Cashless payment is one of the most convenient payment options; This is their high speed and the almost complete absence of regulatory restrictions in making payments.

Therefore, many companies choose non-cash payments for their purposes, minimizing cash handling.

Moreover, payments through credit organizations are a cheaper option compared to payments through banknotes and coins.

What is non-cash payment?

First of all, this payment format is available to everyone - legal entities, entrepreneurs and ordinary citizens. Non-cash payments are made only through banking and other credit structures that are authorized to carry out banking operations.

In general, non-cash payments are settlements that are realized through the movement of funds through accounts belonging to participants in such settlements.

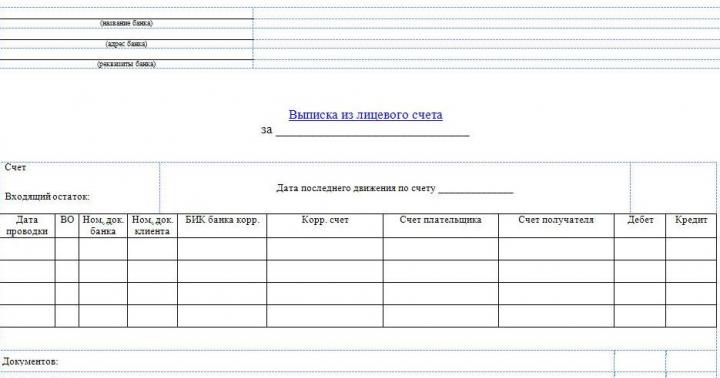

In fact, funds are debited and credited electronically. At the end of the working day, the account owner is provided with an account statement, which reflects the balance at the beginning and end of the day, as well as all incoming and outgoing transactions. This allows you to control cash flows.

Non-cash payments are regulated in the Russian Federation two main regulations:

Non-cash payments are regulated in the Russian Federation two main regulations:

- The Civil Code of the Russian Federation - its Chapter 46 “Calculations” sets out the basic provisions on all permitted forms of non-cash circulation;

- Regulations on the rules for transferring funds No. 383-P, which was approved on June 19, 2012. Bank of Russia. This document provides a more detailed description of non-cash forms of payment, as well as requirements for payment documents. This Regulation does not contradict the norms of civil law.

In addition, there is another regulatory act that was approved by the Bank of Russia - the Regulation on the issuance of payment cards dated December 24, 2004. No. 266-P. This document reveals the procedure for acquiring – payments using payment cards for goods and services. Acquiring is a unique form of non-cash payments, which is available primarily to ordinary citizens.

On the basis of these three documents, non-cash circulation is organized and controlled, which is increasingly replacing cash circulation. And there are reasons for this:

- settlements through bank accounts rarely depend on the time of the transaction (i.e., time of day) and geography;

- non-cash payments are much cheaper to service than cash payments;

- in addition, for organizations it is more preferable to make payments through, since such payments have much fewer requirements for registration, organization and accounting than for cash transactions. Therefore, many start-up companies, in order to save money and protect themselves from fines for errors in compliance and in application or non-use, are switching to non-cash payments. Large, experienced companies are also striving for this.

As for ordinary citizens, for them, non-cash payments are convenient, since it is enough to have a payment card to make a payment, and beneficial, because when paying with a card, fees for settlement services are often not charged.

As for ordinary citizens, for them, non-cash payments are convenient, since it is enough to have a payment card to make a payment, and beneficial, because when paying with a card, fees for settlement services are often not charged.

But the state also benefits from the growth of non-cash payments; in particular, the circulation of the money supply is controlled, and a decrease in the amount of cash in circulation reduces the level of inflation.

Kinds. Their advantages and disadvantages

In legal nature there is several forms, in which non-cash payments are carried out.

