Buying a used vehicle is always a risky step for the future user. After all, the risks lie not only in the technical malfunction of the car, but also in the possibility of purchasing collateral vehicles. For the new owner, such a situation may result in parting with the purchased car and the money spent on it. That is why you should carefully approach the choice of a used car; you must check the car for collateral or credit.

Loan secured by vehicle

If you take out a car loan, the car acts as a kind of guarantee of future payments. The agreement between the financial institution and the buyer of the car provides for the location of the vehicle title from the lender.  The PTS will return to the owner only upon completion of the debt obligations.

The PTS will return to the owner only upon completion of the debt obligations.

Also, many financial organizations provide cash loans for various needs. And this lending option is another way to encumber a car with collateral.

The fact that there is no title prohibits making various transactions with the car. But in reality, unscrupulous people still manage to do this using a copy of this document. This means that the debt in this case passes to the future user.

The way out of such situations can be urgent money secured by the title of the car.

It turns out that a secured loan is not an obstacle to selling a car. But for a financial organization it makes no difference who takes the car from if the debt is not paid. And the buyer’s ignorance of the vehicle being encumbered with collateral does not exclude the possibility of its collection in favor of the lender. Most often, the courts subsequently side with the latter.

The only legal way to sell a mortgaged vehicle is through an agreement with a potential buyer. He can pay the entire required amount on the loan to the bank, and give the difference between the payment and the cost of the car to the seller. One way or another, the owner is obliged to warn the buyer about the mortgage status of the car. Otherwise, the transaction may be declared invalid, and then the former owner of the vehicle must return the funds to the buyer.

Indirect signs of a pawned car

To avoid getting into such situations, you should know the signs of a pawned car. A direct indicator of this is the entry about the creditor organization in the comprehensive insurance policy. The presence of this mark indicates the purchase of a credit car that does not yet have a clean history, that is, the debt has not been repaid. There are also several indirect signs that can be used to suggest that a car is pledged.

- Lack of original PTS. Obtaining a copy of this document is easy, and the procedure will take a minimum of time. After submitting an application to the State Traffic Safety Inspectorate, the owner is issued a duplicate PTS with the appropriate marking. It’s worth thinking about buying a car if you don’t have the original title.

- Minimum period of ownership of the car by the previous owner. To repay a car loan, the car owner is usually given no more than 3 years. Therefore, when buying a car that served its previous owner for less than 3 years, you risk running into mortgaged property.

- Purchasing a car under a commission agreement. If there is a corresponding entry in the PTS, then it should alert the future owner of the vehicle.

- Low cost of the car. Studying price trends in the secondary car market will help identify the suspiciously low cost of the car. Such a “freebie” indicates the seller’s desire to quickly get rid of the vehicle.

- Absence of a car purchase and sale agreement. This document also contains information about the purchase of the vehicle that is the subject of the pledge. Therefore, the absence of one should alert the buyer.

Remember! The absence of all these signs does not indicate the legal purity of the vehicle. For example, a car pledged to a pawnshop is extremely difficult to check for debt.

How to check a vehicle for collateral at a bank

The issue of checking a car for collateral with a bank is relevant for most potential buyers of a used car. Today, it is possible to determine the legal cleanliness of a car in several ways:

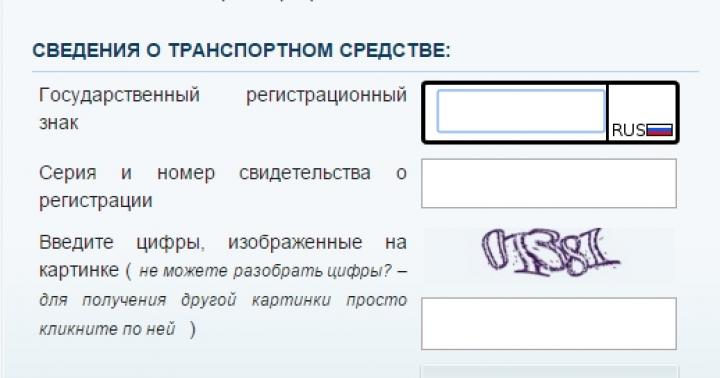

1. Verification of vehicles using personal VIN number. This process is free and can be completed online. In order to find out the information you are interested in, you should go to the website of the Register of Collateral Property and enter the vehicle’s VIN number in the appropriate line. After completing these steps, all the necessary information on the car debt opens.

