-

Instant calculation

CASCO cost -

Dozens of programs

to choose from -

Analysis of the pros and cons

every company

View calculation example

Accurate, fast, safe

The calculation is made in less than a minute and shows the real cost of CASCO

The online CASCO calculator allows you to compare the cost of insurance in different companies in a matter of minutes. If you wish, you can order a policy immediately after payment. The CASCO calculator uses official tariff guidelines and API integration with insurance companies, which guarantees high accuracy of calculations.

A convenient interface makes it possible to calculate CASCO online in 2019 under different conditions: with or without a franchise, multidrive policy or with a limited list of drivers, and so on. The results of the latest calculations are saved for subsequent comparison and selection of the optimal insurance option. Additional information built into the CASCO calculator will help you make an even more informed choice - a description of the pros and cons, reliability and solvency ratings are available for all companies.

-

Expertise

Detailed analysis of the service level

each company from experts. -

Reliability

Current rates, secure

data storage. -

Bottom line

Fast, accurate and safe calculation

CASCO without intermediaries.

Calculation in 16 companies in 2 minutes

- Surgutneftegaz

- Agreement

- Rosgosstrakh

- RESO-Garantiya

- Renaissance Insurance

- Liberty Insurance

- Ingosstrakh

- Zetta Insurance

- Hayde

- British Insurance House

- AlfaInsurance

- Absolute Insurance

Favorable prices

up to 25%

Price benefit

policy

Special conditions and discounts from insurance companies and partners. We directly cooperate with the largest players in the insurance market.

up to 70%

Savings on specials

tariffs

Price calculation for a large number of individual programs. Discounts for drivers with children, young, confident and other categories of car owners.

Your browser does not support video

Convenient and clear

Company verification

You don’t need to check the company for a long time and find out the features of its work. We did it for you. Next to each company there is an assessment of its reliability and solvency.

Advantages and disadvantages

If you want more information, click on “pros and cons” and you will find out what its clients most often say about this company.

Detailed description

Each offer is provided with a simple and understandable description of the insurance program.

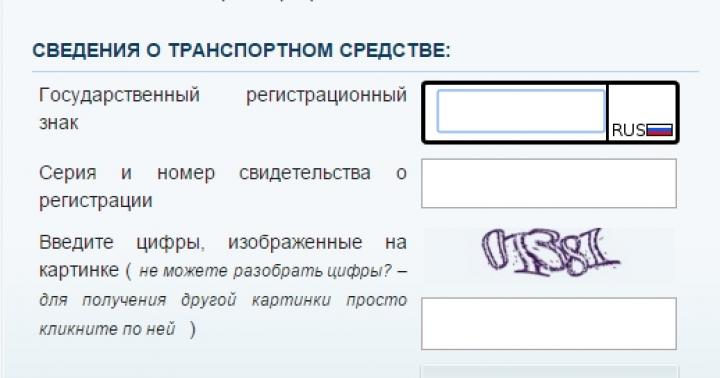

How to use the CASCO calculator?

Fill the form

Enter all the necessary data into the comprehensive insurance calculator calculation form. As a rule, filling out the form takes no more than 2 minutes.

Correct the mistakes

If errors occur, you will see a warning message. Correct the errors and continue calculating the motor insurance premium using the calculator.

After entering all the necessary data, within 5-15 seconds the service will calculate comprehensive insurance coverage for 17 insurance companies.

Select offer

If you like the offer of a particular insurance company, you can order a policy online on the calculation results page.

Find out more

For greater convenience, along with the calculation results, you can view expert ratings and an analysis of the pros and cons of each company.

Come again

Calculations are saved on the Casco calculator page. You can always look at your tariffs, compare prices and recalculate the cost of comprehensive insurance.

Still have questions?

What is a franchise? Is it worth indicating a deductible when filling out the CASCO calculator calculation form?

Franchise (or unconditional franchise) is the amount that the car owner will not receive in the event of an insured event. It is best to consider the principle of applying a franchise using an example:

- When calculating on the CASCO calculator for all companies, you can specify a deductible of 10,000 rubles.

- This means that in the event of an insured event with damage of 50,000 rubles, the insurer will deduct the deductible from the compensation and pay only 40,000.

- If the contract provides for repairs at a service station, the policyholder will have to pay an additional 10,000 rubles for repairs from his own pocket.

Why agree to a deductible if it reduces your payment? The fact is that including a franchise in a CASCO agreement helps you save money when purchasing a policy and not waste time contacting the company in case of minor incidents.