Molds and tools

In accordance with Bank of the Russian Federation Regulation No. 383-P, these forms include:

- Settlements using a payment order. In this case, a document is drawn up that contains an instruction to the bank, at the expense of the payer’s funds, to transfer the amount specified in the payment document. The transfer is carried out within the time frame and to the person specified in the order. This translation option is considered one of the simplest and most traditional. Valid for 10 days, which does not include the day the document was drawn up. This payment format is available even to an ordinary citizen who does not have a current account. The inconvenience of settlements through payment orders is that if an error is made in the document during execution, it can cause a significant delay in payment or its sending to the wrong recipient of funds;

- Payments via letter of credit. In fact, this is a special account that is used only for settlements on transactions that require the intermediation of the bank. In other words, a letter of credit is an order from the payer to the bank to transfer funds to the recipient only if the latter complies with special conditions, for example, delivery of goods, provision of documents and other conditions. The effect of a letter of credit can be described in simple terms as follows: the buyer opens a letter of credit in his bank and transfers there the cost of his purchase, but the supplier will be able to receive these funds subject to delivery of the goods and transfer of accompanying documents to the bank where the letter of credit was opened. And then the bank transfers funds. The convenience of this form of payment lies in the security of the transaction. But the disadvantage of a letter of credit is its high cost, its isolation from the bank account agreement (the letter of credit is opened separately), the participation of several parties in the transfer of funds: the buyer and the supplier, the issuing bank (it opens the letter of credit) and the executing bank (it executes the letter of credit) . By the way, often one bank can be both the executor and the issuer;

- Settlements through collection orders or collection. Their specificity is that such calculations are possible only if the claimant (recipient) has the rights to make claims against the debtor’s (payer) account. These rights may be provided for by law or by an agreement concluded between the account holder (debtor) and the bank. Collection is inherently demanding. Those. In order to collect the required amount, the recipient of the funds must provide the bank holding the payer's account with the necessary information about the debtor and his obligation. Also, the collection order is not inherently of a notification nature. The debtor often finds out about the write-off only after the money has been withdrawn from him. And this can make it difficult for the debtor to carry out other banking operations due to a lack of funds in the account;

- Payments through checkbooks. This option can be conditionally called cash-non-cash, since it involves debiting funds from the drawer’s account to the check holder’s account or issuing cash to him. Moreover, settlement of checks is carried out only on the condition that the drawer has a sufficient amount of money in his account and after confirming the identity of the bearer of the check and the authenticity of the check itself;

- Payments in the form of direct debit. In this case, the transfer of money is made at the request of the recipient. To perform this transfer, the operator who will perform the settlement operation must have an agreement with the payer and his acceptance (consent) to carry out such an operation. Such calculations are carried out within the framework of the national payment system of Russia and in the presence of a payment card. The cardholder's acceptance of the debiting of funds from the card must be enshrined in an agreement or other document that supplements the agreement;

- Payments in the form of electronic money transfer. As part of this type of non-cash payments, an individual (citizen) provides the operator with funds for conducting transactions, both from his personal bank account or without it, and from the accounts of organizations and entrepreneurs that provide funds in favor of this citizen. But this is only possible if the agreement between the individual and the operator provides for such a right. As for entrepreneurs and organizations, they can only use funds from their bank accounts.

The last two types of non-cash payments are regulated by the law “On the National Payment System” dated June 27, 2011. No. 161-FZ.

The advantages of non-cash payments are described in the following video:

If you have not yet registered an organization, then easiest way This can be done using online services that will help you generate all the necessary documents for free: If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue and will completely replace an accountant at your enterprise and will save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online. It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it has become!

Principles of non-cash payments

Cashless payment system based on the following principles:

Based on these principles, not only the construction of a non-cash payment system is carried out, but also their implementation.

Order of conduct

Any non-cash payments are carried out only if you have an account opened under a bank account agreement. However, the current legislation of the Russian Federation provides for the possibility of conducting non-cash transactions without the payer opening a current account. But this is only possible when making payments by ordinary citizens whose transfers of funds are not related to business activities.

To conduct non-cash payments, an account can be opened either in a bank or in another credit institution that has a license from the Bank of Russia to carry out such operations.