Important! The lack of information on the website about a possible pledge of a car does not at all guarantee the opposite. After all, registration of pledged vehicles in the register is voluntary, not mandatory. Consequently, the owner of the car decided simply not to enter the data into the registry.

2. Check in the registry of pledged cars using the link. This site is an initiative of some banks who decided to create a project for exchanging information about mortgaged cars. Finding out information about transport for collateral at a given address is simple and does not take much time.

3. Check the car in the traffic police database using the link traffic police.rf. Such a database will not reveal the presence of a mortgage on the car, but it will help check other restrictions on the sale of a car. Search, theft, seizure by court - all such information about your future car can be found on the traffic police website.

How to avoid falling into the hands of scammers

When buying a used car, you should study the legal side of the issue. It is worth paying special attention to the consideration of the purchase and sale agreement. Proper completion of this document ensures that there are no future troubles that the car may cause to the next owner. Focus on the presence of the following data in the document:

- passport details of the parties;

- all technical information about the car;

- car cost;

- place of drawing up the contract;

- date of signing the document.

Important! It is mandatory to have the signatures of the parties at the end of the drawn up agreement. Check that all information about the vehicle has been copied exactly from the title. Please note that from the legal side of the issue, it is important to mention in the text of the document that the car is not collateral for a financial organization.

What to do if the purchased car is mortgaged

Buying a car not from a dealership, but from a private person is always risky. The problems are not only in the technical condition of the transport, but also in its documentary condition. The risk of purchasing a stolen or mortgaged vehicle is quite high. Let's look at how a car is checked for collateral or credit.

The purchase of a mortgaged vehicle obliges the buyer to repay the outstanding portion of the loan. How to protect yourself using methods available to a wide range of users of various resources?

The concept of collateral transport

The first thing you need to understand is status of the car being pledged. The previous owner may have needed a large amount of money and turned to a pawnshop or bank, which provides him with an amount not exceeding 90% of the market value.

To check a car before purchasing for a criminal record, it would be useful to check whether the VIN code matches the car itself. Full .

For a long time there have been companies offering money against the security of a vehicle.

Or the car was not purchased for the full amount, but in installments. The bank becomes the owner of the vehicle during the debt repayment period, although the borrower continues to use the car.

Learn more about checking a vehicle for prohibited registration actions.

Signs of collateral

Anyone who wants to avoid financial losses and litigation should familiarize themselves with the tools offered. To begin with, it is worth mentioning a number of signs that the vehicle being sold does not belong to the seller, and he does not have the right to sell.

Here are a few of them:

- Information about the lending bank stated in the CASCO policy issued to the owner of the car. The car was purchased on credit and the debt has not yet been repaid.

- The seller does not have the original PTS (vehicle passport). The seller received a duplicate from the traffic police after reporting the loss of the original. But was it a loss or did he get rid of the original, which had many records of frequent sales?

- Passed after purchase very little time less than three years. Car loans are often issued for a period of three years.

- The price of the proposed vehicle is lower than the market price that exists for similar models.

- The owner of the vehicle “lost” somewhere DCP ( contract of sale). The contract may stipulate the collateral condition of the transport.

- Any of the additional devices are not available. Additional tires are not for sale or the radio has been removed.

Even if the title is original and the vehicle has no signs of being in collateral, you should not let down your guard.

Even if the title is original and the vehicle has no signs of being in collateral, you should not let down your guard. If the buyer does not see the described signs of a pledge, this does not mean the legal purity of the vehicle being sold. Loans from a pawn shop or from private lenders do not “spoil” documents.

