In accordance with Part 2 of Art. 34 of the RF IC, shares in the capital of commercial organizations, if they were contributed during the marriage, regardless of which spouse they are in the name of, are the joint property of both spouses.

Thus, shares in the authorized capital of a limited liability company, regardless of which spouse they are in the name of, are the joint property of both spouses, that is, the share, for example, of a husband in the authorized capital of an LLC is also the joint property of his wife, even if she is not a member of this limited liability company.

According to Art. 1150 of the Civil Code of the Russian Federation, the right of inheritance belonging to the surviving spouse of the testator by virtue of a will or law does not detract from his right to part of the property acquired during the marriage with the testator and which is their joint property. In this case, the share of the deceased spouse in this property is included in the inheritance and passes to the heirs.

In the absence of other heirs of the deceased LLC participant, no special problems arise with determining the scope of the rights of the surviving spouse, since the surviving spouse inherits the entire share in full by inheritance. The regime of joint ownership ends, as all property passes to the surviving spouse.

The situation is more complicated with determining the scope of the rights of the surviving spouse in a situation where there are other first-line heirs. Practice has shown that under such circumstances the rights of both other heirs and the surviving spouse may be violated. From the date of opening of the inheritance, the testator’s property belongs to the heirs on the right of common shared ownership, that is, each of the heirs owns an ideal share in the property, but not any specific property. However, surviving spouses sometimes abuse their right by assigning the right to a share in the authorized capital of the company to themselves, since the property was jointly owned by them and their spouse, ignoring the rights of other heirs.

On the other hand, in practice cases often arise when the share of the surviving spouse is included in the inheritance estate. This is evidenced by the established notarial practice related to the registration of inheritance rights to property acquired by spouses during marriage. Thus, a certificate of ownership of a surviving spouse’s share in jointly acquired property is issued only at the request of this spouse. If the surviving spouse has not expressed a desire to receive a certificate of ownership, then his share in the jointly acquired property is included in the inheritance estate. Thus, the subject of inheritance becomes not a share in the right of common ownership of property, as it should be, but all property, which, of course, violates the rights and legitimate interests of the surviving spouse.

As already mentioned, according to Art. 1150 of the Civil Code of the Russian Federation, the share of the deceased spouse in the common property is included in the inheritance and passes to the heirs. But what is the size of the deceased spouse's share? In accordance with Art. 39 of the RF IC, when dividing the common property of spouses and determining shares in this property, the shares of the spouses are recognized as equal, unless otherwise provided by the agreement between the spouses. Based on Art. 17 of the Civil Code of the Russian Federation, all rights of the deceased spouse are terminated, which in practice leads to the establishment of actual personal ownership of this property by the surviving spouse.

Article 1150 of the Civil Code of the Russian Federation allows us to conclude that the surviving spouse’s right to a share is heterogeneous. For example, in addition to the surviving spouse, there is another first-degree heir. In this case, the surviving spouse will be the owner of 1/2 share as a participant in common joint property according to the rules of Art. 39 of the RF IC and 1/2 of the share of the deceased spouse as an heir (that is, in total, his share in the testator’s property will be 3/4). Only the last part passes to the spouse as an heir and constitutes common shared property with other heirs, subject to special rules on the division of property.

For that part of the share that passes to the spouse of the deceased participant as the surviving spouse, a certificate of ownership of the share in the common joint property of the spouses is issued. This certificate is issued by a notary according to the rules of Art. 75 Fundamentals of the legislation of the Russian Federation on notaries in compliance with the provisions of Art. 256 of the Civil Code of the Russian Federation and Art. 34 - 37 RF IC. At the same time, the Methodological Recommendations "On the inheritance of shares in the authorized capital of limited liability companies" indicate the obligation of the notary to request from the surviving spouse documents confirming the ownership of the share by one of the spouses and the acquisition of the share during the marriage on a paid basis, and a statement that the regime The spouses' joint ownership of the share in the authorized capital of the company was not changed by the marriage contract.

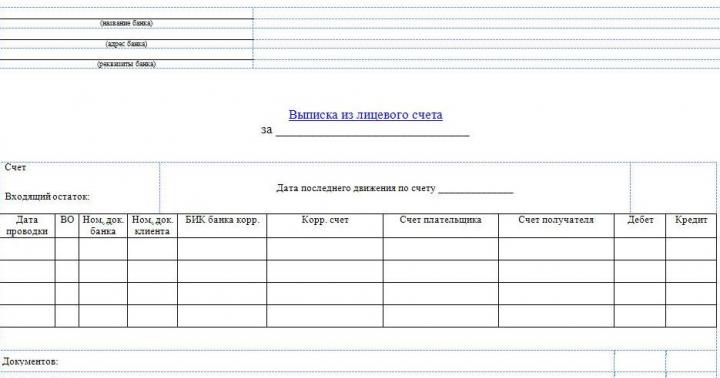

For the other part of the share, the surviving spouse receives an inheritance certificate. As explained in the above methodological recommendations, in order to formalize inheritance rights to a share in the authorized capital of a limited liability company, heirs must submit the following documents to the notary: charter (copy of the charter) of the limited liability company; extract from the Unified State Register of Legal Entities; document of title of the testator for a share in the authorized capital of the company; a certificate from the company confirming payment of the share by the testator; report on the market value of the share in the authorized capital of the deceased LLC participant; list of LLC participants.