To make non-cash transfers payers can open:

All these accounts can be opened in rubles and in foreign currencies.

Accounting Rules

To record non-cash transactions, organizations use account 51 “Current accounts”, where analytics are built for each current account opened by the organization. All transactions are reflected on the basis, for example, on the basis of payment orders, collection orders, etc. And to reflect transactions on special accounts, organizations use account 55 “Special bank accounts” with analytics on letters of credit, deposits, check books, and other similar forms of non-cash payments.

To record non-cash transactions, organizations use account 51 “Current accounts”, where analytics are built for each current account opened by the organization. All transactions are reflected on the basis, for example, on the basis of payment orders, collection orders, etc. And to reflect transactions on special accounts, organizations use account 55 “Special bank accounts” with analytics on letters of credit, deposits, check books, and other similar forms of non-cash payments.

Entrepreneurs do not use it, but they record income and expense transactions on a bank account in their books of income and expenses. And based on the register data, the calculation is carried out. They also use payment orders or collection orders, memorial orders, etc. as confirmation of non-cash transactions.

As for ordinary citizens, they can receive statements from their accounts to control their funds.

Responsibility for violation of settlement relations

Punishment for such violations is provided for in Chapter 15 of the Code of Administrative Offenses of the Russian Federation. Moreover, both account holders and credit institutions are punished.

For example:

- In case of violation of work with a special account, payment agents may be charged from 40 to 50 thousand rubles;

- if the bank violated the deadline for transferring funds to the budget from the taxpayer’s account, then up to 5 thousand rubles will be collected from the bank official.

The history of occurrence and basic principles of these types of calculations are described in the following video lecture:

Minimum order amount in the online store: 5,000 rub.

Cash payment for individuals

After placing your order you can:

- Come to the pick-up point and pay for your order.

- Pay the order to the courier upon delivery.

If you pick up the order yourself, then pay for the goods at the office at the address: Moscow, Varshavskoe highway, 125D building 2, office: 315 (pickup point)

- When you pay for your order, you receive sales and cash receipts.

Cash payment for legal entities

Payment method for settlements with organizations:

As in the case of individuals, you can pay for your order to the courier upon delivery or in the office.

- Payment is made only in rubles.

- To receive the goods, you must provide the original power of attorney from the paying organization or certify our copy of the delivery note with the seal of the paying organization.

- When you pay for your order, you will receive a cash receipt, delivery note and invoice.

Payment by bank transfer for individuals

How to pay an individual by bank transfer:

Individuals can pay for their order by bank transfer to our bank account (bank commission is possible). After paying for the order, be sure to notify us or about payment by phone +7 495 215-50-52 or email

- Upon receipt of your order, you receive sales and cash receipts.

Payment by bank transfer for legal entities

How to pay a legal entity by bank transfer:

To pay for your order by bank transfer, you must provide the full details of your company at . The manager will issue you an invoice and send it in the manner agreed upon with you. The invoice and reserve for goods is valid for three banking days.

The goods are released after funds are credited to our bank account. To receive the goods, you must provide the original power of attorney from the paying organization or certify our copy of the delivery note with the seal of the paying organization.

- Upon receipt of your order, you will receive an invoice, delivery note and invoice.

Electronic payments

We pay through: Sberbank, Alfa-Bank, Webmoney, Qiwi, Visa and MasterCard, etc.:

Electronic payments- a convenient service that allows customers to pay for their online purchases with electronic currencies.

You can pay with us using payment systems:

- Sberbank

- Alfa Bank

- Webmoney

- Visa and MasterCard

Note! Some payment methods apply a fee.

More and more businesses and individuals are choosing a virtual form of payment. The fact is that it is not a low-cost option and is produced much faster, regardless of time and days of the week. Payment by bank transfer is very convenient and practically not limited by regulatory documents. Therefore, it is gradually replacing conventional cash payments. More detailed information is provided below.

What is non-cash?