General directions for checking the purity of a transaction

There is an understanding of how cars sold are checked to see if they are pledged.

Again, the above listed signs may also alert the buyer. But a sign is not a crime, but a signal that motivates a more thorough analysis of a potential purchase.

Wanting to protect himself, the buyer can check the identity of the seller, the condition of the documents and the VIN code on specialized websites. It is better to either delve into the verification methods yourself or do it with a hired specialist.

Interested in checking for theft before purchasing? .

More details about some of the methods and directions below.

How to check whether a car is pledged using the VIN code

Is the vehicle pledged to the bank? checked free of charge based onVIN. Each car receives this code, according to which everything that happened to the car is recognized: accidents, date and place of production, manufacturer, credit, and so on.

VIN codes have been applied to vehicles for several decades. They contain basic information about the car.

VIN codes have been applied to vehicles for several decades. They contain basic information about the car. The code is located under the hood and on the door pillar (driver's side). When purchasing, you need to look at these inscriptions and make sure that they match. If they differ, it is better not to buy a car.

The AutoCode website also helps. The information may be incomplete because in the Russian Federation there is no mandatory requirement for registration. Any owner of a car, if desired, has the right to enter data on it or neglect his right. This is just free information. A document based on the VIN code becomes more significant after certification by a notary.

Checking collateral status online

There are several sites that help you detect the presence or presence of a credit encumbrance.

Traffic police website

The traffic police has its own resource. The VIN provides information about the vehicle, prohibiting the change of owner by court decision. The reason for the claim is not visible, but it could also be overdue debts to the bank.

The traffic police website will not provide complete information, but it will show if the car is problematic.

The traffic police website will not provide complete information, but it will show if the car is problematic. Bailiff service

Bailiffs also record their work. That’s why they created a resource that helps all interested visitors find out the status of their future purchase.

How does this happen? The seller provides his passport information. If he is marked on the site as a person against whom a lawsuit has been filed, the transaction is risky. Until the cause of the claim is clarified, it's better to look for another car.

FMS online

The Russian Federal Migration Service (migration service) will help check the seller’s legitimacy. You need to go to the FMS website. Here you can check the passport of the “owner” of the vehicle for authenticity.

The presence of a passport on the list indicates that it is fictitious; it could have been stolen and altered to resemble someone else’s photograph. The purchase runs the risk of the car being stolen and then having to give it back. The scammers are unlikely to return the money.

The FMS website will not provide information on the transport itself, but it will help expose a rogue seller with a false passport.

The FMS website will not provide information on the transport itself, but it will help expose a rogue seller with a false passport. Register of pledges to help the buyer

In 2014, the register of FNP of the Russian Federation began its work in Russia. The Chamber of Notaries registers borrowers who take out loans from banking institutions. If the car was once pledged, then based on the VIN code and the owner’s last name, it will be known whether it is still pledged.

If the bank considers it necessary, it enters this data into the register.

The Federal Chamber of Notaries prescribes on your website lien notices movable property. When a loan agreement is drawn up to provide a secured loan, the notary makes an entry about this in the general database. To protect their rights, banks are interested in making such entries mandatory.

The buyer of a pledged car may lose it if the bank presents an entry in the registry and its rights to the car. The FNP website is very important to check.

Notary's assistance in checking a car

The Ministry of Justice of the Russian Federation has developed a form on which data about the car is filled out by the mortgagee and transferred to the notary. This procedure is relatively quick and does not exceed a day. And online – no more than an hour. If the creditor has not registered the car in the registry as collateral, he may not receive money from the new owner.

Consulting a notary will help if the pledged car was officially registered as collateral.

Consulting a notary will help if the pledged car was officially registered as collateral. At the notary office, upon application, a certified extract on the status of the vehicle is provided.

Sometimes sellers offer to complete the verification faster with a familiar notary in order to save time and bureaucratic red tape. So often scammers are coming. They are excellent psychologists.

Checking collateral by PTS

This is the abbreviated name for a vehicle passport. If the car is pledged to the bank, then the title is transferred to the financial institution. An ignorant buyer will not notice its absence.

When the passport is available, and many owners are listed there, the reason for the frequent sale of the car is alarming. There's something wrong with him.

If the car is new and the price is lower than the market price, and the seller attaches a duplicate title, such “luck” can result in a big problem.

Banks take away the original vehicle passport from pledged cars.

A duplicate is not necessarily a fake. If the surname is changed or the original is actually damaged, a copy of the PTS is issued. In this case, an entry is made in the “special notes” field in the passport about the reason for issuing a duplicate.

A more reliable and reliable option for a transaction is purchasing without intermediaries and powers of attorney, only from the owner.

Buying from hand to hand directly from the owner is the best option.

Buying from hand to hand directly from the owner is the best option. Checking a car for credit

To avoid falling into the trap of scammers, you should carefully study each document and know what and where to look. This is not only a passport for a car, but also an insurance policy. The CASCO policy contains a record of the owner of the vehicle.

If a bank is listed there, then in the event of a theft or accident, insurance payments will be received not by the buyer of the car, but by the legal owner.

If the seller does not have documents confirming his right to the car, then he may be hiding the fact that the purchase agreement contains a record of the purchase using credit funds.

If you bought a pledged vehicle

Perhaps the buyer was unable or did not try to find out the status of the car upon purchase. But then I realized the situation I was in.

Important changes took place in the civil code in this regard in 2014.

Previously, the borrower sold the car, stopped paying under the contract, and the bank took the vehicle from the new owner. But Now the situation has changed and the good credit history and integrity of the defrauded buyer are taken into account. The deposit does not pass to him if he did not know about the true status of the car.

And one more important point. Starting from September 2016, if the collateral property was not noted by the bank in the register, then it is not allowed to confiscate it from the new buyer.

Quick check of a car for arrest

There are several ways to investigate the situation, but usually users save time and look for quick check options. Therefore, only such methods are described below.

The presence or absence of an arrest is checked on the resources of the traffic police. Haste can result in serious fines for the buyer. Seizure prohibits any type of transaction involving the transfer of a car to new ownership.

Preliminary acquaintance with the status of transport will relieve unnecessary worries. Today this can be done online.

Exists two quick ways to obtain information about the presence of an arrest for a movable company:

- database on the FSSP (bailiffs) resource;

- traffic police information base.

Both resources have approximately the same procedure for obtaining information. Fill in the required fields or enter the car body number.

Association of Banks

A banking association (abbreviated as NBKI) has been created in Russia and has its own database. You can use it on the Internet using this link. Most often, they use it to identify credit scammers.

The only problem is that access to information is paid. Not all banks are members of the association, and therefore the data in it is not displayed for those financial organizations that are not included in it.

NBKI is a useful resource, but is not yet able to disclose all information on collateral.

NBKI is a useful resource, but is not yet able to disclose all information on collateral. As a result, it is worth noting that buying a car in Russia is a significant event. Not everyone can buy it in a showroom, so there is a secondary market and some freedom for “dealers” who take advantage of the ignorance of potential buyers, their greed and other mistakes.

To prevent yourself from joining the army of deceived victims, you should remember and apply one principle: it is better to first spend time analyzing the status of the machine than to lose both time and money trying to get out of a fraudulent scheme.

Buying a car from strangers is a big risk. In addition to malfunctions that do not appear immediately, it turns out that the car is stolen or is used as collateral. The last option is the most unpleasant, because you can be left without money and at the same time lose your long-awaited purchase. Therefore, before purchasing, you should check the car for collateral with the bank.

Transactions with a car presented to the bank as collateral are prohibited - the car ensures the return of funds issued to the borrower to the bank. When concluding an agreement, the car's passport is transferred to the lender before the end of the agreement. To conduct an illegal car transaction, the seller makes a copy - in this case, all obligations to repay the loan pass to the buyer.

