VAT adjustment is necessary when the purchase or sale price changes. In this situation, an adjustment invoice is generated. Using the example of the 1C Accounting 8.3 program, let's look at adjusting input VAT when the cost decreases. First, we will generate the document “Receipt of goods” and register the “Invoice received”:

When filling out, check the box “Reflect the VAT deduction in the purchase book by the date of receipt”:

Let's say we purchased a large batch of goods, and the supplier offered a discount. Accordingly, there was a decrease in the total cost and VAT. To reflect this in the program, we create a document “Receipt Adjustment”:

In the adjustment on the “Main” tab, you need to check that the basis document is reflected and there is a checkmark next to the “Restore VAT in the purchase book” item.

On the “Products” tab, in the “Price” column, set a new cost, and the values in the “Cost”, “VAT” and “Total” columns will be calculated automatically:

Be sure to register an “Adjustment Invoice” in the receipt adjustment; it is this document that will reflect the decrease/increase in the amount. This data will be displayed in the corresponding field of the document:

We generate the “Purchases Book” and “Sales Book” reports, and check how the “Adjustment Invoice” will be reflected in the reporting:

The “Purchases Book” report reflected the initial amount. But in the “Sales Book” report the amount will already be displayed based on the adjustment invoice.

Now let's look at an example of increasing cost. In the same way, we fill out the “Receipt of goods” and register the document “Invoice”:

The supplier increased the price for a new batch of goods, and an “Adjustment Invoice” was issued. If the buyer agrees with the new cost, then the “Receipt Adjustment” document is drawn up in the same way as in the previous case. You can also create a receipt adjustment using the “Create based on” button from the receipt invoice.

You must fill out:

Type of operation - “Adjustment by agreement of the parties.”

Base.

Restore VAT in the sales book – check the box.

On the “Products” tab, in the “Price” column, set a new price.

We register “Adjustment invoice received”:

In this situation, you need to refer to the routine operation “Creating purchase ledger entries”:

Since in the original “Invoice” document the checkbox “Reflect VAT deduction in the purchase book by the date of receipt” was checked, the data from this document is not displayed when creating purchase book entries. But the adjustment entry is reflected.

As a result, both invoices will appear in the purchase ledger:

If the cost decreases, the data from the adjustment invoice is reflected in the sales book, and if the cost increases, it is reflected in the purchase book.

When sold, an adjustment invoice for a decrease in value will go into the purchase book, and for an increase, it will go into the sales book.

Sales adjustments are made in a similar way. We create a document “Adjustment of sales” taking into account the price reduction:

And we register the “Adjustment Invoice”. Fill in the data in the appropriate field to reduce the cost:

Please note that before generating reports, you must complete regulatory VAT operations.

The Purchase Ledger report will reflect the decrease in value based on the created adjustment invoice. The “Operation code” column will contain 18, and the column with the name of the seller will display the name of our organization:

Now we form “Adjustment of sales” taking into account the increase in price:

The “Adjustment Invoice” document will reflect the increase in the amount.

When working in the 1C 8.3 Accounting program, input errors are not that rare. Of course, the human factor does not always play a role, but it also plays a big role.

Let's assume that the program reflects the fact of purchase or sale of a product. After some time, it turns out that the data entered was incorrect. The reasons are not important to us. The main thing to understand is that making changes to previously completed documents is not always correct. This can lead to disastrous consequences and break the logic of the data. That's right - make an adjustment in 1C for the previous period using the relevant documents.

Adjustment of receipt and invoice from supplier to decrease

Let's look at a specific situation. On October 11, 2017, our organization LLC Confetprom purchased one pair of rubber gloves from a supplier at a price of 25 rubles per pair. After some time, it became clear that incorrect data had been entered into the program.

It turns out that the supplier changed the price for us, which was 22 rubles. Unfortunately, this information was not conveyed to the employee who made the purchase of gloves in the program, and he made a mistake.

In order to correct a previously created receipt document, there is an adjustment to it. You can enter an adjustment document directly from the receipt itself, as shown in the figure below.

The program filled in all the data automatically. Please note that on the first tab “Main” in our example, the “Recover VAT in the sales book” checkbox is selected. The fact is that the price and, as a result, the cost of the gloves was reduced. In this regard, we need the previously deductible VAT to be restored in the sales book.