Thus, in order to confirm his rights to a share in the authorized capital of the LLC, the surviving spouse must have two documents: a certificate of ownership of the share in the common joint property of the spouses; certificate of inheritance.

However, having received these documents, the surviving spouse does not automatically acquire the status of a participant in a limited liability company, as many heirs believe. This provision is dictated by established judicial practice, which we consider justified. The courts proceed from the fact that the provisions of Art. 34 and 35 of the RF IC establish only the composition of the objects of common joint property of spouses and its legal regime. The procedure for becoming a member of the company is regulated not by this regulatory act, but by the norms of corporate legislation.

The concept of a share in the authorized capital of a limited liability company is intertwined with the status of a participant in a limited liability company; in this context, these are separate concepts. According to paragraph 8 of Art. 21 of the Federal Law of February 8, 1998 No. 14 “On Limited Liability Companies” (hereinafter referred to as the LLC Law), the company’s charter may provide that the transfer of a share in the authorized capital of the company to the heirs of persons who were participants in the company is allowed only with the consent of other members of the society.

In the issue of inheriting a share, we observe a situation in which the heir has the “right to the share”, but due to certain circumstances, such as: failure to obtain the consent of the remaining participants in the limited liability company to transfer the share, the “rights from the share” may not be transferred to him, which, first of all, should be understood as a set of rights to participate in the management of society. In this case, the heir can only exercise his right to the share by demanding payment of the actual value of the share. Thus, it is precisely the mechanism for obtaining the consent of the remaining participants in the company to transfer a share that confirms the practical need to separate such conventional concepts as “the right to a share” and “rights from a share.”

This is explained by the fact that the surviving spouse, like the heirs, has the right to the share as a property value, but is the legal holder of the rights of the participant.

The charter may provide that the transfer of a share in the authorized capital of the company to the heirs of persons who were participants in the company is permitted only with the consent of the remaining participants in the company. It is important to note that the Presidium of the Supreme Arbitration Court of the Russian Federation in its Resolution separately indicated that the provision of the company, which provides for the admission of new participants into the company only by decision of its participants, does not apply to relations related to the inheritance of a share, if special provisions of the charter on the transfer the rights to a share to the heirs do not contain a direct indication of the need to obtain the consent of the remaining participants in the company for such a transfer. Thus, if the company’s charter provides for the need to obtain the consent of the remaining participants of the company to transfer a share to a third party, this does not mean at all that such consent is required in the event of a transfer of the share to the heirs of a deceased participant. We believe that this rule also applies to the transfer of a share to the surviving spouse.

The issue of transferring a share in the authorized capital of a company to the heirs of a deceased participant, including the surviving spouse, is not regulated in detail by the legislator. But based on the systematic interpretation of the provisions of Art. 21 of the LLC Law in their relationship with the provisions of the Civil Code of the Russian Federation regarding the rules for opening and accepting an inheritance, as well as on the basis of judicial practice, it is possible to describe the procedure for transferring a share to the surviving spouse, as well as to the heirs of the deceased participant, as follows. If the consent of the remaining participants for the transfer of the share is not required, the surviving spouse must, on the basis of the received documents (certificate of inheritance, as well as a certificate of ownership of the share in the common joint property of the spouses), notify the company in writing about the transfer of the share in the authorized capital. In this case, the surviving spouse will be considered a participant in the company from the moment the inheritance is opened. It turns out that the surviving spouse acquires the status of a participant in the company “retroactively”. This is due to procedural features caused by differences in the norms of corporate legislation regulating the procedure for joining members of the company, and the norms of civil law regulating the acceptance and opening of an inheritance.

If the charter of the company requires obtaining consent to transfer the share to the heirs, then until such consent is received, the heirs cannot exercise the rights of the participant related to the management of the company. The procedure for contacting the society and obtaining consent is regulated by clause 10 of Art. 21 of the LLC Law. It is interesting to note here that, as in the case when consent to transfer a share is not required, when obtaining the consent of the remaining participants in the company, the courts proceed from the fact that the share of the deceased participant in the company passes to the heirs from the day the inheritance is opened.

If the participants did not consent to the transfer of the share or part of the share to the heirs, then by virtue of clause 5 of Art. 23 of the LLC Law, the corresponding share or part of the share passes to the company on the day following the expiration date of the period established by this Law or the charter for obtaining such consent.

In practice, situations arise when the remaining participants in an LLC refuse to transfer the share to the heir, sometimes without even waiting for the heir to apply. The Scientific Advisory Council on the application of the norms of corporate legislation and the norms of insolvency (bankruptcy) legislation has developed a position according to which company participants cannot express their refusal to accept the heir's share in the LLC before the expiration of the six-month period established for entering into inheritance rights, or presenting certificates of inheritance. The Council proceeded from the fact that before presenting a certificate of the right to inheritance, the heir cannot provide evidence of his right to a share in the LLC. Accordingly, the participants cannot be asked to give consent to transfer the share to the heir in the absence of evidence that the person is the heir.

As follows from paragraph. 2 clause 5 art. 23 of the Law on LLC, in the absence of consent of the participants to transfer the share, the company is obliged to pay the heirs of the deceased participant of the company the actual value of the share or part of the share, determined on the basis of data from the company’s financial statements for the last reporting period preceding the day of death of the company participant, or, with their consent, to issue them in kind property of the same value.