The deductible is set in monetary terms (usually 5,000, 10,000 or 20,000 rubles) or as a percentage of the insured amount (2%, 5%, 10%, and so on). Our CASCO calculator uses the cash option (however, for some companies the calculator automatically converts to percentage).

How much does CASCO cost on average in 2019?

The average cost of CASCO for individuals in Russia is about 55,000 rubles. It should be remembered that this figure also takes into account various reduced programs (CASCO 50 to 50, CASCO only against theft, and so on).

If we talk about calculating full CASCO insurance using a calculator, then in 2019 the average cost of the policy is 65,000 rubles. Of course, this figure varies greatly depending on the model of the car being insured and other parameters. CASCO prices for credit cars can be 5-20% higher.

How does CASCO differ from OSAGO?

The key difference between the two types of insurance is the object of protection. CASCO is insurance property(car) and your own risks on the road. OSAGO is motor vehicle insurance driver's responsibility. How will these insurance products help in different situations?

- If you are at fault for an accident, OSAGO will compensate for the damage to other road users. However, your losses will not be reimbursed.

- If you are NOT at fault for the accident, under the MTPL of the culprit you will be able to receive compensation for the damage received.

- Regardless of the degree of culpability of the participants in the accident, CASCO only compensates for the damage of the holder of the CASCO policy.

- In turn, other participants in the accident cannot receive compensation under your CASCO policy.

- In most cases, CASCO compensates for the car owner's losses due to car theft, natural disasters and other incidents.

Thus, only together CASCO and OSAGO guarantee complete protection against possible financial losses on the road. In addition, purchasing CASCO insurance together with MTPL may be more profitable than purchasing two policies separately (you can check it in the MTPL + CASCO calculator).

How to reduce the cost of CASCO? What parameters in the CASCO calculator help reduce the price of the policy?

There are several popular ways to save when purchasing CASCO insurance:

- Include a franchise in the contract. This is the most common method of reducing the cost of CASCO insurance when paying online. A deductible of 10,000 rubles will reduce the price of the policy by 10,000 - 25,000 (depending on the company and insurance program).

- Exclude young drivers from the list of persons allowed to drive a car. Sometimes the CASCO tariff can be halved.

- Insure only against major risks (total and theft). Many insurers are ready to give a discount of up to 50% (compared to a standard policy).

- If this is relevant, buy CASCO along with other insurance products from the same company. This could be MTPL, DSAGO, apartment insurance, etc. This strategy will reduce the cost of CASCO when calculated in a calculator by 5-15%.

What documents are needed to apply for CASCO insurance? Is it possible to apply for CASCO insurance online?

To apply for CASCO insurance, the following documents are usually required:

- Passport of a citizen of the Russian Federation.

- Driver's licenses of drivers authorized to drive a car.

- Vehicle passport.

- Application for insurance.

In some cases, insurance companies may require other documents at their discretion, such as a diagnostic card. Almost always, a pre-insurance inspection is a mandatory condition for CASCO insurance, so even if you can pay for CASCO via the Internet, you will still have to meet with an agent to show the car. At the moment, you can fully buy comprehensive insurance online only if the car is new and has not yet left the showroom (however, such a purchase is only possible in a few companies).

What is a pre-insurance examination and how to prepare for it?

A pre-insurance inspection of the car is carried out by the insurance company in order to identify defects on the car body. Damaged elements are indicated by the insurer's specialist in the inspection report. If an insured event occurs, the insurer may refuse to repair these parts. Moreover, even if such elements received additional damage as a result of an insured event.

If the policyholder corrects the damage after concluding the contract, it is imperative to ask the insurance company to carry out an additional inspection of the car. Legally, the damage is corrected only if you have a certificate of re-inspection of the car in your hands. Remember that this document must be signed by a representative of the insurer.

The pre-insurance examination does not affect the price of the policy when calculating CASCO online or offline. But the insurance company can use its results when an insured event occurs. Therefore, the correct approach to pre-insurance examination is important:

- Wash your car immediately before going to the appraiser.

- Find out which parts of the car have the VIN number of the car.

- Carefully check the numbers of components and assemblies of the car that the specialist enters in the inspection report. Any mistake in this document could cost you a payout later.

- If the inspection does not reveal any damage, ask the insurance company employee to cross out the boxes where the damage is indicated.