A form of non-cash payment is the movement of funds through the accounts of clients of banking or credit organizations in electronic form. Any payment for goods by bank transfer is carried out only through specialized organizations that have licenses to perform banking operations.

Bank transfer is available to absolutely all persons, regardless of the form of their activity. As a rule, at the end of the working day, account holders are provided with a statement of their cash flow activity for the day, which allows them to control all transactions. But if necessary, such a statement can be requested from a credit institution at any time.

Regulation of non-cash payments

Payment by bank transfer is subject to only three regulatory documents that fully control their implementation. The main one is the Civil Code of the Russian Federation, Chapter 46 of which describes all the basic requirements for permitted non-cash forms of money circulation.

- regulations on the issue of payment cards;

- Regulations on the rules for making money transfers.

The first document was approved by the Central Bank on December 24, 2004 and reveals the procedure for the legal implementation of acquiring. This concept defines the non-cash payment for services or goods that is familiar to many ordinary citizens.

The second document was approved only on June 19, 2012 by the Bank of Russia and contains all the necessary detailed descriptions of possible forms of non-cash payments and requirements for them. Everything contained in the provision fully complies with the norms of the Civil Code.

Any payment by bank transfer must be carried out in strict compliance with all of the listed regulatory documents, but such control is not an obstacle to the growing popularity of non-cash money circulation among the entire population.

Advantages of non-cash payments

First of all, payment by bank transfer requires minimal documents in comparison with regular cash payments between organizations. Many companies choose this form of payment because it makes it possible to avoid large fines due to errors in registering cash discipline and using cash registers.

Large organizations are also increasingly invoicing their clients by bank transfer, instead of taking cash from them. This allows companies to save significantly, since servicing such operations is much cheaper.

The obvious benefit of such calculations for ordinary citizens is the convenience of transactions. The fact is that you can carry them out simply by having a payment bank card and the ability to access the Internet, and commissions for money transfers between accounts are not always charged or amount to minimal losses.

Such virtual settlements also have benefits for the state, because it allows you to constantly monitor all cash flows in real time. In addition, a decrease in the turnover of the living money supply reduces the possibility of inflation in the country.

In general, the advantages of non-cash payments are clearly visible to everyone, and most importantly, they can be carried out at any time of the day, on any day of the week and completely regardless of the geography of the transfer.

Types of bank transfer payments for individuals

Ordinary citizens may think that bank transfers are only transfers between accounts, but in fact there are 6 types of them. Most are available only to legal entities and organizations and are controlled by the same regulatory documents.

The most common form of payment available to civilians is in the form of an electronic transfer. It represents the transfer of funds from the payer’s personal bank account to the recipient’s account through a banking operator. The recipient can be an individual or an organization, the main thing is that such a right is described in the agreement between the account holder and the bank. The payer can only be a private person.

Another form of payment, which, like the previous one, is regulated by the law “On the National Payment System” is direct debit. It represents the debiting of funds from the owner’s account at the request of the recipient, but only if this is permitted by the agreement between the account owner and the credit institution. Most often, such payments are mandatory fees for servicing a bank card or account.

Most common form

Individual entrepreneurs pay by bank transfer most often by means of a payment order. Even individuals who do not have a current account with a credit institution can use this form. Payment involves the preparation and transfer to the bank of a certain document - an order, detailing the amount, recipient and time frame within which the transfer must be made. All this is carried out at the expense of the payer.

The validity period of the order is officially 10 days, not taking into account the moment of submission of the document, but in practice everything happens much faster. Only incorrect execution of the order can slow down the receipt of funds.

The most secure form

The most secure form of non-cash payment is payment through a letter of credit. It represents an inconvenience for the payer, since it requires a separate opening of a letter of credit, even if this bank already has a current account, but all this is for the sake of security.

The payer must transfer a certain amount for goods or services to an open account and oblige the bank to pay them to the recipient only if certain conditions are met. That is, until the recipient gives the credit institution confirmation that he has fully fulfilled his obligations under the transaction, he will not receive the money. In this case, the bank acts as an uninterested third party and guarantees the legality of the transaction.