The LLC Law does not provide for a period for payment of the actual value of the share of a deceased member of the company to the heirs, who, in accordance with paragraph 5 of Art. 23 of this Law, the transfer of the share of a deceased member of the company is denied. The Recommendations of the Scientific Advisory Council on the application of the norms of corporate legislation and the norms of insolvency (bankruptcy) legislation, already mentioned above, indicate that in this case the three-month period established by paragraph 2 of Art. 23 of the LLC Law, unless a different period is provided for by the company’s charter.

Inheriting a share in an LLC after the death of one of the participants presupposes a certain procedure, the implementation of which is possible only if a number of conditions are met. Before you begin the documentation procedure, you should study in detail all the intricacies of the process regulated by law. This will help avoid unnecessary time costs and reduce the risk of disputes between the heir and the other members of the LLC.

The concept of “authorized capital”

This is a certain amount of funds required to launch the LLC’s activities legally. In other words, this is a monetary fund formed at the time of creation of the organization.

The contribution is made directly at the time of registration of the LLC and its minimum amount is 10,000 rubles. After completing the documentation and issuing the appropriate certificate of the legal existence of the office, the money is transferred to the bank account of the newly created enterprise.

If the founder of an LLC is not one person, but several, the capital is distributed among them by breaking it into parts. The size of the amounts is established with the consent of all parties, and the shares themselves are reflected either in the form of specific values or as a percentage of the total size of the fund.

Information about the authorized capital, and in particular, the size of shares, their transfer to third parties as a result of sale or donation, inheritance of shares and other information regarding the initial contribution, are clearly and in detail set out in the organization’s charter. Competent preparation of the document allows you to avoid disputes if any arise during the activities of the LLC.

The entire inheritance process is regulated by the organization’s Charter, which most often describes in detail the algorithm of actions in the event of the death of one of the founders.

The entire inheritance process is regulated by the organization’s Charter, which most often describes in detail the algorithm of actions in the event of the death of one of the founders.

When information about restrictions regarding the transfer of a share is not contained in the main title document of the enterprise, the successor has the right to acquire assets in the standard manner regulated by legislative acts of the Russian Federation.

Stage 1: visiting a notary

To fully own part of the authorized capital, the heir will need to visit a notary office to obtain a certificate. The visit must be made within 6 months from the date of death of the LLC founder.

It is important to prepare and bring with you the following documents for the notary:

- passport of the interested party, in this case, the heir to the share;

- death certificate of the founder;

- certificate from the last place of registration of the deceased;

- will, if any;

- a document confirming the existence of family ties between the deceased and the applicant;

- papers proving the testator's right to own part of the authorized capital;

- a copy of the organization's charter;

- documents confirming the contribution of the amount to the capital of the LLC by the deceased participant;

- list of founders of a business entity.

Another mandatory document, without which the issuance of a certificate will not be possible, is an expert’s opinion on the real value of the share. The paper serves as the basis for calculating the amount of state duty, payment of which is considered a prerequisite for obtaining inheritance rights.

In addition, the value of the duty depends on the degree of relationship with the deceased founder of the LLC. Thus, the heirs of the first stage are required to pay 0.3% of the value of the share. For other applicants the rate is 0.6%.

The assessment procedure is carried out using the services of a licensed company, whose employees carry out the assessment in several steps:

- economic analysis of regional indicators regarding the region where the office is located;

- study of factors influencing the work of the organization;

- familiarization with the financial and management reports of the LLC to assess the condition of the enterprise;

- determining the nature of the share;

- final calculation of the cost of the share of interest.

At the end of the procedure, the authorized person fills out the expert opinion form, certifying it with the seal and signature of the head of the appraisal office. Next, the document is handed over to the interested heir.

Stage 2: meeting of LLC founders

After checking the compliance of the package of documents with the mandatory list of such, as well as the reliability of the information provided, the notary prepares a certificate of entry into the right to own shares in the authorized capital. After which the document is handed over to the applicant for the inheritance.

After checking the compliance of the package of documents with the mandatory list of such, as well as the reliability of the information provided, the notary prepares a certificate of entry into the right to own shares in the authorized capital. After which the document is handed over to the applicant for the inheritance.

Further actions oblige the citizen to inform all other LLC participants about the issuance of a certificate in order to convene a meeting of them. The notification must be in writing, and there is no standard form of paper - the form can be arbitrary. The number of copies must correspond to the number of shareholders.

Directly at the meeting, the newly-minted participant is admitted to the founders of the enterprise. After that, appropriate changes are made to the documents.

Stage 3: registration of property rights

The final stage involves visiting the tax service to notify it of the transfer of part of the authorized capital into the ownership of another person. Here you will need to fill out the application form P140001. Then prepare the following documents for the tax office:

- notarial certificates confirming the existence of rights to the share;

- a copy of the organization’s minutes of the meeting, during which the heir was accepted into the ranks of the founders.

Tax officers are required to make changes to the register within 5 days from the date of filing the papers, indicating information about the new LLC participant. After which, the heir receives an extract from the Unified State Register of Legal Entities and becomes a full-fledged founder of the enterprise.

It is important to clarify that if the rights to part of the capital are transferred to an heir, he is exempt from paying personal income tax. This point is regulated by the Tax Code of the Russian Federation.