Also here you can indicate how the created adjustment should be reflected: in all sections of accounting or only for VAT.

By going to the “Products” tab, we see that our rubber gloves with all other data have already been added to the corresponding tabular part. In this case, the string itself is divided into two substrings. The upper part contains data from the primary receipt document, and the lower part contains the adjustment.

In our case, the price of gloves has changed downwards from 25 rubles to 22 rubles. We reflected this change in the second line.

Let's make adjustments and check the formed movements. As you can see in the figure below, the cost of rubber gloves has been adjusted by 3 rubles. A VAT adjustment was also made to the amount of 18% of this cost. It amounted to 54 kopecks.

After completing the adjustment, we can do the same. This is done in a manner similar to registration from receipt of goods.

Adjustment of sales and invoices from the seller

Situations when it is necessary to adjust the primary document up or down, carried out in previous periods, may also arise when selling goods. In such a situation, you can safely use the instructions described above.

An implementation adjustment in 1C 8.3, just like a receipt adjustment, is created on the basis of a primary document. The set of fields is quite similar. Only the movements created in the program differ.

How to adjust receipt and sales documents in the 1C 8.3 Accounting program

There are often situations when, after some time, errors are discovered in previously entered documents. In such cases, it is necessary to adjust the document.

Many people go into the document “retroactively”, correct it and repost it. This type of adjustment can lead to serious errors and consequences. In addition, it is often necessary to simply document discrepancies in data for further proceedings with the supplier.

For example, let’s take the document “Receipts (acts, invoices)”. Adjustments to the implementation in 1C 8.3 are absolutely similar to those received.

Let’s say that two months ago a document was drawn up where a certain product was capitalized in the amount of 8997.76 rubles.

After arrival we begin to sell the goods.

After some time, we discovered an error in the receipt document. The price should be different, for example, 223 rubles. The amount is correspondingly 9143 rubles.

Discrepancies arise:

- in mutual settlements

- in VAT accounting

To record and correct this situation, there is a document “Receipt Adjustment”.

Adjustment can be of two types:

- Correction in primary documents

- Adjustment by agreement of the parties

The differences are that in the first case we simply correct our error found in the primary document. In this case, all columns of the tabular section are available for editing. You can generate a correction invoice.

When making adjustments by agreement of the parties, that is, when the parties agreed that the terms of delivery change (the price or quantity changes), the column with the VAT rate cannot be edited. But you can check the “Restore VAT in the sales book” checkbox and also create a corrected invoice in 1s 8.3.

In addition, it is possible to choose where the adjustment will be reflected:

- in all sections of accounting

- only for VAT accounting

- only in printed form (if the original document is corrected)