Cash-non-cash payment

Conventionally, cash/non-cash payment determines settlements through checkbooks, since after debiting funds from the drawer’s account, it may imply issuing them in cash or transferring them to a bank account. This form of payment is more common in Europe and the USA and is carried out only after confirming the identity of the bearer of the check and receiving information about the presence of an amount sufficient for the transfer in the drawer’s account, and, of course, after confirming the authenticity of the check.

Another form of non-cash payment is a transfer through collection or collection order. It is carried out only when the recipient of the funds provides the bank with confirmation of the account owner’s monetary obligations to it. In essence, this is debt collection and it occurs even without timely notification to the account owner. As a rule, the debtor learns about the withdrawal after the transfer has been made.

What is non-cash based on?

First of all, all non-cash payments must be carried out in accordance with laws and regulations. In addition to the general rules, each credit institution is obliged to act only within the framework of a valid agreement between the bank and the account owner. Going beyond the scope of the document is allowed only when signing a new agreement. In addition, the bank does not have the right to influence the choice of payment form for the participants in the transaction.

Any invoice issued for payment by bank transfer, a sample of which can be obtained directly from a credit institution, must be supported by a sufficient amount of funds in the payer’s account. In addition, money transfer operations must be carried out within a specified period, otherwise sanctions or fines may be imposed on the culprit. And, of course, every account holder has the right of acceptance, which means that even the state is prohibited from debiting money from the account without prior notification.

Types of accounts

Any non-cash payment is permissible only if you have a bank account with the required amount on it. The only exception is payment by means of a payment order, which is permitted by law and can be made even in the absence of a bank account, but only by individuals. To conduct business, you must have a bank account.

There are several varieties of them:

Funds control

For individuals, keeping track of the movement of funds in an account allows you to keep bank statements; for organizations, it is more and more difficult. They use books of income and expenses, in which they record data on payment orders, collection transactions, memorial orders, and so on. Analytics of special accounts is carried out using statements of letters of credit, deposits, check transactions and other forms of payments.

The bank should tell you in detail how to issue an invoice for non-cash payment to the account holder, as well as inform you about possible fines. They are imposed both on the credit institutions themselves and on paying agents if they fail to fulfill their obligations on time.

Non-cash payments are a special type of payments that do not use cash. All payments are made by transferring funds from account to account in credit institutions or, for example, by offsetting mutual claims. Initially, they were introduced to facilitate and accelerate capital turnover, as well as to reduce the amount of cash. The circulation costs associated with cash also decreased. Government institutions also promote non-cash payments for the reasons listed above (increasing the speed of cash turnover plus saving on their maintenance).

Cashless payments and payments

The very first non-cash settlements and payments were settlements and payments using checks and bills. Afterwards, clearing houses were introduced - organizations that carry out transactions between different banks. Then, in most developed countries, giro payments spread as a subtype of non-cash payments (through giro banks, commercial banks, savings banks).

Non-cash payment transactions are the main type of banking operations. There are collection, transfer, and letter of credit operations.

Non-cash payments and payments are regulated by law. In Russia, this is the Civil Code of the Russian Federation (from Article 861 to Article 885), the Federal Law “On the Central Bank of the Russian Federation”. The federal law “On Banks and Banking Activities” and other regulations also apply.

What is cashless payment?

A non-cash payment is considered to be a settlement using non-cash money circulation (in non-cash form - that is, in the form of an entry on the corresponding account). Non-cash payment is carried out according to several principles:

- in the legal field,

- on bank accounts,

- in accordance with liquidity at the level of uninterrupted payments,

- voluntarily (with the consent of the payer),

- at a certain time,

- with control over the correctness of calculations according to the order in which they are performed,

- on contractual terms.

The full definition and all conditions for making such payments are indicated in the current Regulations on non-cash payments (approved by the Central Bank of the Russian Federation).