Inheritance in the event of the death of the sole founder of the LLC

The right to own shares in the capital after the death of the sole participant of the organization is legally transferred to his heirs. The procedure in this case will be similar to the standard regulations, excluding the convening of a meeting of founders.

Direct management can begin six months after the funeral of the testator. Until this moment, management is carried out by a person appointed as a notary, unless otherwise provided by the will of the deceased.

After entering into inheritance, a citizen can either independently head the company or appoint a director.

Restrictions on inheritance of shares in the authorized capital

Restrictions on the rights to a share of the authorized capital after the death of one of the founders of the LLC are indicated in the organization’s charter. If there are any, you will have to act in accordance with the regulations of the document.

In this case, the transfer of the share to the successor is possible only after receiving written consent from the remaining members of the organization. First of all, you will need to notify the founders of your rights to the share and request consent from each of them to document the inheritance. A written request requires prior certification at a notary office.

In this case, the transfer of the share to the successor is possible only after receiving written consent from the remaining members of the organization. First of all, you will need to notify the founders of your rights to the share and request consent from each of them to document the inheritance. A written request requires prior certification at a notary office.

Within a month from the date of receipt of the notification, members of the organization must provide a response. If this does not happen within the specified period, the consent is counted automatically.

The next actions of the heir depend on the verdict of the participants. If the answer is positive, the algorithm will be similar to the standard procedure for registering an inheritance. Only here you will need to provide the notary with the official consents of the shareholders and the minutes of the meeting where the decision of the participants was recorded.

In another situation, when at least one of the members of the LLC does not want to include the applicant in the ranks of the founders, the latter is entitled to compensation in the amount of the real value of the share identified on the basis of accounting documents for the last reporting period. In this case, compensation can be provided both in cash and in the form of property.

According to tax legislation, payment to an heir of the value of a share, instead of granting rights to it, is subject to tax in the prescribed manner.

Prohibition on inheritance of a share in the authorized capital

Here we can talk about the impossibility of obtaining a share by right of succession and, accordingly, participation in an LLC is completely excluded. In such a situation, the person who is the heir is also entitled to compensation, the amount of which must correspond to the actual value of the share of the deceased testator. The payment is made after a meeting of the participants and an assessment of the deceased person's share by an outside expert.

Here we can talk about the impossibility of obtaining a share by right of succession and, accordingly, participation in an LLC is completely excluded. In such a situation, the person who is the heir is also entitled to compensation, the amount of which must correspond to the actual value of the share of the deceased testator. The payment is made after a meeting of the participants and an assessment of the deceased person's share by an outside expert.

After the heir presents a certificate of right to the share, he is paid its value in the form of cash or as property of a similar price.

As for the shareholder’s part, it can later be distributed among members of the enterprise, repaid, or sold to a third party.

Obtaining a share in the authorized capital of an LLC by inheritance- the process is quite labor-intensive and complex in the legal sense. There are many features, one of which is obtaining consent from all founders. In some cases, a ban may even be imposed on the transfer of part of the authorized capital to the successor of a deceased participant. Here everything depends on the clauses of the organization’s Charter and the preliminary agreement of the shareholders. If no restrictions are provided, the heir takes full ownership of the inherited share in accordance with the standard regulations.

A testator who owns a share in the authorized capital of an LLC (Limited Liability Company) has the right to transfer it by inheritance. After accepting inheritance rights and property, the heir receives either share in a business enterprise with the opportunity to receive a profit proportional to it, or equivalent sum of money from the Society.

Usually the heirs at law are immediate family the deceased owner of an interest in the LLC, sometimes - dependents who were in his care for the last year.

His dependents can claim the property of the testator, including a share in an LLC: relatives who have received help from him for at least a year, or strangers who have lived with him for 12 months (Article 1148 of the Civil Code of the Russian Federation). Such persons are called to inherit along with the current line of heirs.

In regions where the program exists "Inheritance Without Borders", it is possible to contact any notary in the city or region.

According to the law, if the heir has accepted by legal or physical means any part of the property left by the testator, then he accepted his share in full, with all debts and additional obligations. This happens even if the heir did not know about any thing or right as part of the inheritance.

Example

L. inherited a house with all its belongings from her husband. She was the sole heir by law. Within the prescribed period, the woman turned to a notary, after which she received a certificate of inheritance. Her husband had a share in the LLC, which L. did not know about until an invitation addressed to her husband to participate in the general meeting of participants arrived at the address of their joint residence. Even despite ignorance and past deadlines for accepting the inheritance, it is considered that the widow accepted all the property in full, since she submitted documents for part of it. The woman needs to go to court to restore the deadlines for accepting inherited property. If the judicial authority agrees, it will be necessary to re-issue the certificate of inheritance rights, adding the inherited share in the LLC to it. After this, depending on the content of the Company’s charter, you should follow the established procedure - apply to join the organization or ask for payment of the cash equivalent of a share.

The procedure for registering inheritance rights to a share

The heirs receive the deceased testator's share in the LLC, unless otherwise provided by the official charter of the Company. Eat three inheritance options: unconditional transfer of the inherited part in the authorized capital, receipt of a share with the consent of the LLC or its members and the inability of the successor to become an equity participant in the organization. Regardless of the situation, the heir enters into the inheritance and receives from the notary's office a certificate confirming the succession rights to a share in the Company. Then it is advisable for him to receive a copy of the charter of the LLC in order to find out whether the consent of the participants is necessary for him to join the ranks and whether it is permissible.

The procedure for registering an inheritance for a share in the absence of restrictions on succession in the LLC Charter

- After issuing a certificate of inheritance, the heir applies to statement about his acceptance into the Society.

- At the next general meeting of LLC participants, a decision is made to admit a new member to the Society, who will inherit from the deceased citizen - the owner of a share in the authorized capital. Changes are made to the organization's documents.

- After this, the heir submits a package of documents to the Unified State Register of Legal Entities (Unified State Register of Legal Entities): an application in form P14001, a certificate of the right to inheritance (original or notarized copies), minutes of the meeting of LLC participants.

- The heir becomes the owner of a share in the authorized capital after the registration procedure, that is, after making changes to the unified state register based on the submitted documents. It is also necessary to amend the Company's charter with appropriate registration in the register.

- If the testator was the only member of the LLC, the issue of admitting the heir to the Company formalized. Minutes of the meeting of the Company's participants in the Unified State Register of Legal Entities in this case not served.

- All controversial issues resolved through appeal to court.

- The established procedure is not an obligation on the part of the heir, but only a right. However, only such a procedure will give him the opportunity to preserve his property interests.

The procedure for registering an inheritance for a share if there are restrictions on succession in the LLC Charter

- Heir in general order receives a certificate of inheritance rights and sends the appeal to the LLC.

- Depending on what is stated in the charter, the Company or all its participants make a decision. Consent is considered to be written permission to alienate the share by the heir or the absence of a statement of refusal. They are sent to the heir within 30 days from receipt of his request or another period specified in the charter. The document may provide for various options for obtaining the consent of its participants to transfer a capital share (part thereof) to a third party.

- Registration in the Unified State Register of Legal Entities is carried out by submitting the list of documents specified above, with the addition of a statement of consent of the LLC or all its members (depending on what is provided for in the charter).

- The heir becomes the owner of a share in the authorized capital of the Company after making changes to the unified state register.

- In case of a written refusal to allow the alienation of a share The company is obliged to buy it from the heir.

The procedure for registering an inheritance for a share if there is a ban on succession in the LLC Charter

- The heir in the usual sequence receives a certificate of inheritance rights. He then contacts the Society with application for payment of the monetary equivalent of a share in the authorized capital(Article 1176 of the Civil Code of the Russian Federation).

- The actual value of the share is based on the accounting records of the LLC for the last period before the death of the testator. It can be replaced with property of equivalent value in kind, if the heir does not object. Payment occurs within a year after the transfer of the share to the LLC or within the period established by the charter of the Company.

- The LLC must not pay the heir the cash equivalent, if it has characteristic features bankruptcy or will receive them as a result of payment.

Conclusion

Passed on by inheritance preemptive right to a share in the LLC, and not the opportunity to become its participant.

Admission of an heir to membership in the Society is possible if if this is provided for in the charter documents of the organization. If the heir is denied participation in the LLC, he may be entitled to compensation for the testator's share.

To become the full owner of the property received by inheritance, the heir must perform the following actions: receive a certificate of the right to inheritance from the notary's office within the prescribed period; apply for admission to the LLC; after the general meeting of members and an affirmative answer, register in the Unified State Register of Legal Entities.

Receiving monetary compensation in case of reluctance to join the society or refusal on the part of the organization occurs within one year or other period specified in the charter of the LLC.

My husband died four years ago. Can I now inherit part of the share in the LLC or is it too late?

Answer

The deadline for inheritance has long passed. Try to restore it through the court if you had a good reason for missing it. We will have to justify why this happened. Much also depends on the presence of other heirs and on how much of the property you received.

I have a share in an LLC and real estate (apartment). How will the property be divided in the event of my death? There are three heirs: a husband and two adult sons.

Answer

First, your spouse's share will be deducted from all property acquired during a joint marriage - only he will receive it. If you do not leave a will, the three heirs will receive all the remaining property in equal shares (Article 1142 of the Civil Code of the Russian Federation).

My minor daughter inherited from her father (we were divorced) a share in an LLC. With the permission of the guardianship authorities, we sold this share to one of the co-founders of the organization in exchange for the purchase of an apartment in the name of our daughter. He bought the property, but did not act as a tax agent and did not withhold income tax on the sale. There is a difference between selling a share and buying an apartment. What should I do about it? Receive guardianship permission again, declare on behalf of your daughter and pay tax to the budget?

Answer

According to established practice, in transactions between legal entities and individuals, it is the legal entity that assumes the responsibility to pay taxes. If it so happens that the other party has accepted an obligation, you will still have to pay deductions. Unfortunately, income taxes on the transaction will fall on you and your minor daughter.

Changes: January, 2019

You can register a share in an LLC by inheritance in the event of the death of the testator, who is the owner of a part in the authorized capital of the business entity. The procedure for registering rights to inherited property is carried out in the manner prescribed by the current civil legislation. To implement it, it is necessary to fulfill a number of requirements and prepare a package of documents.

The article provides information on how to register a share in an LLC by inheritance, what documents need to be prepared to implement the procedure, as well as what you can count on if the charter provides for a ban on transferring a share of capital by inheritance.

What does the law and legal practice say?

According to the provisions of the Civil Code of the Russian Federation, in particular Article 93 of this source of law, part of the authorized capital of the company, owned by its participant by right of ownership, can be transferred to his relatives by inheritance.

Note! The law does not limit the right of LLC founders to establish a ban on inheritance of its assets. If such a restriction occurs, it must be recorded in the company’s charter.

To exclude the possibility of unwanted participants joining the founders, its founders often include a clause in the charter stating that part of the capital can be inherited only with the consent of the other founders of the company.

It should be noted that legal practice in recent years has been saturated with cases of inheriting a share in an LLC, which indicates the relevance of the issue and the popularity of such an organizational and legal form as a limited liability company.

Additional Information! LLC is one of the optimal forms of organizing business activities, which is popular among representatives of small and medium-sized businesses. Although more requirements are put forward for an LLC, in comparison with an individual entrepreneur, enterprises of this organizational and legal form are more competitive and prone to development.

Our lawyers know The answer to your question

or by phone:

The procedure for entering into inheritance rights

According to civil law, property owned by a person in the event of his death is transferred to his heirs. Inheritance is carried out by law or by will. If the testator was one of the founders of the LLC, accordingly, he owned a share in the authorized capital of the company; after his death, it passes to his descendants.

Important! The transfer of part of the company's assets is possible subject to compliance not only with civil law, but also with the clauses of the charter.

Thus, the statutory documents may provide for the following conditions:

- entry into the LLC of the heir of one of the company's participants is possible only with the consent of its remaining members;

- the heir’s entry into the circle of founders is prohibited.

Note! The presence of any conditions in the charter limits the rights of the heirs, but in no case deprives them of the right to inherit.

For example, if the charter contains a clause prohibiting a person who is the heir of a deceased founder from joining the membership, this does not mean that he will be left with nothing, and the testator’s share will go to the LLC. The inheritance procedure with conditions of this kind is described in more detail below.

Managing shares until inheritance

The rules for managing inherited property, in particular shares in the charter of an LLC, are regulated by Art. 1173 of the Civil Code of the Russian Federation. In accordance with this norm, the management of the part, from the moment the inheritance is opened until the heirs enter into their rights, is carried out by a notary on the basis of an inheritance trust management agreement.

Features of the trust management agreement:

- a person vested with the powers of a manager in accordance with the agreement has the right to carry out all operations necessary for the full functioning of the LLC;

- the contract, as a rule, specifies all types of actions that the manager is allowed to perform;

- the manager does not have the right to dispose of the share, the management of which is entrusted to him according to the agreement;

- the agreement terminates at the moment the heir joins the founders of the LLC and the ownership of the share in the capital of the LLC is transferred to him;

- if the heir is denied the right to become one of the founders of the company, which is justified by the charter of the LLC, the moment of termination of the agreement is the moment of disposal of the testator's shares (distribution among other founders, alienation, repayment).

Inheritance of part of capital without restrictions

The simplest procedure for transferring a share in an LLC by inheritance is used if the charter does not provide for any restrictions regarding heirs. If, in order to exercise his right, the heir is not required to obtain permission from the current participants of the company, the procedure is carried out in accordance with the norms of the relevant legislative acts.

It is worth noting that in recent years such situations have happened extremely rarely; as a rule, issues of inheriting part of the capital of an LLC are resolved only through agreement.

To enter into inheritance rights, the heir must contact a notary office to obtain a Certificate.

You must have the following documents with you:

- applicant's passport;

- original certificate from the place of registration of the testator;

- original Death Certificate;

- documents indicating the presence of family ties between the applicant and the deceased founder of the LLC;

- copies of statutory documents;

- documents confirming the deceased’s ownership of a share in the capital of the company, which, in fact, is the subject of inheritance;

- a complete list of current members of the LLC;

- a copy of a certificate confirming the fact of payment by the deceased founder of his share in the capital of the LLC.

An integral condition for the implementation of the procedure is an assessment, which results in a report on the market value of that part of the authorized capital that is subject to inheritance. Without providing this document, registration of the right to a share in an LLC by inheritance is impossible.

The powers necessary to carry out assessment activities are possessed by specialized companies that have received permission to provide services of this kind.

Assessment stages:

- conducting a detailed analysis of the main economic indicators of the region in which the company operates;

- establishing the factors determining the activities of the LLC;

- familiarization with the reporting documentation of the company;

- assessment of the general financial condition of the company;

- studying the business activity of an enterprise with the subsequent determination of its liquidity;

- establishing the nature of the share that is the subject of inheritance;

- establishing the cost equivalent of the inherited share, taking into account the results obtained during the previous stages.

Based on the results of the work, the expert issues an assessment report, drawn up on paper and signed by the head of the assessment company. The contents of the document must be previously agreed upon by the appraiser with an administrative representative.

Subtleties of registration of inheritance rights, connection between assessment and amount of state duty

An assessment of the inheritance share is necessary not only to find out its value, but also to determine the amount of the state duty, the payment of which is one of the main conditions for registering inheritance rights.

The amount of the duty depends on two factors:

- estimated value of the share;

- degree of relationship of the heir.

Additional Information! The amount of the duty is regulated by tax legislation. Thus, relatives of the first degree (children, parents) will have to pay 0.3% of the estimated value of the inherited share to take over their rights.

However, the law sets a limit on the amount of state duty for such persons; it cannot exceed 100 thousand rubles.

Heirs of the second and subsequent degrees must pay 0.6%, while the maximum payment cannot be more than 1 million.

After checking the accuracy and authenticity of all documents provided by the applicant, which includes an expert’s opinion, the notary issues a Certificate, on the basis of which the heir becomes a member of the founders of the company with the simultaneous transfer to him of the share previously owned by the testator.

The final stage is the registration of property rights to part of the inherited capital. To implement the procedure, you must contact Rosreestr with an application for amendments to the Unified State Register of Legal Entities and a package of documents.

These include:

- documents confirming the existence of the right to a share in the LLC, previously certified by a notary;

- materials indicating that the applicant was accepted into the founders of the company as a successor to a deceased participant.

To confirm this fact, as a rule, they use an extract from the minutes drawn up during the meeting of the LLC founders dedicated to resolving this issue. The minutes must be drawn up in accordance with legal requirements and contain all the necessary details (information about the founders who took part in the meeting, their signatures, the date of the meeting and other data).

Inheritance of a share in an LLC with a condition

Most often, inheritance of a share in an LLC occurs only if the remaining participants agree with the admission of a new founder to the company. This requirement is quite justified, since in the case of inheritance by law, and not by will, the heir may be a person who is not related to the business and does not have the skills necessary to run it.

To protect society from unqualified interference, its founders introduce a restrictive clause into the content of the charter.

The procedure for entering into the right of inheritance in this case is similar to the standard one. The only difference is that the basis for accepting an heir as a member of the LLC is not a Certificate, as in the previous case, but the consent of the existing founders.

Procedure for obtaining consent:

- sending a notarized offer to the company or sending out appeals separately addressed to each founder;

- getting a response. Shareholders are given a period of 30 days to make a decision. During this period, they need to notify the heir of their decision.

If all founders make a positive decision, this information is entered into the minutes.

What to do if the founders of the company do not agree with the transfer of a share in the LLC to a new participant?

If at least one of the company's participants reveals his disagreement with the introduction of a new founder, the latter has the right to demand compensation for the cost of the inherited part in monetary or other equivalent.

The cost of the share depends on:

- the size of the company's net assets;

- the size of the hereditary part.

Important! The basis for settlement transactions is the financial and accounting statements of the LLC.

What can you count on if the transfer of part of the capital by inheritance is prohibited by the charter?

Cases when the charter of a company prohibits the transfer of shares by inheritance, although extremely rare, do sometimes occur. The only option for resolving an issue of this kind is to present the founders of the company with a demand to pay compensation in the amount of the value of the deceased shareholder’s share.

This must be done immediately after receiving the Certificate from the notary.

Important! The timing of payment of compensation, its amount and calculation procedure are established at the meeting of the founders of the company.

In some cases, payment is not made. This applies to cases where:

- the company has all the signs of financial insolvency;

- The organization is subject to bankruptcy proceedings.

After the heir receives compensation, the testator's share passes directly into the ownership of the company, is distributed among its members, or is alienated in favor of a third party.

Your rating of this article:

Refusal to inherit a share in an LLC- a transaction that is executed unilaterally and involves specific actions of a legal nature. What are the features of the procedure? What can act as an object for inheritance? When can an heir be refused a share? These and other questions will be discussed in the article.

Is it possible to inherit the authorized capital of an LLC?

The Constitution of the Russian Federation stipulates the right of inheritance of citizens of a wide variety of objects. The same approach is considered in a number of provisions of the Civil Code of the Russian Federation, the Civil Code of the Russian Federation, as well as the Federal Law on Companies. It is important to understand what inheritance is. Essentially, this is the transfer of a certain asset in the form in which it is located without making any changes.

The issue of inheriting a share of the company deserves special attention. The entire company or part of it can be transferred to the recipient's disposal. In the first case, the successor receives not only the assets and liabilities, but also the debts (liabilities) of the LLC. At the same time, the company or its founders cannot influence the fact of transfer of the company’s share from the deceased participant to the legal heirs.

When is it possible to refuse to transfer a share?

The Federal Law on Companies stipulates that the founders of a company can change the rules and add conditions to the charter that imply a complete prohibition or partial restriction of the transfer of shares to the legal heirs without a decision of the LLC participants.

Today, there are three ways to transfer inheritance in the form of a share of a company from one of the founders in the event of his death. Each of the options can be reflected in the charter:

- There are no restrictions.

- It is prohibited to inherit an LLC share.

- The share can be inherited subject to the consent of the founders of the company.

If there is no prohibition on inheritance in the company's charter, then there is no need for approval of the transfer of inheritance from the other founders. The heir receives the right to his part of the company immediately after the opening of such a right. In this case, registration of the heir in the Unified State Register of Legal Entities as a founder of the company does not matter.

Situations are possible when the company's participants refuse to accept a new person as a founder, or the charter provides for a ban on the transfer of shares. In this case, the heir has the right to receive the actual value of his share. The price parameter is determined on the basis of information from the organization’s balance sheet, current at the end of the reporting period preceding the death of one of the company’s participants.

From the above, we can conclude that the existence of the right to inherit part of the company does not mean that the heir will become one of the founders of the LLC. If other participants do not give their consent to the transfer of the share, and this condition is stated in the charter, the property will be transferred to the company on the first day following the deadline for obtaining consent.

Our lawyers know The answer to your question

or by phone:

What are the dangers of refusing to inherit an LLC share?

According to the law, a citizen has the right not only to accept the due inheritance, but also to refuse to receive it. This process is stipulated in the Civil Code of the Russian Federation. The possibility of refusal applies to various material assets, including a share in a business that was previously owned by a deceased relative.

But it is worth remembering that refusal of the due inheritance entails a number of legal consequences, namely:

- The impossibility of canceling or changing an already made decision. It will not be possible to refuse first and then change your mind after a while.

- Refusal is possible only from all, and not part of, the required property. An exception applies to situations where the testator receives a share in the LLC simultaneously for a number of reasons - by will and by law.

If the heir has decided to renounce his share, it must be unconditional and irrevocable.

Is it possible to refuse in favor of the existing founders of an LLC?

The heir has the right not only to renounce his part in the company, but also to do so in favor of the LLC participant or other persons determined by law. In this case, the inheritance order doesn't matter much. The peculiarity of such a transaction is that there is no need to obtain approval from the recipients of the share - the procedure for renouncing the company's share in favor of any person is one-sided.

But it is worth remembering that the law limits the number of persons in whose favor you can renounce your share in the company. Thus, the share of an LLC can be transferred only to those entities that are reflected in the law. Performing these manipulations for the benefit of other persons is prohibited. What does it mean? Refusal in favor of one of the company participants is possible only in two cases:

- The founder is one of the heirs who are indicated in the Civil Code of the Russian Federation (Articles 1141-1148).

- The participant is named in the will.

If the refusal is made in favor of a person in respect of whom this action is prohibited, such an operation is considered legally void and is declared invalid. In addition, mutually beneficial transactions are prohibited by law. For example, when an heir renounces part of the company in favor of a person, subject to the performance of a certain action or service. Executing a transaction with a reservation is prohibited.

When is it not possible to give up your share?

If the heir is a person who has not yet turned 18 years old, or has incomplete (limited) legal capacity, in order to renounce the share in the LLC, you will have to contact the guardianship organizations and obtain permission from them. The application can be signed by the heir himself, or by another entity who, by law, has the right to represent him without issuing a power of attorney.

According to the law, it is prohibited to renounce a share in a company in favor of third parties in the following situations:

- The heirs in respect of whom the refusal is made are recognized as unworthy.

- There is a waiver of the obligatory share.

- If part of the LLC is inherited by will in favor of entities that are not reflected in the document.

How can one refuse an inheritance in the form of a share of society?

The process of refusing to inherit a company's share is not just a statement that is declared by the founders of the company. In this case, the heir must take certain actions confirming his reluctance to accept a share in the authorized capital of the organization. In particular, it is necessary to fill out an application and have it certified by a notary. A similar process can be carried out in person, by sending your representative, or by sending a proxy. If the heir does not take any action, this is perceived as non-acceptance of the inheritance, which becomes the use of the state.

The application for refusal is submitted to the notary, who is located at the place where the inheritance was opened. In case of refusal of an LLC share, a number of points must be taken into account:

- There is no need to write down the reason why you decided to give up part of the company. At least, the legislation does not provide for such a requirement.

- If the refusal is carried out by an 18-year-old citizen, there is no need to obtain any permissions, for example, the consent of the husband (wife).

- When carrying out the procedure, it is enough to submit an application. The document is certified by a notary and then attached to the inheritance case. The notary is not required to issue any certificate confirming such an action.

- There is no need to pay duties or taxes. The only possible cost is payment for notary services.

How to resolve disputes when inheriting a share?

Judicial practice confirms that a transaction to inherit a share in an LLC can be challenged. The most common cases are when a formalized refusal is declared invalid. There may be several reasons:

- The person was misled during the registration process.

- The testator did not understand the legal significance of such an operation or could not control the actions performed.

- The person receiving a share in the LLC was subject to pressure or threats. This also includes situations where the heir was deliberately misled, and the refusal was obtained fraudulently.

Until Resolution No. 9 was issued, all disputes relating to ownership rights to the LLC’s share were considered by arbitration courts. But after the publication of the mentioned document, such cases were transferred to courts of general jurisdiction. It is also worth noting that according to the Supreme Court of the Russian Federation, obtaining a certificate confirming the right of inheritance is not the obligation of the heir. On the other hand, if he has such a document approved by a notary, the heir is obliged to confirm his rights and prove the fact of inheritance.

How can you give up a share in an LLC - the main ways

The process of renouncing a share implies a simultaneous renunciation of other property of the person transferring the share as an inheritance. This is due to the fact that giving up only part of the share is prohibited by law. In a situation where a person does not plan to enter into an inheritance and does not want to be the founder of a company, he still must take over the rights and then refuse. You can do it like this:

- Sell your share to third parties. There is no need to take into account the right of first refusal.

- Leave the LLC. Here you need to fill out an application with a notary to withdraw from the society.

Results

It turns out that inheriting a share in a company’s management company is possible without the approval of the founders. But to obtain participant status, the consent of other founders is still necessary (if this is noted in the charter). In case of refusal of a share, it is important to strictly comply with legal requirements and remember the legal consequences. It is important to understand that such an action is one-sided, and it will not be possible to return everything to normal.