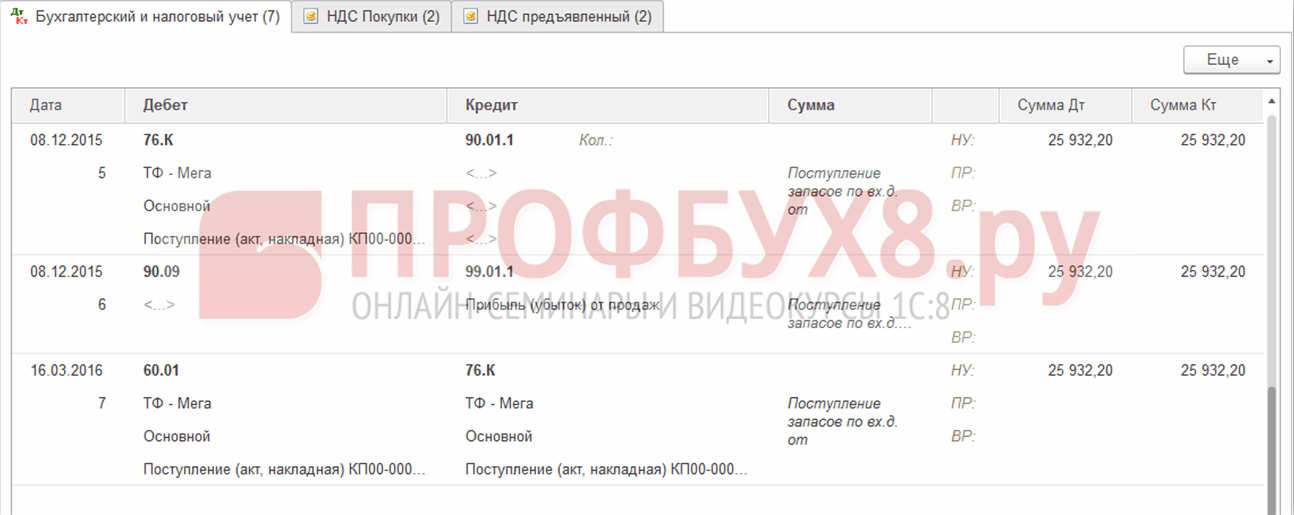

Let's look at the postings that the adjustment document created in 1C:

As you can see, the document corrects the difference in invoice 60.01 and VAT (invoice 19.03). Moreover, if after the change the amount decreases, the VAT is reversed, and the 60th account is posted as a debit.

If the amount increases, account 60 is posted to the credit in both cases.

The cost of lower-level sales, unfortunately, is not recalculated or adjusted, but I would like to see this.

Similarly, in 1C Accounting 8.3, adjustments are made to the sale of goods, only in addition to the 62nd account, sales revenue and the financial result (profit (loss) from sales) are also adjusted:

Based on materials from: programmist1s.ru

There are often situations when, after some time, errors are discovered in previously entered documents. In such cases, it is necessary to adjust the document.

Many people go into the document “retroactively”, correct it and repost it. This method of correcting your own mistakes can lead to serious errors and consequences. In addition, it is often necessary to simply document discrepancies in data for further proceedings with the supplier.

It is correct to make such changes using the 1C documents “Adjustment of receipts” and “Adjustment of sales”. Let's look at step-by-step instructions on how to work with them in 1C 8.3

Example of registration of a downward adjustment of receipts

For example, let’s take the document “Receipts (acts, invoices)”. Adjustments to the implementation in 1C 8.3 are absolutely similar to those received. Let's say that two months ago we issued a document where we receive some goods worth 8,997.76 rubles.

After arrival we begin to sell the goods.

After some time, we discovered an error in the receipt document. The price should be different, for example, 223 rubles. The amount, respectively, is 9,143 rubles.

Discrepancies arise:

- in mutual settlements;

- in VAT accounting.

To record and correct this situation, there is a document “Receipt Adjustment”.

Adjustment can be of two types:

Get 267 video lessons on 1C for free:

- Correction in primary documents.

- Adjustment by agreement of the parties.

The differences are that in the first case we simply correct our error found in the primary document. In this case, all columns of the tabular section are available for editing. Can .

When making adjustments by agreement of the parties, that is, when the parties agreed that the terms of delivery change (the price or quantity changes), the column with the VAT rate cannot be edited. But you can check the “ ” checkbox and also create a corrected invoice in 1C 8.3.

An example of adjusting receipts for the previous period downwards:

In addition, it is possible to choose where the adjustment will be reflected:

- in all sections of accounting;

- only for VAT accounting;

- only in printed form (if the original document is corrected).

Let's look at the postings that the adjustment document created in 1C:

As you can see, the document corrects the difference in invoice 60.01 and VAT (invoice 19.03). Moreover, if after the change the amount decreases, the VAT is reversed, and the 60th account is posted as a debit.

Important! If the accountant plans to make adjustments to the previous period and the tax is not underestimated, then the tax data in 1C 8.3 is adjusted manually.

Let's look at an example.

Let’s say that the Confetprom company discovered a technical error in March when providing communication services for December 2015; the amount of costs was exceeded by 30,600 rubles.

It was issued with the document Receipts (acts, invoices) from the Purchases section. An invoice was also immediately registered:

An invoice was also issued:

and VAT was accepted for deduction:

A corrective document was issued for this receipt.

It is important to determine the reason for the adjustment (type of operation):

- Correcting your own error - if a technical error is made, but the primary documents are correct.

- Correction of primary documents - if the conformity of goods/services and other things does not coincide with the primary documents, there is a technical error in the supplier’s documents.

Let's look at this example in these two situations.