The only way out in such a situation is to take control of it and find out whether the car is pledged or not.

Is it possible to determine this immediately?

Careful examination of the car documents is the responsibility of the buyer. The seller must provide:

- PTS (car passport). First you need to see how many owners the car had, and how long each of them owned it. Then it is important to make sure that the document is original and not a copy. There are notes about this in the “Special notes” column.

- STS (vehicle registration certificate). Verify that all data matches, including the year of manufacture; check VIN and owner information.

- Rights - it matters who sells the car, the owner or the reseller.

The license plate number is also a source of information, since it is individual for each vehicle.

Using the license plate number, you can find out whether it was involved in an accident and what damage it received. If it was used as a taxi, then this is also being clarified.

Without accurate data, it is impossible to say with certainty that the selected vehicle is collateral. However some points should immediately alert you:

Even if all of the above signs are not present, you should not rejoice: the pledge of a vehicle in a car pawnshop or from a private person is not included in any documents, in this case it will be difficult to check the car for pledge.

Is it possible to know for sure

An accessible and simple way is to find out the truth using the car’s VIN.

An accessible and simple way is to find out the truth using the car’s VIN.

VIN is a unique identification code assigned to each vehicle (Vehicle identification number). Provides information about the manufacturer and main characteristics of the machine; the year of manufacture is indicated. It is placed on non-removable parts of the body, chassis, and special nameplates.

Usually the buyer calms down after checking the code in 2-3 easily accessible places - however, you need to understand that scammers also try to interrupt the code where it is at the top. Most often, the VIN on the engine suffers, especially if the nameplate is secured with screws.

This code can be read using a scanner; in addition, there are special programs that are installed on smartphones. The VIN code is used to check the car for collateral and credit, and you can also find information on it on the relevant websites.

Where to check a car for collateral and credit

The traffic police website provides free data on the car pledge http://www.gibdd.ru/check/auto/# - the VIN is entered in the specified line, then the resulting list is carefully studied. If the existing number is on this list, you may suspect encumbrance or theft.

The traffic police website provides free data on the car pledge http://www.gibdd.ru/check/auto/# - the VIN is entered in the specified line, then the resulting list is carefully studied. If the existing number is on this list, you may suspect encumbrance or theft.

There are several other sites that specialize in selling or collecting information about used cars; they also have their own databases:

- https://www.autodna.ru/

It should be noted that checking basic data can be done for free; for detailed information you will have to pay a small amount. Using online checks is also convenient because, for the most part, registration or personal data is not required - this can be done anonymously.

The “Register of Pledged Property” has begun to function; the database of this resource contains information about the pledged property of citizens and organizations. You can find out whether the car is pledged or not by following this link: https://www.reestr-zalogov.ru/search/index, there is a search page using seller information. The data provided by the site is based on the database of the Notary Chamber.

If you need a verification document

When purchasing a car, you can check for restrictions with a notary during a personal visit - after the procedure, an extract is issued, which will cost a very modest amount. If it turns out that the car is pledged, then having such a document in hand, you can try to defend the car - for this, the victim must be recognized as a bona fide buyer. Theoretically, the car can then remain the property of the buyer.

If you don’t want to delve into how to check a car for collateral at a bank, you can entrust this to specialists. This option, such as contacting specialized companies that will professionally check the selected vehicle in all respects, is suitable if you are satisfied with the cost of their services.

Conclusion

When buying a car, you should take care that the acquisition does not become an expensive problem. To do this, you need to use all available opportunities - a pawned car can be identified without spending a lot of money.

Where do these machines come from? The pattern of their appearance is quite simple. The vehicle is purchased on credit and serves as collateral, being pledged to the bank. If the buyer is unable to repay the loan, the car is taken by the bank, which is its actual owner.

Some unscrupulous people sell such a car to another person without notifying him of the fact of the pledge. After some time, the bank finds a new owner and takes the car. However, no one returns the money to the victim.

If we consider law enforcement practice, we can see that the courts in most cases take the side of the banks, leaving victims alone with the problem. In such a situation, you can try to sue the fraudster, but there is little chance of recovering the lost money, especially if the car has passed through several hands.

How to check a car for collateral

The greatest chance to buy a similar car is from those who buy cars on the secondary market. But even purchasing from an official dealer does not guarantee the absence of encumbrances.

Checking the legal purity of a car should begin with studying the title. Many banks, when issuing a car loan, take the vehicle’s passport from the buyer. The absence of this document from the seller should serve as a reason to refuse the purchase.

However, most scammers receive a duplicate PTS from the traffic police, declaring the loss of the original. If you are buying a relatively new car, and instead of the original title, you are shown a duplicate, this should alert you and prompt you to conduct a thorough check. Unfortunately, not all banks take the original document, so its presence should not reassure you.

Another cause for concern is the frequent change of owners. If you see that a car has changed hands several times over six months, this may serve as an indirect sign that the car is being pledged. Some people, upon learning that a car is mortgaged, prefer to sell it quickly.

Ask the seller for documents proving that you paid for the car. This could be a purchase and sale agreement. If the car was purchased at a dealership, ask for a receipt or cash receipt to prove payment. You can independently request financial documents from the dealer and find out the history of the car. There they can tell you whether the car was bought for or taken out on credit.

Banks, when issuing car loans, in most cases require the issuance of CASCO policies. If the seller has such a policy, ask to see it. Pay attention to the “Beneficiary” column, which indicates the recipient of the insurance compensation. If the bank is listed there, the car was taken on credit.

It would not be superfluous to check the car according to the database. Today, several services have appeared on the Internet that, based on the VIN code of a vehicle, can provide information about it, including reporting the fact of a pledge.

Try to get to know the seller's credit history. The long and difficult path is to send requests to Russian banks yourself. There is an easier way - information is now available to citizens in the Central Catalog of Credit Histories. Knowing the seller’s passport details, you can make a request about whether he has debts. If he took out a loan to buy a car, this information should be reflected there.

Recently, on the basis of the Federal Notary Chamber, a Register of notifications of pledge of movable property was created, to which banks can submit information about cars pledged as pledge. Unfortunately, this procedure is not mandatory for credit institutions, so not all problem cars are included in the register.

Buying a used car is obviously a big risk. It doesn't matter where the purchase is made. Both individuals and salons often deceive customers. There are many ways of deception, but one of the most common is the sale of cars for which the loan has not been paid or that are pledged.

Ways to check a car for collateral

Many banks that issue loans for large amounts require clients to provide a car as collateral. Cases when people who have already pledged a car seek to quickly sell it to third parties cannot be called rare. The same applies to cars on which the outstanding loan hangs. The buyer's task is to avoid becoming a participant in such a scheme.

Checking a car for the presence of collateral or loans is carried out in several ways:

- Check by VIN code online on the official website of the traffic police. The VIN is a unique identification number that is assigned to each vehicle. It is located on the car body, on the engine, and is also indicated in the accompanying documents. The first thing you need to do is compare the VIN indicated in the documents with the VIN codes on the car. They must match completely. To check the car for collateral or credit, the VIN code is entered into a special line or window, after which you need to press the desired button. Everything that organizations involved in the financial sector have for the vehicle you are looking for will appear on the screen. You can also check by VIN code.

- Register of pledged property. This register contains information about all movable property pledged.

- A good way to avoid getting scammed is check the seller’s data for a match with those indicated in the documents for the car. If the sale is carried out by proxy, then this is the main reason to begin an intensive inspection.

- The most reliable option is to contact a specialized expert company. Specialists from such organizations are able to carry out verification in different ways. Their conclusion can really be trusted. The main disadvantage of using this method is the need to incur additional costs. But these are small things compared to the possible losses.