Guarantee of authenticity when applying for CASCO insurance

Guarantee of CASCO authenticity - purchasing insurance from trusted intermediaries or directly at the office of the insurance company. At the same time, you can apply for a policy at home, because this procedure is also available via the Internet. However, you will still have to visit the insurance company’s office at least once - for a pre-insurance inspection of the car for damage. In the case of a new vehicle purchased at a car dealership, this procedure is usually not required.

If there is a need to purchase insurance through dubious intermediaries, then to guarantee the authenticity of CASCO it is worth checking their credentials. To do this, you need to ask the intermediary for documents: a passport, a power of attorney from the insurer, an agency agreement. After this, it is worth contacting the insurance company to clarify whether this citizen is really authorized to enter into contracts on behalf of the insurer, accept money from clients and inspect the insured vehicle.

How to order delivery of a CASCO policy?

Insurance companies are very interested in voluntary vehicle insurance, which is why they often offer clients free additional services, in particular delivery of documents at a time and place convenient for the car owner. When coordinating the place and time of a meeting with a representative of the insurer, you need to remember an important feature of CASCO.

When applying for such a policy, in most cases an inspection and photograph of the vehicle is required. If you order delivery of the policy at night, the insurance company representative will not be able to inspect the car or take photographs, so in any case a visit to the insurance company’s office will be required, because without an inspection, insurance protection is not valid.

The location of the vehicle inspection is also important. This must be an open area with the ability to place the vehicle so that there is at least four meters between it and walls, fences or other cars. Otherwise, photographing is not possible, since the entire car must fit in the frame.

In simple and understandable language about the nuances of insurance

Many insurance companies do not insure the car only against theft. “Theft” is insured as an addition to the main insurance risk “damage”. Comprehensive insurance against all types of risks is called “full CASCO”.

Insurance companies often avoid insuring insurance separately from theft, since during the “dashing” 90s, a common method of fraud was insurance followed by theft of one’s own car. And after the insurance company paid the entire amount, the owner “found” his own car.

Theft or theft

- Theft is the unlawful taking of a vehicle without theft.

- Theft is the secret taking of someone else's property. Also, the car can be taken away during robbery, robbery, extortion or fraud.

Theft refers to such criminal acts when a car was taken for movement or subsequent profit (resale). An incident is called theft if criminals secretly open locks and anti-theft systems in order to take possession of a vehicle.

Car theft insurance covers almost all types of theft. When they occur, the insured person is paid coverage.

When insurance is denied

- If the cost of the vehicle is high, and it itself has been stolen several times.

- Often insurance companies refuse to issue anti-theft insurance as a separate package, offering a full range of insurance services.

When the policyholder refuses to pay

- If the documents were left inside the stolen car.

- The second set of keys is missing. However, if the insured person loses the second set of keys outside of the insured event, the insurance company must be notified about the incident.

- If the owner of a vehicle has a car key stolen, after which the car is stolen with its help. The insurance company may attribute this to negligence towards the property and refuse to pay. This point is easily disputed in court, but to prevent refusal, it is enough to contact the police with a statement of theft.

- Other reasons. Sometimes insurance companies justify the refusal with something exotic. For example, a car was stolen in a different area where the insurance contract was signed (sometimes insurers include such a clause in the contract). This is a direct violation of the ownership rights of the vehicle. The court recognizes such a clause in the contract as illegal.

Important! In the above cases, the court always takes the side of the insured person. Small companies can refuse on such points. Therefore, you should only take out theft insurance from a large, trusted insurance company that has been providing services for many years.

When is it legal to refuse payment?

How to minimize the cost of insurance and the possibility of theft

The cost of insurance directly depends on the risk of car theft. There are several ways to minimize the risk of theft. They must be taken into account when calculating payments:

- When purchasing, choose an “unpopular” car brand. To find out the “popularity” rating of scammers, study publicly available hijacking statistics.

- Install anti-theft markings on your car. This will make the car unattractive to criminals.

- Leave your vehicle in a guarded parking lot.

- When exiting the vehicle, close the door and set the alarm. Never leave your keys in the ignition.

- Do not leave children in the car, even if you go out for a few minutes. The car may be stolen along with the children or they may be thrown directly onto the street.

Receiving payment in case of theft

Algorithm for vehicle theft:

Algorithm for vehicle theft:

- If you discover something missing, call your insurance company immediately.

- Write a statement to the police and ask for documentary evidence of acceptance of the statement.

- On the same day, go to the insurance company’s office and begin the payment processing procedure.