Own mistake

In this case, a technical error was made in the amount by the accountant, so we select Correct our own error:

When editing a document of a previous period, in the Item of other income and expenses field, Corrective entries for transactions of previous years are set. This is an income/expense item with the item type Profit (loss) of previous years:

On the Services tab, enter new data:

When posting, the document generates reversing entries downward if the final amount is less than the corrected amount. And additional transactions for the missing amount in the opposite situation:

In addition, when adjusting the previous period in 1C 8.3, adjustment entries for profit (loss) are created:

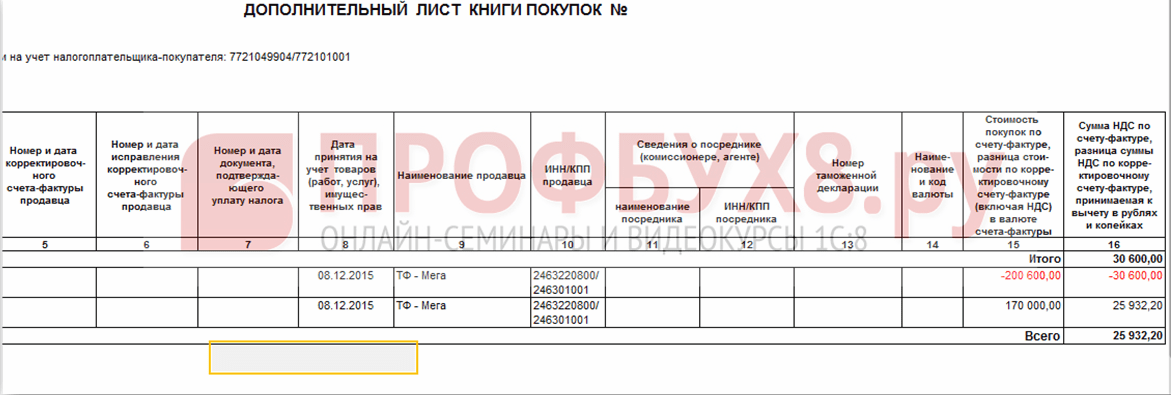

The Purchase Book displays the adjusted VAT amount:

After correcting the previous period in 1C 8.3, you need to do it for the last year in the Operations section - Closing the month in December.

How to correct a mistake if you forgot to enter an invoice, how to take into account “forgotten” unaccounted documents in terms of tax accounting when calculating income tax in 1C 8.3, read in

Technical error in supplier documents

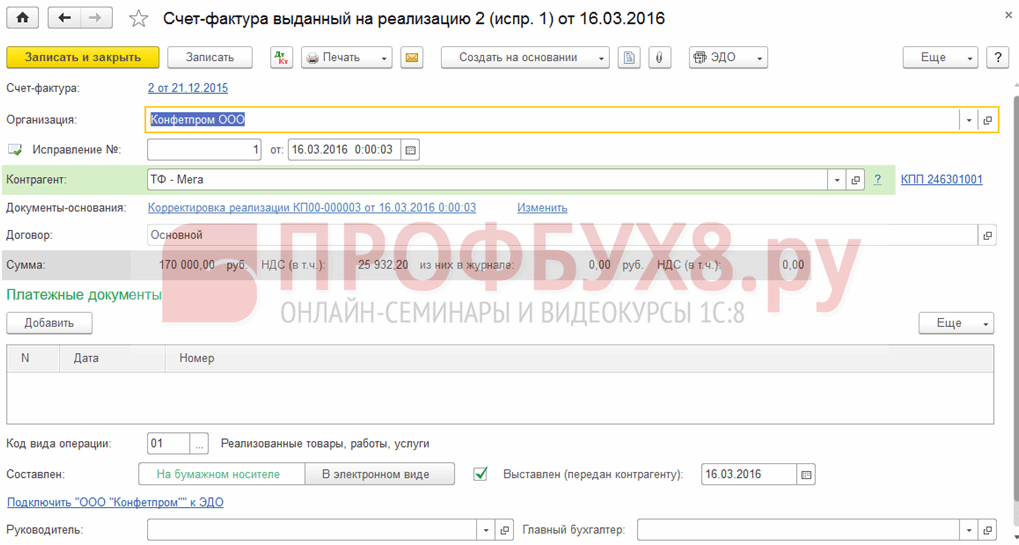

If a mistake is made by the supplier, Type of operation is set to Correction in the primary documents. We indicate the correction number for both the receipt and the invoice:

On the Services tab, indicate the correct values:

The document makes similar entries with the correction of its own error in adjusting the previous period. You can also print the corrected printed documents.