How to avoid becoming a victim of scammers

The first sign that we have a fraudster in front of us can be considered some haste when concluding a deal. If the seller offers to “speed up the process,” this is already suspicious, especially when he suddenly has a “notary acquaintance.” You should not agree to this, but it is better to immediately refuse to enter into an agreement, no matter how favorable the initial conditions may seem. Most scammers are excellent psychologists. And they are able to actively apply their knowledge in practice. The existing official procedure takes a lot of time and effort. So, some people simply cannot resist the temptation to become the owner of a new car without unnecessary red tape.

You should not make a deal alone. It's better to take one or two friends with you. It is very good if one of them has specific knowledge of procedural rules. You need to ask your companions to monitor the seller’s actions. The fact is that there have been cases when, after completing official documents, buyers received a fake set of papers. Such situations may well end in the banal disappearance of the seller along with the car. It is useless to report theft, since ownership cannot be proven.

You should not make a deal alone. It's better to take one or two friends with you. It is very good if one of them has specific knowledge of procedural rules. You need to ask your companions to monitor the seller’s actions. The fact is that there have been cases when, after completing official documents, buyers received a fake set of papers. Such situations may well end in the banal disappearance of the seller along with the car. It is useless to report theft, since ownership cannot be proven.

In addition, it is better to try not to buy a car under any powers of attorney, except when the transaction is made with people you can trust, for example, good friends.

Signs of collateral

There are several clear signs that your car loan has not been repaid:

- very low car mileage;

- the date of registration coincides with the date of deregistration;

- the price of the car is significantly lower than the real one;

- no traces of vehicle operation.

To these signs it is worth adding the absence of any additional equipment, for example, a car radio, another set of tires and everything that is typical for cars that were used, but suddenly decided to sell.

You need to find out whether you have the original PTS on hand. As a rule, it is the original that serves as a guarantee of collateral redemption for financial institutions. You should conduct business with the direct owner of the car and avoid intermediaries.

If it is known for certain that the car was originally purchased on credit, it is necessary that the seller provide all original documents regarding full repayment. As for the collateral, it is important to have a sales receipt and all the papers accompanying the redemption.

Due to the transaction tax, many do not want to indicate in the contract the actual cost at which the vehicle is purchased. But the seller’s rigid position of refusal to indicate the real price is a clear sign that something is wrong with the car.

If you bought a loan car

If it so happens that a car that is pledged to a bank is nevertheless purchased, then sooner or later the financial institution will demand that the debt be repaid in order to redeem the car. Otherwise, the car will be seized and driven to a special parking lot.

If it so happens that a car that is pledged to a bank is nevertheless purchased, then sooner or later the financial institution will demand that the debt be repaid in order to redeem the car. Otherwise, the car will be seized and driven to a special parking lot.

You should not give up and give up, even though judicial practice does not have a completely unambiguous approach to this issue. There have been precedents in arbitration courts when foreclosure is not applied to the property of a bona fide purchaser. However, this only applies to organizations that simply need to say in court that the collateral or loan was not known at the time of the purchase.

Unfortunately, most often it is individuals who become victims of fraudsters. Their cases are heard in courts of general jurisdiction, that is, district or city. And the judicial practice here is completely opposite. The court does not pay attention to the factor of good faith, but simply follows the principle that the lien is imposed on the property and not on the owner.

In such cases, it is necessary to strictly adhere to your position and insist that the pledge was not known. Since the good faith of the purchaser relates to the original right of ownership, grounds arise for the termination of the lien. But in such a situation, much will depend directly on the judge.

Another option is to launch an “attack” on the seller in order to get your investment back. In essence, the seller did not have the right to sell property that did not actually belong to him. He was obliged to hand over the car completely free from any encroachment by third parties. This kind of case can be won. But the method is effective only if the seller was initially solvent, since it can take quite a long time for him to return the money by court decision.

Several fairly simple methods discussed in the article will completely avoid any troubles. Vigilance when buying a car is very important, otherwise you can not only lose your own money, but also end up in debt to a financial institution.