Cost of theft insurance

On average, the price of car theft insurance is 3–5% of the value of the vehicle. The amount primarily depends on the make of the car and the degree of risk. Each insurance company has its own statistics. If a car brand falls into the risk group, the cost of insurance can reach 15–20%. Insurers often refuse to conclude a contract.

Insurance companies may offer a discount if additional anti-theft elements are installed. Such equipment will pay for itself in a few years, but you need to take into account some points:

- Additional equipment will violate the terms of the warranty if the vehicle is operated under warranty conditions. When applying for insurance directly at a car dealer, check whether the installation of additional equipment will affect the warranty conditions.

- Sometimes, to install an anti-theft structure, you have to damage the car body or upholstery.

- Often, installation of anti-theft systems entails a monthly subscription fee.

Important: Be sure to clarify all points before applying for a policy. Otherwise, by saving on one item, you will lose money on others.

Let's sum it up

While cases of vehicle theft are being recorded, it is worth taking out theft insurance. The insurance company will compensate for damage in the event of theft. The correct choice of insurance and a detailed study of the contract will help you avoid problems with payment.

CASCO - voluntary vehicle insurance.

This is insurance against any troubles, be it damage or theft. And no matter under what circumstances the damage occurred (an accident, ice falling from the roof, a stone breaking the windshield, scratching in a parking lot, glass breaking), the insurance company will compensate you for the damage in any case. In the event of an accident with other participants, it does not matter at all whether you are at fault or not.

What does the cost of CASCO depend on?

To accurately calculate the cost of CASCO, the insurance company will ask you for many parameters, such as the make and model of the car, year of manufacture, mileage, engine type and power, gearbox type, body type, the presence of an alarm, the presence of an auto start, and, of course, age and length of service of drivers admitted to driving. All these parameters directly or indirectly affect the likelihood of accidents and theft, and, accordingly, the cost of insurance. Preference is given to adult, experienced drivers with families, as this promotes a calm driving style and minimizes the risk of accidents. The cost of the policy in this case will be minimal. The cost is also affected by statistics on thefts of a given car model in a particular region and the cost of spare parts for it.

What is a franchise?

A deductible is the amount by which the cost of your payment will be reduced in the event of an insured event. Moreover, the higher the deductible, the lower the cost of the policy. Typically, the franchise size can be chosen in the approximate range from 10,000 to 75,000 rubles. If you have CASCO insurance with a deductible of 20,000 rubles, and the damage is 100,000 rubles, then the insurance company will pay you only 80,000 rubles. By choosing CASCO with a franchise, you can save more than 50% on the cost of the policy. You must understand that in case of minor damage (up to the deductible amount), the insurance company will not pay you anything at all.

What compensation will I receive if the car is stolen or completely wrecked?

The CASCO agreement stipulates the insurance amount that you will receive in the event of a complete loss of property. This amount is calculated based on the age and condition of your car and can be changed, as a rule, only within small limits from the calculated one. The CASCO online calculator is able to determine the cost of the car from the parameters you entered; however, the insurer makes the final decision after inspecting the vehicle.

Can I be denied compensation for my losses?

Yes, there are some circumstances in which the insurer may refuse to compensate you for damage:

- If it is proven that the damage was caused intentionally.

- If at the time of causing the damage the car was driven by a person who does not have a license to drive a vehicle.

- If the Driver was intoxicated or under the influence of other substances.

- If the insured event occurred outside the policy area (for example, abroad).

These are just the main points. Check with your insurance company for a complete list.

Car insurance on credit

If you decide to buy a new car on credit, then voluntary CASCO will become mandatory for you. After all, the car is pledged to the bank, and the bank insures it at your expense. In this case, the bank will oblige you to insure the car not with any insurance company, but only with the bank’s partner company, and at the maximum rate for all types of risks.

Due to the high cost of full comprehensive insurance, car owners are looking for ways to save costs by limiting the list of risks included in the insurance program. One of the most popular programs is comprehensive insurance against theft. This program is suitable for experienced drivers with a minimum number of traffic violations. Car theft insurance is important when purchasing new and expensive cars. In this article we will look at the features of the comprehensive insurance program; we will tell you about the cost of such insurance; Let's consider the advantages and disadvantages of such a policy and the features of the occurrence of an insured event.