Types of non-cash payments

Initially, non-cash payments were made in the form of bills or checks. Today they apply

- payment orders and order requirements,

- checks, letters of credit,

- collection orders,

- electronic payments.

A detailed list of settlements (payments) is indicated in the corresponding document of the Bank of Russia dated June 19, 2012. Regulation No. 383-P “On the rules for transferring funds” specifies all types of non-cash payments, except the last one (electronic), however, the Federal Law of June 27, 2011 No. 161, as amended on July 23, 2013, also applies - “On National payment system." According to this document, electronic payments (using electronic money) have also become a form of non-cash payments.

Refund of non-cash payment

By law, it is permissible for clients served by a bank to revoke their payment documents. However, in practice, returning a non-cash payment entails a whole series of procedures.

- If the money was transferred incorrectly, the operation was carried out and the funds were credited, the return of money via non-cash payment is made in court. At the same time, it is important to prove that no services were provided (when funds were credited to the company’s account).

- If a return is required by a store customer returning an item, then several options are possible: transfer of the required amount by the seller to the buyer by non-cash method (for example, return transfer to a card) or in cash.

Attention. Often, companies operating in the trade sector enter into an agreement with the bank that services the terminals about the possibility of returning funds for non-cash payments.

From the client in whose favor a refund is to be made, a current account number, bank name and correspondent account number, INN and BIC of the recipient, and his full name are usually required.

Payment by bank transfer

Payment by bank transfer can be made in several ways: using

- payment order or demand,

- letter of credit,

- collection order,

- check (checkbook).

Payment by bank transfer is carried out in the form of a transfer of funds from the sender’s account to the recipient’s account, which can be in this or another bank. At the same time, a payment order is the most frequently used form of payment.

A payment request means a request from the recipient to the payer to pay a certain amount. Used for the convenience of non-cash payment for goods and services. The payer must provide acceptance (agree to pay the amount) or refuse - then the claim is returned without fulfillment.

Collection orders are issued by government agencies based on a court decision.

A letter of credit is an obligation to make a payment upon presentation by the recipient of certain documents (acts, delivery documents).

Accepting non-cash payments

Non-cash payments are accepted in several ways: either by crediting to the organization’s account through a bank, or through a terminal (cash register, bank pinpad). In addition, today organizations are trying to automate the transfer of funds as much as possible in order to eliminate errors and the “human factor”. The commission for non-cash payments, in contrast to payment systems that charge up to 5%, is 0%. To accept non-cash payments, organizations solve several problems:

Preparation of invoices and contracts (optional),

Control of funds transfer,

Preparation of closing documents.

To accept payments, you need the organization's INN, current account number, BIC of the servicing payer bank, legal and postal address.

Problems of non-cash payments

The main problems of non-cash payments are:

- the difficulty of establishing a settlement and payment system,

- risks arising in connection with payments,

- the presence of non-payments (their changes affect the budget deficit),

- speed of payments (including taking into account failures and delays, errors made by both senders and recipients of funds, and the payment centers themselves),

- priority of payments and its regulation, causing damage to other creditors,

- insufficient development of the regulatory framework for making non-cash payments (for bills of exchange and letters of credit).

In addition, enterprises are responsible for compliance with loan agreements, as well as established payment discipline. If an organization does not fulfill its payment obligations, it may be declared insolvent.

Accounting for non-cash payments

When making payments between organizations in the form of non-cash payments (by transferring from account to account), there is a need to account for non-cash payments using special payment documents. They are the basis for calculation and can be issued in the form of an order:

- payer (this can be either a client or the bank itself),

- recipient of funds, or claimant.

Enterprises themselves determine the appropriate forms of documents for recording non-cash payments; only the presence of details is required -

- name of the enterprise,

- document number,

- name of the paying bank, MFO, RCC, current account number,

- name of the recipient, recipient bank, its details.

Accounting for such transactions is carried out using account 51 “Current accounts” (both receipts on debit and disposals on this account).

