGO. Or to the judicial authorities with a claim for damages against the culprit of the accident.

What would happen if no one invented OSAGO?

If no one came up with OSAGO, then there would be no question of resolving issues by civilized methods. At the moment, the resolution of all conflict issues is regulated by the legislation of the Russian Federation.

The profession of an insurance agent is very prestigious in large cities.

An agent is a person who acts on behalf of a certain company and concludes insurance contracts.

Now you can find a huge number of vacancies with fairly decent wages. Is insurance agent really such a prestigious profession?

Insurance agent- a link between a large company and people who want to make their lives safer. The insurance agent is obliged to find out the wishes of the client, tell him about the possible insurance conditions, current tariffs and compensation payments.

After these actions, an insurance contract is concluded on the most favorable terms for the client.

This profession has certain requirements for candidates. Fits sociable and purposeful people. Any person who has reached the age of majority can become an insurance agent.

Responsibilities of insurance agents

- Search for clients. Insurance agent on one's own is looking for clients who will use its services. It is very difficult to develop a base at first and it will take a lot of effort. Depends on the number of clients salary.

- Conclusion of contracts. An insurance agent must be able to conclude contracts for each type of insurance. Also, this specialist makes renegotiation of contracts. Bears liability.

- Damage assessment. Often companies allocate a position to special employees who assess material damage. However, each insurance agent is required to be able to do this on their own.

- Accounting and preservation of documents. The insurance agent is fully responsible for storage of insurance policies and contributions.

- Service advertising. Insurance agents must active advertising their services to the public. Attracting new customers is a prerequisite for the work of an insurance agent.

The main and main task of the insurance agent is Attraction of new clients.

Registration of insurance policies and contributions is the daily work of an agent. Finding new customers is largely dependent on professionalism specialist.

In order to develop a certain customer base, you need to have the skills that every insurance agent should have. An insurance agent has duties that are quite simple to fulfill, but not everyone can do it.

Qualities an insurance agent should have

Stress resistance

This skill can be called a key one, since this profession often involves conflict situations. If you are an impulsive and nervous person, you will make a terrible insurance agent.

The task of an insurance agent is to attract as many people as possible to any type of insurance.

It's simple - the customer is always right. Even if he yelled at you when you came to draw up an insurance policy or gave you unflattering words - he is right, and you should come back later.

It is worth understanding that you need to cherish every client and the last boor should be an interesting and good-natured person for you.

Sociability

The ability to find answers to all questions and find common topics with people will come in handy everywhere. For an insurance agent, this is a necessary quality. An insurance agent is obliged not only to accurately tell the list of services, but to be able to interest a person.

That's why insure the refrigerator or food processor? You must explain that manufacturers have stopped monitoring the quality of the goods, and you will help correct the situation - even if something breaks, a person will be able to buy a new device without loss. Or to remind you of thieves who do not disdain even a refrigerator.

industriousness

You will not be able to sit and do nothing with such a profession. Every minute you have to think - where to find new customers. And after smart thoughts visit you, go to the implementation of your ideas. Insurance agent - quite active work that won't let you sit still. Irregular work schedule involves the provision of insurance services both in the daytime and in the evening.

Resourcefulness

Insurance agents who sit at the points and draw up comprehensive insurance know that the worst thing in professional activity is to make rounds in the private sector.

Every insurance agent who went around the houses of “nervous and embittered” people at least a couple of times doubted that he had chosen the right education. Not every insurance agent will be hired to work for a certain “point”, and if they are, this does not mean that there will be an influx of customers.

So why is it so scary to work in the private sector? Just imagine, you had a fight with your husband, your dinner was burnt and the child broke a vase, and then an insurance agent came: “Come on, I will insure you for all occasions.”

Usually, in this case, the agent is asked to leave and the services are refused, but there are other options - tell him everything you think about such "beggars", swear, etc.

The second and worst thing that can meet you during the “bypass” is dogs, which are very numerous in private sectors. And do not try to do anything to them - maybe they have already been insured! Any harm to these "harmless" animals, even if they try to bite you, threatens with a fine.

Good memory

An insurance agent is obliged to remember all types of insurance and offer them to his clients. In addition, it is worth remembering the characteristics of certain people. If a person does not have a car, it does not make sense to offer him a comprehensive insurance policy.

Presentable appearance

Regardless of gender, an insurance agent must inspire confidence. To do this, you will need to devote a lot of time to your appearance and be neat and well-groomed.

The history of the profession and the main difference between an agent and a broker

The profession appeared in ancient times. At first, the practice of non-commercial property insurance was relevant. Subsequently, insurance acquired a commercial focus and appeared in its modern form.

In the process of formation of this industry, many institutions providing insurance services began to appear. Now you can see insurance institutions, both public and private.

insurance agent working for one company. Clients can draw up an insurance contract only on the terms and conditions provided by a certain insurance company.

If a person liked the insurance conditions in several companies at once, it is better to contact insurance broker.

An insurance broker, unlike an agent, can work immediately with several companies. He knows the range of all insurance services and accompanies the client during the validity of the policy.

Unlike an insurance agent, a broker offers the most favorable insurance conditions in different offices. Practice shows that brokers better informed about the features of the insurance market than agents.

How to become an insurance agent

Anyone can become an insurance agent. For this it is enough to have secondary education.

Many insurance companies conduct their own training of employees. A person of any age can achieve success in this profession, the main thing is purposefulness and willingness to work.

Some vocational schools provide training to become insurance agents. You can also go to special courses.

If you do not have time to study theory, you can safely contact an employer who will provide you with quality training in practice.

An insurance agent is a profession that provides career growth and high wages. It all depends on the person and desire to work.

insurance agent salary

The salary of an insurance agent depends entirely on his diligence and activity. On average, an insurance agent has 10-20% from transactions.

Actively working beginners have at least 18 thousand rubles. per month. Insurance agents with long experience up to 50 thousand rubles. Some insurance agents with a very large client base have an income of 200 thousand rubles.

When starting to work as an insurance agent, you need to keep in mind that the first time will be very hard to find clients. And this will definitely affect the salary.

Customers are money and they will not go into your own hands. If you sit still, you won't even earn a ruble.

It is also worth understanding that not all people want to insure. You will have to make a lot of effort and spend a lot of nerves to get your first salary. But over time, it will be easier to find new customers, and wages will increase.

The profession of an insurance agent, like any other, has its advantages and disadvantages. This specialty will allow you to quickly improve your financial situation and move up the career ladder, but not everyone will be able to achieve such success. If you do not know how to work with people, no other professional skills will help you find clients.

When asked about OSAGO, what it is and what it is eaten with, many smile condescendingly, confident in their knowledge. However, in practice, the level of basic awareness of motor vehicle citizenship among drivers is low - the basis of knowledge is various particulars of the applied order.

Few are able to intelligibly explain what OSAGO is in principle. This can lead to erroneous beliefs, unpleasant consequences when purchasing a policy, drawing up and analyzing an accident, generating losses, incomplete payments and fines.

Therefore, despite the presence of a mass of material on various aspects of OSAGO, there is a need for one generalizing article, after reading which you will know all the important basics of compulsory insurance.

First, let's deal with the terminology.

Deciphering the abbreviation OSAGO means "Compulsory Motor Third Party Liability Insurance".

Often, the phrase “owners of vehicles” is also added to this.

What does "mandatory insurance" mean?

From the above transcript, the first two words - “compulsory insurance” (OS) can be immediately clear.

They explicitly say that:

- The contract belongs to the field of insurance business;

- The agreement is made on a mandatory, not voluntary basis.

Compulsory insurance means that the insurance contract is concluded according to the prescription of the law and its most important aspects are controlled by the state.

It can be:

- insured objects;

- insured subjects;

- insurance premiums;

- Insurance indemnities;

- Insurance rules.

The conclusion of a mandatory insurance contract is regulated by the Civil Code of the Russian Federation (g. 48, art. 927). OS is usually carried out in areas that affect large segments of the population.

Such an agreement applies not only to vehicles (TC). For example, some types of the following insurances are mandatory:

- Professional (military personnel, tax officials, electricians, high-altitude workers, etc.);

- Social (medical, various types of benefits, etc.);

- Transport (passengers, cargo, vehicles, etc.).

Federal Law No. 4015-1 (“On the Insurance Business in the Russian Federation”), Article 3 (clause 4), prescribes that each type of OS has a special legislative act that regulates it. For an auto citizen, this is Federal Law No. 40 (“Law on OSAGO”).

What does "civil liability" mean?

Further, in the abbreviation OSAGO there is a less clear combination: “auto civil liability”. Intuitively, you can guess that some kind of liability, called civil liability, is insured. I will elaborate on this point below.

Here, too, it will be useful to know that liability insurance (CO) is a large cluster that includes more than 10 industry varieties. And OSAGO is only a small part of it.

For example, CO includes insurance:

- Manufacturers of goods;

- Financial organizations of depositors;

- Many kinds of industry;

- Responsibility of a citizen.

This also includes transport insurance. The word “civilian auto insurance” matters here, since not all types of transport insurance concern cars.

For example, there are types of liability insurance for vehicle owners:

- air

- Maritime

- Railway

That is, “auto civil liability” implies the insurance liability of a subject using wheeled vehicles - this is OSAGO.

What is the essence of OSAGO - the basic principles of auto civil liability

With the term OSAGO itself, I think everything is clear. But from it the essence of the autocitizen as such is not completely clear. Why is it needed at all? What does it give and to whom? Let's take a look at this important issue.

Civil Liability

It is well known that the person guilty of it must be financially responsible for the damage caused, according to the Civil Code of the Russian Federation (Article 1064, etc.) - this is material civil liability. As a result, the defendant will suffer a loss nominally equal to the damage caused.

This may be the responsibility:

- Criminal

- Material

- Criminal material

OSAGO concerns only material liability - the car citizen has nothing to do with criminal proceedings.

For all entities (individuals and legal entities) there is a permanent liability as a potential culprit to potential victims. After all, any citizen, under certain circumstances, can become the inflictor of harm and be responsible for it.

That is, it is classified as a risk. And often such a risk is applied through some objects that the culprit uses. What do insurance companies (ICs) do? That's right - risks are insured, and the risk associated with the use of some things as well.

For example, there is a related CMTPL civil liability policy. Not civil, but civil - this is voluntary insurance that covers liability for damage in a variety of situations (mainly domestic).

Auto civil liability

In addition to civil liability insurance, there are other similar policies. But they all have one main principle - their subject is not the object itself, but the responsibility of the subject associated with it.

That is, direct classical insurance, when the owner receives compensation for damage to his property, does not occur. The possibility of material liability to the victim is insured. Not the possibility of causing harm, as some write, but the possibility of responsibility for it.

After all, the harm done to the victim does not bring material loss to the perpetrator. It brings the upcoming responsibility, which is insured. Many people understand this subtle point vaguely.

OSAGO just refers to a similar type of insurance, providing a policy of motor third party liability. It covers the possible loss of the perpetrator, which he may incur when compensating for harm to the victim. Provided that this harm is caused by a car.

Hence such a term - auto civil liability, i.e. liability associated with the vehicle of the culprit, which acted as an agent of causing harm.

What is OSAGO - definition

I think, after reading the above, the principle of insurance, which is the basis of OSAGO, has become clear to you. Now we can derive a general definition of autocitizen.

So, OSAGO is insurance by an entity (individual or legal entity) of the possibility of its material liability for harm caused to another entity, which is in the process of movement by means of a vehicle.

Pay attention to the ending - there is no word "use". And not in vain - harm can be done to the vehicle even without the fact of its use (for example, by transport that has fallen off the handbrake).

Some use the "as intended" ending, but that's not quite the right wording. Yes, this applies to passenger cars - their direct purpose is to simply move around. But with special equipment it is different. Damage caused by structures not related to movement is not reimbursed under the CMTPL, and these structures determine the direct purpose of such vehicles.

Well, we figured out the main thing, now let's deal with the particulars associated with OSAGO.

When did OSAGO appear?

Where did compulsory auto insurance originate, what year did it start and who invented it? Some motorists are also interested in such questions.

Voluntary car insurance started back in 1898 (in the USSR in 1991), only 3 years after the invention of the first car. Then the American insurance company Travelers Insurance Company issued the first policy for a horseless carriage to a certain Martin Truman.

The insurance cost $12 and covered $500 in damages, a decent sum in those days. It is noteworthy that Truman bought a policy against the collision of his miracle wagon with horse-drawn carriages, and not with other cars, which were then a mere minuscule.

It took the US auto industry more than 30 years to increase the number of cars that required the introduction of special insurance for them - mandatory. For the first time, the OSAGO prototype was introduced in Massachusetts (in 1925), soon everyone else joined it, and by the mid-30s Europe took over.

After the 50s of the twentieth century. OSAGO has become a generally accepted norm for all developed and many developing countries.

How did OSAGO develop in RUSSIA?

Contrary to common prejudice, the idea of compulsory insurance appeared in Russia a long time ago: in 1924, a year before the introduction of OSAGO in the United States. But due to the meager number of cars in the then USSR, such an undertaking by the leaders was considered irrelevant, although interesting.

In the sixties, the development of the Soviet version of OSAGO was already quite seriously planned, but again the top management did not support it. Because of this, the first real bills on compulsory auto insurance were considered by the already young State Duma in 1993-94.

True, the development was sluggish, and only in 2000 the final bill was adopted in the first reading. Then it was finalized for another two years, and on April 25, 2002, the Federal Law “On OSAGO” (No. 40) was finally adopted.

It is noteworthy that in those days, Russian motorists took the new duty on their shoulders very negatively, but now this has been forgotten and OSAGO for cars is perceived as an ordinary and mandatory attribute.

Three main advantages of OSAGO

Compulsory motor insurance is distinguished by three main positive qualities, the totality of which contributes to its spread throughout the world.

- The insurer pays for the fault of the insured. Provided that it is still impossible to refuse an auto citizen, its presence gives the motorist a certain guarantee of the safety of his wallet in case of his fault. This is undoubtedly a plus factor and is financially interested in the owner of the policy.

- Guarantee of receiving insurance payments. Victims in many cases are spared the tedious hassle of collecting compensation from the guilty party and receive money with high efficiency. Under OSAGO, damage is paid even to an uninsured person, because the main thing here is that the person responsible for the accident has a policy.

- Improving the level of road safety. The autocitizen encourages drivers to comply with traffic rules and drive carefully. This indirectly saves people time, nerves, effort and money, and also protects their health and life.

The listed qualities bear fruit:

- OSAGO is gaining popularity as a profitable insurance service, despite the increase in its tariffs;

- The bulk of compensation in case of an accident is settled exclusively within the framework of OSAGO, which unloads the courts and other government agencies;

- The number of accidents is under control and does not go beyond the predicted limits, despite the ever-increasing number of cars in the Russian Federation.

However, the autocitizen has also negative aspects, which for the most part can be eliminated in the future.

8 significant disadvantages of OSAGO

After the end of the stage of active reform, which is currently taking place, the Russian OSAGO should become a reliable guarantee of worthy compensation for harm to victims and minimization of problems for the perpetrator.

However, now the system has not yet been fully debugged and is subject to the construction of discrediting schemes on its basis. These include:

- Understatement of the amount of compensation, to which almost all insurance companies are prone, to one degree or another;

- Imposition of additional services from the insurer, raising the fee for the policy and often completely unnecessary to the driver;

- Depreciation accounting the required replacement of parts when paying a refund and the high probability of fraud in the initial wear data for costing;

- Cases of understating insurance points the driver without any grounds for that and noted quite often;

- Compensation for harm to health and life not yet developed enough compared to hardware reimbursements;

- Fairly low refund limits in comparison with Western countries;

- The possibility of acquiring left policies slightly different from the original.

- Lack of strict state control over insurers. This makes it possible for the IC to use legal incidents in a clearly negative way for the purpose of profit. An example is the sensational epic with demands for payments from pedestrians hit by cars.

Recently, many attribute the significantly increased cost of the policy to the minuses. However, at the same time, reimbursement limits were increased, which counterbalanced the negative.

Why pedestrians paid money to restore cars that hit them

In 2012, after the precedent of the Krasnoyarsk Regional Court, when the Investigative Committee managed to recover money from the parents of an injured underage girl to repair the car that knocked her down, a flurry of similar proceedings and high-profile scandals began.

The thing is that in the Krasnoyarsk precedent, the Constitutional Court, to which an appeal was filed from the girl's parents, took the side of the insurer. Considering this as a "green light", the Investigative Committee began vying to recover the cost of damage paid to customers from the pedestrians they knocked down. Moreover, local courts, also impressed by the decision of the Constitutional Court, often took the side of the UK, little considering the nuances of each case.

Things got to the point that money was collected from people who remained disabled of the 1st group and even from heirs who died under the wheels of pedestrians.

Guided by Federal Law No. 40, the damage to the vehicle should really be paid by the culprit, and according to Art. 1064 of the Civil Code of the Russian Federation and the opinion of the Constitutional Court of the Russian Federation, if an accident occurred due to the fault of a pedestrian, then he must pay for the car damaged by his body.

Lawyers also clarify that in such cases it is impossible to judge so categorically. Yes, clause 4.5 of the SDA may be violated by a downed pedestrian (“look around”), but in relation to the driver in such an accident, clause 10.1 (“sudden obstacle”) of the same traffic rules is violated in 100% of cases. It turns out that in the most unfavorable case for a pedestrian, the fault will be at least mutual, and this is already minus 50% of compensation under the law.

Currently, after the personal intervention of the president, the courts have moderated their ardor and the UK rarely wins such cases, but this incident has not yet been resolved at the legislative level.

Obligations of the driver under OSAGO

OSAGO involves a number of responsibilities for the driver of the vehicle.

Here is their main list:

- Registration of compulsory insurance for transport used on a common basis;

- Presentation of the insurance policy traffic police employees (this requirement may be excluded from clause 2.1.1. of the SDA in the future);

- Notifying the IC about the facts of changes in information about the policyholder (place of residence, last name, etc.);

- Providing your policy details, in the event of an accident, to other participants in the incident;

- Notification of the occurrence of an insured event your insurer, by means of a special notification form, within the period established by law.

- Providing accurate information about the insured event;

- Provision of a car to determine the extent of damage.

Driver's rights under OSAGO

OSAGO provides the insured with a number of rights.

They are the following:

- Receive compulsory insurance services from any insurer on an unconditional basis, if all conditions are met;

- Restore the policy lost for any reason;

- Conclude an agreement for the selected time period;

- Break the contract on your own in cases established by law (change of ownership, etc.);

- Receive insurance compensation in accordance with the provisions of the law and in full;

- Claim additional insurance coverage if there is a shortage of the amount of the initial payment for the restoration of a car or health;

- Claim reimbursement of expenses related to the insured event;

- Require an independent review from the insurer in case of disagreement with the conclusion of the initial inspection of the car by an employee of the insurance company;

- Take advantage of advanced features compulsory insurance.

How is the price for OSAGO formed?

One of the main aspects of autocitizenship is its price. In some sources, one can come across the assertion that the cost of OSAGO is controlled by the state. This is only nominally true, since such control does not result in a fixed policy price.

In fact, the cost of the policy depends on:

- Direct state regulation;

- Calculations of insurers;

- TS driver.

As a result, the spread in insurance prices can be very significant.

Let's take a look at all this briefly.

Direct state regulation of OSAGO cost

According to Federal Law No. 40 (Art. 8-9), the Central Bank of the Russian Federation acts as a price regulator. But he indicates for the UK only the values of the base tariff corridor.

This corridor is defined according to:

- Maximum and minimum tariff rates;

- Territorial coefficients.

According to Art. 9, paragraph 1 (FZ No. 40), the cost of the policy is calculated as the product of base rates (BS) and territorial coefficients (TC).

The BS and TC values are set by the Central Bank of the Russian Federation for a period of at least one year.

Basic tariff rates

These rates are divided into 7 tariff groups corresponding to related categories of auto, motorcycle, and electric transport.

These tariff groups can be divided into subgroups, according to various conditions that may affect the degree of risk of harm:

- Type of subject of ownership;

- Scope of application;

- nature of use;

- passenger capacity;

- Load capacity.

I will give an example for passenger vehicles with a minimum and maximum base cost of the policy. Passenger cars are included in the tariff group for categories "B" and "BE", which is divided into 3 subgroups:

- Legal entity - from 2573 to 3087 rubles.

- Individuals (including individual entrepreneurs) - from 3432 to 4118 rubles.

- Vehicles used as taxis - from 5138 to 6166 rubles.

Territorial coefficients

The basic cost of the policy also depends on the regional factor, according to Art. 9, paragraph 2 (FZ No. 40). Such regulation was introduced due to a significant difference in the operating conditions of the vehicle between different regions (risk levels, price levels, etc.).

Such a difference in the conditions for OSAGO is expressed in territorial coefficients, the values of which are updated according to the same rules as the base rates.

The territorial coefficient is determined according to the place of primary use of the vehicle, taking into account the address of registration of the owner or owner (Article 9, paragraph 2, paragraph "a", Federal Law No. 40).

TCs are divided into 86 groups, almost completely corresponding to 85 subjects of the Federation. Group 86 is dedicated to the foreign leased territory of Baikonur. Most groups are subdivided into subgroups - large cities have their own coefficient, and all other settlements have one common coefficient.

Also, special-purpose vehicles have their own shopping malls, without separation from the influence of the region.

Calculations of insurance companies

Based on the base cost, insurers build their own calculations, taking into account the individual characteristics of the driver, vehicles and insurance history.

The main factors that affect the calculations of the SC are as follows:

- Base price corridor;

- Age of the driver;

- Driving experience;

- Safe driving;

- The number of drivers included in the policy;

- The period of validity of the contract;

- Technical data of the vehicle.

Moreover, this list can be expanded, according to subparagraph "e" (clause 2, article 9 of the Federal Law No. 40). For example, some SCs take into account the gender of the driver.

Driving safety of the driver

Accident-free driving is a special parameter that is fundamental for OSAGO. It is determined by the point system of bonus-malus coefficients (MBM) and it significantly affects the cost of insurance.

In this system, there is a base value assigned to the driver at the start of his driving history - the insurance class (initial KBM = 1, initial class = 3). Then, depending on the number of insurance payments, adjustments are made annually to this class, reducing or increasing it.

Moreover, such classiness increases slowly (by 1 class unit or 0.5 KBM points per year). But you can lose it quickly - two insurance payments a year are enough to slide from the highest class (13) back to the basic one (3).

Such a system contributes to the so-called. accident-free driving, which has a positive effect on overall road safety.

However, there is one flaw here - insurance safety and true safety are not the same thing. Insurance companies reduce the cost of the policy not for the absence of accidents, but for the absence of insurance payments. That is, a driver can constantly get into an accident and be in bad standing with the traffic police, but if he settles everything privately, then for the UK he is “white and fluffy”.

In the future, this situation may change and the IC will be required to take into account all traffic accidents recorded by the traffic police.

What are car insurance policies?

Within the framework of OSAGO, there are several that the policyholder can choose on a voluntary basis.

Here is their list:

- Basic OSAGO- a classic policy that is mandatory. It assumes the possibility of access to the control of the vehicle by no more than 5 drivers.

- Unlimited OSAGO- a similar policy (issued to the main owner) gives the right to drive a car to an unlimited number of drivers. This option is significantly more expensive.

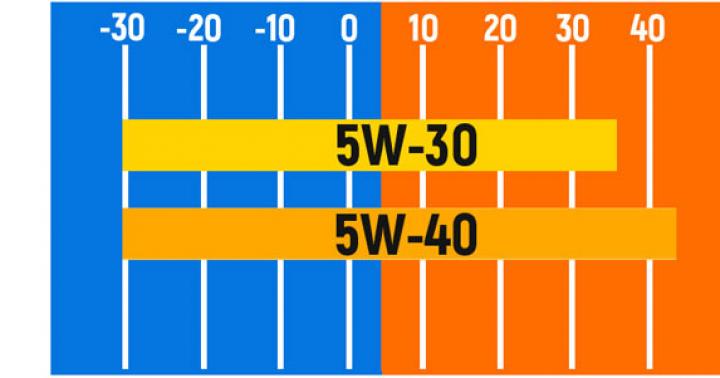

- DSAGO- this is an extension for the OSAGO policy, which gives the driver the right to independently choose the amount of compensation in a wider range. This insurance is useful for expensive cars.

- Seasonal OSAGO- allows the driver to significantly reduce the cost of the policy, reducing the insurance period (options are available for 3 or 6 months). Such insurance is popular with those who use the vehicle not all year round.

- Electronic OSAGO (e-OSAGO)- this is not a type of policy, but the possibility of acquiring it online, which all insurance companies are required to provide from January 2017. This option is suitable for those who want to buy OSAGO quickly, without queues and imposing any additional stages. An electronic policy does not have a legally significant paper form. Although some companies offer e-OSAGO with a duplicated paper contract, this is not provided for by law.

By 2020, it is planned to give insurers more freedom in terms of creating branded OSAGO insurance programs. This is the idea of the so-called. imputed insurance, providing for the liberalization of tariffs and conditions of insurance, but within the framework of state control.

What are the options for insurance compensation procedures?

As you know, the maximum amount of payment for OSAGO for 2016 and 2017 is:

- 400 thousand rubles. - for damage to the "iron";

- 500 thousand rubles- for harm to health or life.

The amount of compensation is calculated based on the amount of damage within these limits. The minimum payment under OSAGO is not limited.

Methods of insurance compensation are constantly being reformed. At first, only the classic version was available - the victim applied for compensation to the company of the culprit.

Then an alternative appeared - direct compensation from the IC of the victim, who could choose one option out of two. Later, this innovation was canceled by the introduction of uncontested direct reimbursement. To all this, the option of in-kind compensation (car repair) was subsequently added.

So, what payment methods are available today? Here is the list as of February 2017:

- Direct non-alternative refund– currently the main payment option;

- classic refund- a fallback option used for insured events, the conditions of which exclude payments under the main direct scheme;

- Reimbursement in kind- now this option takes the place of the alternative.

- Compensatory compensation- this is an insurance option for cases when payments from the insurer are not available (for various reasons). Instead of the UK, the RSA (Russian Union of Insurers) pays money from a special compensation fund.

Question in the subject: Is insurance paid to the person responsible for the accident?

This can only happen if the parties involved in the accident are at fault. In such cases, the refund is usually 50% of what is due. But the IC can make more accurate calculations, taking into account the share of guilt of each participant in the incident.

What will happen to payout options in the near future?

Regarding payment options, it should be clarified that in 2017 a serious reform is coming in relation to their payments - it is planned to replace cash compensation with natural ones for almost all insured events.

So, on December 14, 2016, the State Duma adopted the relevant bill (from M. Yemelyanov) in the first reading. The Central Bank insists on the introduction of the law into force before March 1, 2017.

Yemelyanov's bill was introduced quite recently (by the standards of the Duma) - in June 2016, and only six months later it was adopted in the first reading. Why such haste in such an important matter? After all, the Duma usually adopts laws after their detailed and rather lengthy discussion.

The fact is that in this area the situation is close to catastrophic, which threatens the entire OSAGO system and requires urgent intervention.

Throughout the country, many law firms have bred, the profile of which is to repurchase disputed insurance cases from the victims of their disputes and knock out exorbitantly inflated compensation claims from the UK in their favor. By introducing a non-monetary form of compensation as the main one, it is planned to improve the situation and cut the ground from under the feet of legalized legal fraud.

So important news is expected here, which I will certainly inform you about on the pages of my blog.

- If the insurance risk has been increased and the IC requires additional payment, its amount is calculated according to the current tariffs for this time, which may differ from the original ones (Article 8, paragraph 3, paragraph 2 of the Federal Law No. 40), keep this in mind.

- Payment for the policy accepted by the insurance company from the insured(insurance premium) should participate in its greater share in direct insurance compensation, more precisely, it is 80% of the total amount paid.

- Calculations and the final price for the OSAGO policy in one locality for one driver and one car should not differ significantly from different insurers, pay attention to this.

- Statistical data on OSAGO(the amount of payments to insurers, the number and amount of compensation, etc.) are made public by the Central Bank in annual reports.

Conclusion

So, you have understood what OSAGO is, what principles it is based on, where it takes its roots from and how this system works. Such knowledge will help you navigate the insurance company correctly and not let yourself be deceived.

How do you feel about car insurance? Do you agree with the principles of such insurance? Share your opinion in the comments.

Video bonus: 15 Most Unusual Celebrity Phobias. Neo from the Matrix is afraid of the dark, and the great creator of "Mick and Mouse" mice! Do you want to know what Arnold Schwarzenegger himself and other celebrities are afraid of? Then watch the video and be surprised from the heart:

That's all, share the article with your friends via social networks, subscribe to the blog and don't forget about compulsory insurance.

P.S. Pictured is Range Rover Sport drive2.ru/r/landrover/1549183.

An insurance company is a commercial organization. Such a statement allows you to establish the goal of such a company - making a profit. In other words, all their activities are aimed primarily at generating benefits.

Therefore, when concluding a contract, this fact must be taken into account. It is necessary to carefully analyze each clause of the agreement, to ensure that the information in the document matches the information of the consultant.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

In addition, it is necessary to understand who CASCO is voluntary vehicle insurance. And, unlike, it is not burdened by strict regulations of state rules and a tariff corridor - the terms of provision in different insurance organizations may have significant inconsistencies.

Almost nothing limits insurers in creating additional services and claims - in this way they reduce the risk of unprofitable activities and form a platform for various means of attracting a client.

Often commercial organizations are guided by the principle of understatement. In particular, not a single experienced employee of the company will immediately provide the insured with a full set of discounts that are beneficial for the client - after all, his salary depends on the size of the insurance premium.

In order to protect yourself from problems during registration and on the offensive, you need to carefully analyze the vehicle insurance market, determine the tricks and nuances of each company. Such actions will help maintain financial stability and avoid unnecessary costs.

How to choose an insurance

Choosing the right insurance company is quite difficult. Even with a full analysis of the market in question, there is a risk of obtaining a policy in the wrong company.

Consumer preferences are largely determined by the CASCO interest rate.

Obviously, too low a percentage suggests the presence of some unpleasant features that may open up when an insured event occurs:

- In one case, such insurance carries with it a number of additional conditions. For example, to obtain a policy, you must install an expensive satellite anti-theft system.

- In another, a similar rate really works, but for a certain make and model of a vehicle.

- It is also possible that a low percentage is used only during advertising campaigns, but again on a limited range of cars.

In choosing an insurance company with certain conditions, insurance brokers can help - these are organizations that offer a choice of insurance from various companies and provide quite useful consulting services for each policy

The main advantages of brokers are in providing a wide range of companies, as well as some independence and objectivity when choosing an insurance company.

The profit of such organizations is based on discounts provided by the insurer for the distribution of their own product on the market. Their size can take significant percentages, but still they are approximately the same for each company.

It would seem that the predisposition of brokers to this or that insurance becomes obvious due to higher discounts. But in fact, such a situation is quite rare in the market, since there is very tough competition in it, which makes it unprofitable to lobby for the interests of a particular company. It is much more reasonable to increase profit on the number of insurances sold.

As a result, the principle of "viral marketing" can work - a satisfied client advises his friends to contact the same brokerage organization. This decision is facilitated by the fact that the companies in question often offer additional cost reductions. Such actions allow the client to purchase a policy at a price that he could not achieve by directly contacting the insurer.

But it should be borne in mind that the broker himself is simply the same agent, he is not responsible for the concluded agreement. Therefore, before purchasing a policy, it is necessary to check the authenticity of the document by number - for this you can call the support service of the relevant insurance organization.

Treaty

The contract is the main part in the execution of the policy. It includes all the information that the insured person will need in the future.

Therefore, it is necessary to define the main aspects of this document:

- When applying for CASCO insurance, you need to carefully analyze the agreement, as well as read all the appendices. Often, they contain quite important clauses of the contract.

- It is necessary to set the type of the amount of payments under the document: aggregate or non-aggregate. The cost of the policy depends on them.

- Clarify the franchise. When drawing up, the documents determine the number of insured events that the company can cover in one year. Therefore, it is necessary to determine the type of franchise: conditional or unconditional.

- Some insurance companies inaccurately define the concepts of "fire", "damage", "theft". For example, if there was an attack on the street, followed by the theft of a vehicle, then this is theft. If the car is set on fire, then it is arson, not a fire. Therefore, it is worth clarifying each term. It is also worth considering that it is forbidden to insure separately from theft - if such an offer was received, then there is some unpleasant nuance.

- Passing a technical inspection on time is mandatory for some insurance companies - otherwise, they may refuse to provide payments. But in fact, not a single adequate company will refuse compensation if the vehicle was in good condition during the accident and the technical inspection was passed.

- Mandatory storage of the car at night in a parking lot with security. But before choosing a site, it should be borne in mind that some parking lots do not have the concept of “guarded” in their legal status.

Knowledge of such aspects will help to avoid misunderstandings. In addition, compliance with them can bring significant benefits.

How CASCO works in the event of an insured event

It is important to understand how CASCO works.

Knowing the main features of the procedure allows you to track any violations during the entire process:

- The insurance contract may set a standard hour price tag. Then the insured person, in case of an increase in the cost of services, will have to make up the difference with his own funds.

- It is recommended that the agreement contain a condition for compensation for damage without a certificate from the competent authorities, if the damage does not exceed 5% about the sum insured. It is also important to clarify the method for determining whether these 5% . For example, after calculations, the amount of damage can be 5, 001% . But the necessary documents can no longer be obtained from the authorities, so compensation will not be made.

- It is worth establishing the availability and clarification of the terms for the provision of the following additional services:

- evacuation of a car in case of a traffic accident within the Moscow Ring Road;

- visit by the emergency commissioner to the accident site;

- receipt and registration by the representative of the company of the necessary documentation both at the scene and in the traffic police;

- inspection of the vehicle at the scene of the accident.

If the policy does not imply the implementation of such options, then the client will have to independently perform these actions.

What to do in case of an accident

Road traffic accidents occur in large numbers every day. A CASCO policy allows you to avoid significant costs after an accident. Knowing the basic actions in the event of an insured event will help you get the maximum benefit.

So, the driver must ensure that the following steps are followed:

- Turn on the emergency signal and put up a special sign at a distance of 15 meters from the vehicle.

- Call the traffic police.

- Notify the insurance company of the accident.

- The car must be in place until the arrival of the competent service. You should not agree to the settlement of the case without drawing up a protocol, since in this case it is not possible to receive compensation payments from the insurance company. You also need to take into account that if you have a CASCO policy, they may insist on taking the blame - after all, the company will pay for the repair anyway. But insurance can rise in price significantly, so you should refuse such an offer.

- It is necessary to record all received and existing damage, as well as provide a photographic display of the accident site. In the future, this information will be attached to the protocol of the case.

- The inspector must also reflect all damage and record information about the participants in the traffic accident. It is recommended to indicate to the specialist the damage received: hidden, scratches, chips, dents. You need to defend your point of view, since the culprit of the accident can get caught quite cunning - he will try to turn the matter to his advantage.

- After fixing the damage and filling out the paperwork, the traffic police officer issues all the necessary certificates that must be provided to the insurer.

- Next, an examination and damage assessment is carried out.

- If all conditions are met, insurance compensation is paid in cash or the vehicle is sent for refurbishment at the expense of the insurance organization

Knowing the answer to the question "How does CASCO work?" eliminates many "pitfalls" of the insurance procedure. The choice of a company largely determines further actions, so you should trust an insurance broker who can provide real advice with real results.