Features of comprehensive insurance against theft only

Most companies offering comprehensive insurance programs to their clients have tariffs for theft and theft risk. The average cost of such insurance policies usually does not exceed 2-3% of the cost of the car. Some companies refuse to issue policies for only one insurance risk due to the following reasons:

- The cost of such policies is 40 or 50% lower than the cost of full comprehensive insurance programs. Despite the fact that the risk of car theft is significantly lower than the risk of an accident, if an insured event occurs, the company will have significantly greater losses than when compensating for damage as a result of an accident;

- Theft and damage-only insurance programs have a higher risk of fraud - often policyholders fake theft to obtain a payout from the insurer equal to the full value of the car.

According to statistics, about 90,000 cars are stolen in Russia every year, and only in 40% of cases the police manage to find stolen cars. Therefore, some companies rarely issue comprehensive insurance contracts exclusively for one insured event. To reduce their own risks, insurers do everything possible to, on the one hand, protect themselves from fraud, and on the other hand, compensate for the high risks of fraud. For this purpose, they either make the price higher or include additional risks in the contract, sometimes significantly increasing the cost of the policy.

Pros and cons of the policy

The advantage of this program is the affordable cost of the policy with full coverage of the cost of the car in the event of theft. However, despite the high risks, a number of companies impose strict conditions in order to reduce losses and sell insurance to the car owner at an inflated price.

With the market value of the policy around 2 or 3% of the cost of the car, in some companies comprehensive insurance against theft can cost 5-10% of its cost, depending on the installed alarm system and the popularity of a particular brand among car thieves.

The disadvantage of this program is the procedure for receiving payments. Even if you insure your car according to all the rules, you will not be able to receive payments quickly and without problems. In fact, many companies try to avoid payments, so they include various restrictions and conditions in the contract to reduce risks. Sometimes the policy is not valid if the theft was not committed in the Russian Federation.

Theft and theft - is there a difference?

For most car owners, the concepts of “theft” and “theft” are the same, but for insurers this is far from the case - there is a difference between these concepts, despite the fact that in both cases the owner loses his vehicle. Table No. 1 presents comparative characteristics of the concepts.

Table No. 1 - Features and differences between the concepts of “hijacking” and “theft”

| Comparison criterion |

Hijacking |

Theft |

|---|---|---|

| Target |

Taking possession of a car |

Cash benefits from a car |

| Nature of the violation |

Thoughtful / spontaneous |

Always thoughtful |

| Car features |

Make, year and model usually don't matter |

Expensive car, usually a new model |

| The essence of the crime |

The car was illegally stolen from a parking lot |

The car is sold or dismantled for parts |

In the case of theft without the intent of theft, companies assume a high probability that the car will eventually be found, so the cost of insuring this risk is significantly lower than theft. When calculating the cost of comprehensive insurance against theft, companies take into account such features as the maintenance of the vehicle and the presence of an anti-theft device installed by qualified specialists. Compliance with these two points allows you to reduce the insurer’s risks, and therefore reduce the cost of comprehensive insurance.

Cost and what it depends on

Car owners can protect themselves from financial risks and reduce insurance costs by choosing single risk insurance. Just look at how much theft insurance and full motor insurance costs from various insurers and calculate the benefits when taking out a “reduced” policy. Table No. 2 shows the cost of an insurance policy for a 2012 Hyundai IX 35 car registered in Moscow. The price is 789 thousand rubles, mileage is 100 thousand km.

Table No. 2 - Cost of a comprehensive insurance policy for the risk of “theft” in 2018, rub.

| Insurance Company |

Driver age 20 years, experience 2 years |

Driver age 28 years, experience 7 years |

Driver age 40 years, experience 15 years |

|---|---|---|---|

| Ingosstrakh |

80 179

|

41 976

|

29 684

|

| RESO-Garantiya |

93 587

|

41 689

|

32 253

|

| Agreement |

71 073

|

43 458

|

33 911

|

| INTOUCH |

62 842

|

33 737

|

26 789

|

| Tinkoff insurance |

37 400

|

37 400

|

31 500

|

| MAX |

101 860

|

68 090

|

41 817

|

Source: insurers' websites https://www.ingos.ru/auto/kasko/calc/

You can calculate your insurance against theft either independently, using the online calculator on the insurer’s website, or by contacting the office or email of the insurance company. Insurance will be cheaper for a car owner over 25 years old with a driving experience of more than 2 years. Such a car owner will be perceived by the insurer as an experienced driver; the advantage will be the absence of applications to the insurance company during the past year, and the absence of fines for violating traffic rules.

Insurance company programs

In Russia, only a few companies offer comprehensive insurance only for the risk of theft. “RESO-Garantiya” under the “Theft” program insures only cars under 12 years of age, and also does not require the presence of an alarm and search system (if the car is not at risk). The Soglasie insurance company operates under the CASCOsnova program. The terms of the program say that cars up to 7 years old and costing no more than 2.5 million rubles are eligible for insurance. Car theft insurance is only allowed for drivers with at least 5 years of experience.

Insurance company rates are usually based on the degree of protection of the car and its position on the list of the most stolen cars. Companies often offer the services of partners for the installation of alarms and anti-theft systems. This may cause the car to be removed from the warranty, which is especially important for those car owners who are applying for comprehensive insurance for a new car. And in this case, you have to choose: either follow the lead of the insurance company, or insure the car in full, but avoid making changes to the design.

Actions upon the occurrence of an insured event

The first thing you need to do when you discover a missing car is to contact the police (call 02 or 911) and tell them that your personal vehicle was stolen by unknown persons. Then make a second call to the contact center of your insurance company. It is also necessary to submit a written application to the police department at the place of registration or residence. There is no need to trample down the place where the vehicle was parked, as traces of intruders and other evidence may remain there.

To receive insurance compensation, you need to contact the insurer with an application, insurance policy, documents for the car, a police certificate about the fact of theft and investigative actions, a passport or other document. Depending on the rules of the insurance company, the list of documents required to receive compensation may vary.

Payments and when they will be refused

Insurance compensation is paid within the limits of the insured amount under the contract minus the unpaid part of the insurance premium, deductible (under the contract), and depreciation. Depreciation wear deserves special attention. Insurance companies deduct 1% of depreciation for each month of operation, so you can calculate the final amount yourself. If the cost of the car at the time of signing the contract is 1,200,000 rubles, then if the car is stolen after 10 months, it will automatically decrease by 10%. The insurer will deduct the difference and pay only RUB 1,080,000. When concluding a contract, you should carefully read the conditions offered by the insurer - in some cases, depreciation may be higher.

The most common reason for refusal of compensation is leaving keys and documents in a stolen car, or finding out that documents were missing before the car was stolen. Often, insurers include clauses in the contract that are not legal - the absence of a second ignition key should not be grounds for refusal to pay. The court most often regards such situations as the insurance company’s withdrawal from fulfilling its obligations to the policyholder and makes a decision in favor of the plaintiff, the insurer’s client.

Each insurer has its own rules and terms for paying compensation. Most often, compensation is paid after the criminal case is closed. Sometimes the insurer will pay a small percentage of the insurance during the investigation and transfer the rest to the insured after the case is closed. A prerequisite is the conclusion of an agreement with the policyholder in the event of the discovery of the car after payment of the insurance. Under one of the conditions, the client will have to return the entire amount of insurance, under the second - to renounce ownership of the car, which will become the property of the company.

Conclusion

It is most profitable to apply for comprehensive insurance for one risk for drivers with experience, no fines and no accidents. The lower these indicators, the higher the cost of the vehicle insurance policy. Risk insurance is paid after the criminal case is closed and an additional agreement is concluded between the policyholder and the insurer in the event of the discovery of a stolen car.

Zetta Insurance LLC offers to issue CASCO against theft under the “Theft +” program, the cost of which is significantly lower than the full insurance package. This will allow you to save significantly, while not sacrificing protection from some of the most common and extremely dangerous incidents. CASCO insurance against theft can be considered the optimal choice for experienced drivers who feel confident on the road, which in itself minimizes the likelihood of an accident.

In addition to theft, the policy covers fire, natural hazards and animal acts. The program has a number of additional advantages:

you can apply for CASCO insurance only against theft at an affordable price - tariff from 1.2% depending on the region and make/model of the car;

the policy is valid for a year, there is a possibility of extension;

CASCO calculation in case of theft is carried out without taking into account the length of service and age of the driver and the year of manufacture of the vehicle;

the ability to additionally include compensation for car damage;

How much does a CASCO insurance policy cost against theft?

The exact price of the policy can be calculated using the CASCO calculator online. To do this, you need to enter the data as accurately as possible into the appropriate fields of the form. A personal agent will also help you calculate comprehensive insurance against theft, taking into account many nuances individually. Please contact us by phone if you have any questions regarding our online services or insurance issues.

Buying CASCO means protecting yourself in case of car theft and a number of other unpleasant situations - for example, dangerous natural phenomena that do not depend on the car owner, are very poorly predicted, but, unfortunately, do happen.