The basis or primary document for accounting is a bank statement or payment order. This is true for different types of payments:

- receipt of money in payment for services or goods,

- depositing cash into a current account,

- receiving advance funds,

- receipt of the authorized capital,

- payment of bills from suppliers, contractors,

transfers to the budget of mandatory payments, contributions to the Pension Fund and other organizations (FSS, FFOMS, TFOMS).

Very often, relations between individual entrepreneurs and organizations are formalized by an invoice for payment. One of the parties issues an invoice to the client, he pays it, and then receives the paid goods or services. Today’s article is for those who do not know what an invoice is and how to issue it.

I would like to point out right away that issuing invoices and maintaining reports is very convenient in special service.

Let's start with the fact that an invoice is a document that the seller issues to the buyer. The invoice contains the following basic information:

- Information about the seller - who issued the invoice;

- Information about the buyer - to whom this invoice was issued;

- List of goods or services, their quantity - what the buyer pays for;

- Prices for goods or services, total amount - how much the buyer must pay;

- Seller's bank account details - where the buyer should pay.

Essentially, the invoicing process goes like this:

- A potential client contacts the seller because he wants to purchase his goods/services;

- The seller, based on the client’s request, draws up an invoice for payment and sends it to the buyer;

- The buyer pays the specified amount to the bank account of the seller;

- The seller verifies receipt of payment and delivers goods/services to the buyer.

When should you issue an invoice?

Here are a few situations:

- There is a valid agreement between the counterparties, but it does not contain specific amounts of goods/services, their volume and delivery/performance dates. The agreement is concluded for a long period and contains general provisions for cooperation between the two parties. As needed for goods/services, the client sends a request to the seller, and the seller issues an invoice to him according to each specific request;

- There are no contractual relations between the parties, and the supply of goods or provision of services must be carried out as quickly as possible. In this situation, the seller issues an invoice for payment, and the contract is drawn up later.

- An invoice for payment is also issued in the case of a one-time supply or service, when there is no point in the parties signing an agreement.

Thus, an invoice for payment is a document that serves as the basis for the buyer to pay the seller in order to receive goods or services from him. Please note that we are talking about non-cash payment, so the seller must have a bank account.

The invoice for payment does not have a unified form; you can develop it yourself. The invoice must contain the following mandatory details:

- Name of the legal entity (if it is an organization) or individual entrepreneur;

- Seller’s TIN (for legal entities you must also indicate the checkpoint);

- Bank details, current account number, personal account number, correspondent account, bank name and BIC;

- List of goods/services;

- The total amount of the invoice, including VAT.

And there you can download examples of filling out in Excel format, screenshots of which we will provide below.

Pay special attention to the allocation of VAT in the invoice! If you are a legal entity or individual entrepreneur using the general regime, then the VAT rate must be specified in the invoice form and its amount must be highlighted. If you use the simplified tax system, then VAT is not allocated, the total amount is indicated in the invoice and the note “Without VAT” is added.

Example of an invoice without VAT:

Example of a VAT invoice:

The account, as we have already noted, can be developed independently. It can be done in Excel or Word and the created file can be used as a template. The invoice can be issued either on the seller's letterhead or without it. To automatically generate invoices for payment, you can also use accounting programs or electronic services.

The invoice must have a serial number. Their new numbering begins at the beginning of each year. You can simply number them in order (No. 1, 2, 3, 4...), or you can use special numbering, although it will still be sequential (No. TT/16-1, TT/16-2...).

In the invoice, you can specify additional conditions for the provision of services or delivery of goods, for example, the deadlines for their implementation.

The manager and chief accountant put their signatures on the account. If the invoice is issued by an individual entrepreneur, then only the individual entrepreneur must sign. It is advisable to put a stamp.

Next it is sent to the buyer for payment. The original invoice can be sent by mail or courier; to speed up the process, a copy of the invoice is sent to the buyer by email or fax. If the buyer agrees with the conditions specified in the invoice, then he pays it.