Bill of lading:

Invoice:

To reflect the corrected invoice in the Purchase Book, you need to create the document Generating Purchase Book Entries from the Operations section by selecting Regular VAT transactions:

In addition to the main sheet in the Purchase Book:

The correction is also reflected in the additional sheet:

Adjustment of sales of the previous period

Let's look at an example.

Let’s say that the Confetprom company discovered a technical error in March when selling communication services for December 2015; the amount of income was underestimated by 20,000 rubles.

It was issued with the document Sales (acts, invoices) from the Sales section. An invoice was also immediately registered:

A corrective document Implementation Adjustment was issued for this implementation. The type of operation in case of a technical error is selected Correction in primary documents. On the Services tab, you need to make corrective changes:

It is also necessary to issue a corrected invoice:

Corrective entries are reflected in the movements:

The corrected implementation is reflected in an additional sheet of the Sales Book. To create it, you need to go to the Sales – Sales Book page:

How to correct an error in receipt or shipment documents that affects primary documents, as well as special tax accounting registers, is discussed in the following.

Cancellation of an erroneously entered document

There are situations when a document is entered by mistake, for example, created.

For example, the Confetprom company in March discovered a non-existent document for the receipt of communication services for December 2015.

Performed by a manual operation Reversal operation in Operations entered manually from the Operations section.

In the Reversing document field, select the erroneously entered document. This reversal document reverses all transactions, as well as VAT charges:

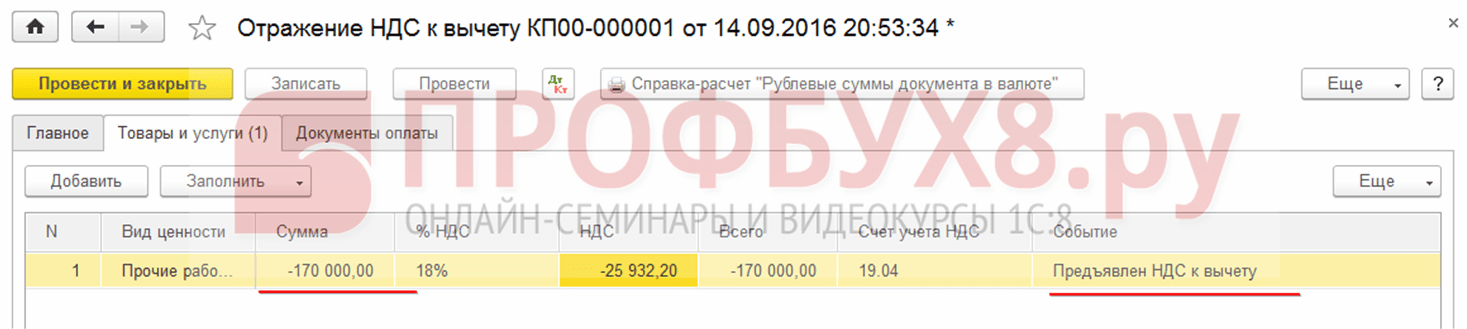

To enter a reversal transaction into the Purchase Ledger, you must create a VAT Reflection for deduction from the Transactions page:

- It is necessary to check all the boxes in the document;

- Be sure to indicate the date of recording of the additional sheet:

On the Products and Services tab:

- Fill in the data from the payment document and set a negative amount;

- Make sure that the Event field is set to VAT submitted for deduction:

You can check whether the cancellation of an erroneous document is correctly reflected in the Purchase Book - section Purchases:

How to reflect the implementation of the previous period

Let's look at an example.

Let’s say that the Confetprom company in March discovered unrecorded sales of communication services for December 2015.

To reflect a forgotten implementation document in 1C 8.3, we create an Implementation (acts, invoices) on the date the error was found. In our case, March, not December:

In the invoice document we indicate the date of correction (March) and the same date is indicated in Issued (transferred to the counterparty):

To reflect VAT in the previous period, you must check the Manual adjustment box and correct it in the Sales VAT register:

- Recording an additional sheet – set to Yes;

- Adjusted period – set the date of the original document. In our case, December: