We have already mentioned that international trade is the oldest type of economic activity.

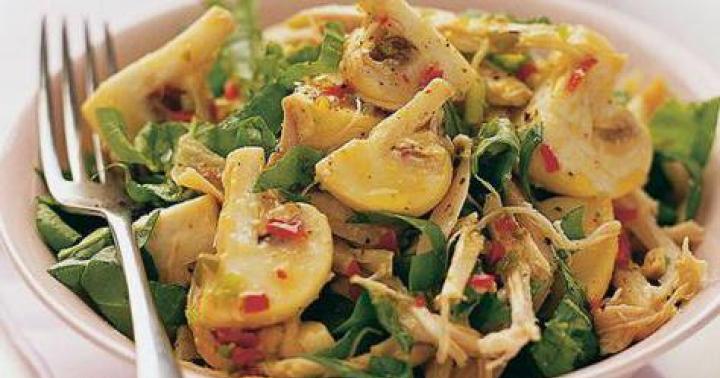

After much research, economists were able to identify the main reasons for the existence of international trade. They are shown symbolically in Fig. 15-1, and we will discuss each of them in more detail below.

Rice. 15-1. Economic foundations of international trade

Unequal distribution of natural resources (benefits). The very first reason for the emergence of international trade is given by nature: it consists in the unequal distribution of natural resources between different countries and peoples. If one country has deposits of oil and another has deposits of chromium, then in order for both countries to be able to make car parts from chrome-plated steels and have gasoline at gas stations, these countries must trade with each other, exchanging oil for chromium . It is according to this model that Russia exports oil and black caviar abroad, and imports bananas and pineapples.

But this logic does not explain why countries also trade goods, each of which they can produce themselves. For example, Americans buy (import) Japanese cars and televisions, although they themselves have a powerful automobile and television industry.

Import- purchase by residents of one country of goods manufactured in other countries.

Export- sale to residents of other countries of goods produced by sectors of the domestic economy.

The principle of absolute advantage. In search of an answer to this question, economics first turned its attention to the absolute differences in the costs of producing identical products.

Let us compare, for example, the costs of producing flax and sugar beets in Russia and Ukraine. Due to differences in soil and climatic conditions, growing flax in Ukraine provides a much smaller yield per 1 hectare than in Russia, where, on the contrary, the yield of sugar beets is lower (there is not enough heat). If these countries each specialize in their own, and then exchange the fruits of their labors, then both peoples will benefit. They use their arable land in the most efficient way.

That is why, even within the USSR, Russia specialized in growing flax, supplying linen fabrics to Ukraine, and received sugar from Ukraine, where it was produced from beets grown in local fields.

In the language of economists, this basis for international specialization of production and trade is called the principle of absolute advantage.

The principle of absolute advantage: Countries benefit from trading with each other if each specializes in goods that it can produce with absolutely fewer resources than its trading partners.

Specialization based on the principle of absolute advantage leads to the fact that humanity as a whole achieves the highest efficiency in using the Earth's resources. The resulting global economy ensures that each type of goods is produced by the country that spends the least amount of resources on it. Therefore, the development of international trade is so important for all countries on the planet and is given so much attention by both governments and international organizations.

The principle of relative advantage. It is still impossible to understand the logic of international trade, knowing only about the unequal distribution of natural goods and the essence of the principle of absolute advantage.

This became clear to economic science already at the beginning of the 19th century, when the process of primary industrialization was completed in many countries. A number of countries were among the leaders, and their absolute costs of production of products in a wide variety of industries became lower than in less developed countries. If international trade in these conditions developed on the basis only of the principle of absolute advantage, then the leading countries would have to stop purchasing goods from less developed countries, but this did not happen.

The next step towards understanding the secrets of international trade was taken by the great English economist David Ricardo (1772-1823). He was able to see in the development of foreign trade the influence of another principle - the principle of relative advantage.

Principle regarding advantages- It is more profitable for each country to export those goods for which the price of choice is relatively lower than in other countries.

In other words, each country should specialize in the production of those goods, the expansion of production of which is associated with a lower cost of choice than in the countries to which it wants to sell these goods.

In real commercial practice, of course, no one makes such scientific calculations. They are completely replaced by an analysis of the ratio of prices on domestic and foreign markets, since this ratio, ceteris paribus, corresponds to differences in the relative efficiency of production of goods.

Let's imagine that the prices of 1 ton of cement and 1 sq. m of glass in Russia will amount to 5 thousand rubles. In Ukraine, 1 ton of cement will cost 20 thousand hryvnia, and glass - 40 thousand hryvnia. If now a Russian entrepreneur exports 1 m2 of glass to Ukraine, then with the proceeds (40 thousand hryvnia) he will be able to buy 2 tons of cement, whereas in Russia - only one.

If he now imports this cement to Russia, he will receive 10 thousand rubles for it. - twice as much as he initially spent on the production of the amount of glass that he exported to Ukraine. The difference between these amounts, i.e. 5 thousand rubles (10 - 5) will be the profit of our economically literate entrepreneur.

Although this calculation is simplified to the limit, it is on the basis of such an analysis that all foreign trade activities are built. Any entrepreneur reasons very simply: it is profitable to export those domestic goods, with the proceeds from the sale of which you can buy more other locally produced goods abroad than similar goods on the domestic market.

This is how huge foreign trade firms structure their commercial practices. All of them are guided in their activities by the principle of relative advantage. This logic of foreign trade immediately affects domestic economic life. The interests of merchants encourage each country to seek such a specialization of its economy that will allow it:

- make the most efficient use of its available resources;

- achieve the highest level of welfare for its citizens through export and import operations.

The process of such specialization creates the basis not only for the development of the world market, but also for the international division and cooperation of labor, that is, the organization of joint activities of firms from different countries in the creation of certain types of final goods. How deep the international division of labor can be can be judged by the following example.

A US resident buying a Pontiac car from the American company General Motors is actually making an international transaction. He pays 10 thousand dollars for this machine, which is distributed as follows: 3 thousand dollars goes to South Korea, whose workers carried out simple and labor-intensive assembly operations; $1850 - Japan for engines, drive axles, and electronic devices purchased from it; Germany receives $700 for the construction of this machine; $450 is transferred to firms in Taiwan, Singapore and Hong Kong for the manufacture of small parts; 250 dollars go to the accounts of English companies for organizing advertising and sales of cars; The services of firms in Ireland and Barbados involved in data processing cost $50. In total, approximately $6 thousand goes to citizens of other countries.

The share of US citizens - managers and shareholders of General Motors, lawyers and bankers serving the company, and other participants in the production of this “American” car - accounts for only 4 thousand dollars.

International trade, if it is based on the principle of comparative advantage and does not encounter any obstacles on its way, turns out to be beneficial for all its participants.

Yet the development of international trade has always been fraught with conflict and opposition. To understand their reasons, let's look at a letter written more than 100 years ago by the French economist Frederic Bastiat (1801 - 1850) for his book “Economic Sophisms.” Ridiculing the arguments of opponents of free international trade, Bastiat “on behalf of the fighters for the integrity of the internal market” wrote:

CHAMBER OF DEPUTIES

We are subject to fierce competition from a foreign rival who has such superior light-producing apparatus that he is able to flood our national market by offering his product at reduced prices. This rival is none other than the sun. We are petitioning for a law to be passed to close all the windows, openings and cracks through which sunlight usually enters our homes, thereby harming the profitable industry with which we have been able to bestow upon the country.

Manufacturers of candles and candlesticks

Of course, it never occurs to anyone to fight the sunlight. But similar calls are familiar to governments around the world. Businessmen often make great efforts to force the state to block foreign competitors from entering the national market. Under pressure from such demands, the governments of many countries are more or less actively pursuing a policy of protectionism (from the Latin protectio - literally “cover”).

Protectionism- state economic policy, the essence of which is to protect domestic producers of goods from competition from firms in other countries by establishing various types of restrictions on imports.

The situation of penetration of goods from foreign manufacturers into the domestic market is a constant source of economic and political friction in many countries of the world. The government needs to calculate its economic policy in such a way that the country as a whole benefits, and does not lose, from the appearance of imported goods on its markets. Let's consider the pros and cons of the appearance of cheap imported goods on the domestic market (Table 15-1).

Analyzing this table, we see a classic example of contradictions between the economic interests of different groups of citizens of the country.

Under pressure from industry lobbies, the Russian government is forced to take measures to protect domestic producers from complete and rapid collapse. For this purpose, a number of measures of state regulation of imports are applied. The most common and flexible instrument of this kind is customs duties - a tax in favor of the state levied when crossing the border from the owner of foreign-made goods imported into the country for sale.

Table 15-1

| pros | Minuses |

|---|---|

|

|

Having paid the duty, the owner of the imported product is forced to increase its price in order to avoid losses and make a profit. As a result, the foreign product becomes more expensive and loses some of the relative superiority that makes it competitive.

The introduction of such duties also means that buyers begin to pay a new - special - tax in support of a certain branch of domestic industry. Its products become competitive without any effort: there is no need to reduce costs, improve quality, or improve after-sales service. Sales will be ensured automatically - due to the “duty weights” on the feet of competitors from abroad.

But there is another important aspect that needs to be paid attention to.

The fact is that if foreign firms earn less from selling their goods on our domestic market, then they have less money to buy our goods for import into their countries.

In other words, the introduction of customs duties, while expanding the market for some sectors of domestic industry, simultaneously narrows it for others. This is what is meant when economists say: “If we take care of our imports, our exports will take care of themselves.”

Protectionism is such a long-standing policy that economic science has managed to thoroughly study all its pros and cons. The conclusion in all cases is the same: even if there are good reasons to support this or that sector of the domestic economy in the fight against foreign competitors, it is better to do this not by regulating imports. It is much more effective to simply give targeted subsidies to domestic firms in these industries.

To protect the domestic market and national producers, governments use protectionist instruments such as import quotas and licenses.

An import quota is a government-set limit on how much certain goods from a particular producing country can be imported into a country per year.

A foreign trade license is close in nature to a quota and is a permission issued by the state to import or export a certain type of goods into or out of a country.

It must be said that import quotas are the crudest method of protecting the market, and governments of other countries usually react to such a policy of an individual country very sharply, introducing similar quotas on the import of its goods.

The long experience of “trade wars” has taught the most developed countries that in such “wars” both sides lose and it is better to prevent the outbreak of “hostilities”. All this, combined with an understanding of the enormous importance of international trade for ensuring sustainable economic growth, forced many countries in the 20th century. abandon protectionism and begin to search for new methods of organizing the world market.

In 1947, 23 countries signed the General Agreement on Tariffs and Trade (more often called by the first letters of the English spelling GATT - General Agreement on Trade and Tariffs). The GATT is based on three principles born out of the centuries-old history of international trade:

- all GATT member countries will apply the same export and import regulation measures to each other, without discriminating against one or more countries compared to others;

- all countries will strive to reduce customs duties in order to open the way for a fuller and more accurate use of their relative superiority and a rational international division of labor;

- GATT member countries will abandon the crudest form of protection of their markets - import quotas.

Today, this Agreement has already been signed by more than 100 countries. Its effectiveness can be judged by the reduction of customs duties in GATT member countries. So, in the 80s. The average import tariff on raw materials in industrialized countries fell from 2.5 to 1.6%, and on industrial products from 10.5 to 6.4%. The success of GATT led to the creation on its basis of the World Trade Organization (WTO), which Russia is now trying to join through long and difficult negotiations.

The reason for this desire is simple: while observing the principles of civilized trade in relation to each other, the GATT/WTO member countries behave in a completely different way towards countries that do not participate in this Agreement. And Russia feels this very painfully. Today it is an outsider in the world market, and restrictive duties on Russian goods, under the pretext of anti-dumping procedures, are established by the United States, the European Union, Mexico, Brazil, India, and Poland.

Dumping- sale of goods at a price lower than production costs or significantly lower than that prevailing in a given market.

As a result, due to such barriers to its export goods, Russia annually loses about $2.5-3 billion in sales revenue. It is almost impossible to negotiate every case of imposition of prohibitively high duties on Russian goods. Salvation can only come from joining the WTO, although it will require a corresponding renunciation of duty protection for the domestic market.

Negotiations on Russia's accession to the WTO have been going on since 1995, and all these years a heated debate between supporters and opponents of this step has continued in our country. Supporters of accession draw the attention of their opponents to the fact that 146 countries have already become members of the WTO, i.e. almost the entire planet. Nepal and Cambodia have recently been admitted and the number of Sfan members of the WTO will increase in the coming years. And therefore, any country that wants to take an equal part in world trade seeks to become a member of the WTO. There is little point in Russia avoiding this, since exports play a huge role in our country's economy.

Having joined the WTO, Russia:

- will receive better than existing and non-discriminatory conditions for access of Russian products to foreign markets;

- will be able to take advantage of international mechanisms for resolving trade disputes;

- will provide a more favorable climate for foreign investment;

- will expand opportunities for Russian firms to do business in WTO member countries;

- will create conditions for improving the quality and competitiveness of domestic products as a result of increasing the flow of foreign goods, services and investments into the Russian market;

- will be able to participate in the development of international trade rules taking into account its national interests;

- will improve its reputation in the world as a full participant in international trade.

But such a step also has serious opponents, since Russia’s accession to the WTO will lead to a sharp intensification of competition between domestic producers and firms from economically more developed countries of the West and East. Meanwhile, Russia is a northern country, and work in this climate requires large expenses not only for heating and lighting, but also for the creation and maintenance of those capacities that provide the country and its enterprises with competitiveness in the market. As a result, domestic firms often have higher costs, and in an open economy (after joining the WTO), such firms can quickly go bankrupt and their employees lose their jobs.

Now the Russian Government is conducting complex negotiations on the conditions under which Russia can join the WTO, i.e., it is trying to achieve the most favorable balance between the benefits of accession and the concessions necessary for this (in the form of lowering tariffs on imports of goods and opening domestic markets).

It should be remembered that there will always be contradictions between national and foreign producers in the world economy as long as the national interests of individual countries exist. The whole question is in organizing a mechanism for eliminating or smoothing out contradictions. International trade organizations are just a way (very far from ideal) of coordinating interests.

Development of international trade in the 20th century. has indeed turned it into a decisive factor in economic growth for most countries in the world. According to economists' calculations, the full implementation of all the tasks of global trade liberalization envisaged during the creation of the WTO could lead to an increase in the daily income of every citizen of the developed countries of the world by 40 US cents, or $146 per year. Understanding this forced many countries to take steps that at the beginning of the 20th century. seemed simply unthinkable.

We are talking about the complete opening by countries of their national markets within the framework of trade unions, or, as they are more often called, international free trade zones.

The most famous free trade area is the aforementioned European Union (EU), created under the name of the European Economic Community in 1958 and today comprising the vast majority of Western European countries.

The single internal market of the European Union (hereinafter referred to as the EU) is a unique interstate space in which the barrier function of internal state borders is abolished, there are no national obstacles to market relations, discriminatory restrictions on the movement of goods, services, capital, labor, legal entities and individuals are prohibited, spatial differences in factors and results of economic activity are reduced.

The concepts of "internal market", "single market" and "common" market are often used interchangeably, and yet only slightly, but these concepts have semantic nuances. The common market is a stage of international economic integration, which involves not only the abolition of internal import and export duties, but also the creation of all conditions for the free movement of goods, works and services, as well as capital and labor resources. The concept of a single market emphasizes equality of conditions and mandatory national treatment for all goods, works, services and factors of production. This is reflected in the position of the Court of Justice of the European Union in its judgment of 5 May 1982 in Case 15/81 Gaston Schul Douane Expediteur BV ν Inspecteur der Invoerrechten en Accijnzen: the common market aims to eliminate all barriers to intra-community trade with a view to mergers national markets into a single market; Moreover, the benefits of such a market should be available not only to business players, but also to individuals. For a common and single market, it is important to maintain a level playing field, which is achieved through harmonized regulation. This may be followed by the stage of transformation of the united national markets into the internal market, which implies not only harmonization, but also unified regulation of all aspects and areas of the market. Let us consider how these stages took place within the EU.

The creation of a single European economic space and the construction of a common market was one of the main goals of the Treaty of Rome of 1957. Art. 2 of the Treaty on the European Economic Community established: “The Community aims to promote, through the creation of a common market and progressive convergence of the economic policies of the Member States, the harmonious development of economic activity throughout the Community, continuous and balanced growth, increasing stability, accelerated improvements in living standards and closer links between the states which it unites."

The Treaty of Rome provided for the gradual implementation of the common market concept over 12 years after the treaty entered into force (three stages of four years each). Firstly, the formation of a common market required the elimination of all import and export duties between member states, i.e., the transition to a common market was possible only after the creation of a customs union. If customs barriers were eliminated quite quickly between the EEC member states, even earlier than the deadlines they had set, then the formation of a common market required not only trade liberalization, but also the free movement of production factors: labor, capital, services. In addition to these freedoms, it is also necessary to talk about the free establishment of companies on the territory of the member states for the development of business and an active sector of the economy.

In general, by January 1, 1970, the foundations of the common market were laid. The general rules that remain unchanged now are as follows.

Within the common market, obstacles to competition and interaction between the economies of the member states must be eliminated. The conditions under which these restrictions are eliminated are called the “principles of the common market” or “freedom of the common market”: freedom of movement of goods, freedom of movement of persons, freedom of movement of services, freedom of movement of capital. The method of forming a common market is the method of positive integration, i.e. not only eliminating obstacles and barriers (negative integration), but also pursuing an active policy of a common harmonized, coordinated and coordinated format for market regulation.

In 1985, the President of the European Commission, Jacques Delors, spoke about the need to reach the single market stage by 1992. The concept of a single market was laid down in the Single European Act 1986 (SEA). The significance of the EEA's formulation was that measures to create a common market were complemented by the elimination of technical barriers to trade between member countries and the abolition of border control formalities within the Community.

The Treaty on the EU (Maastricht Treaty of 1992) made significant changes to the section “Common Trade Policy”, in particular, the articles defining the procedure and stages for the formation of a common trade policy were abolished. The Maastricht Treaty significantly limited the powers of member states to introduce protective trade measures: since 1993, such measures could be taken by states independently only with the prior permission of the Commission. The concept of a single market began to really function on January 1, 1993 and today is an integral part of the economic and monetary union of the member states.

The Lisbon Treaty of 2007 does not refer to the categories “single market”, “common market”, the term “internal market” appears in it. Nevertheless, the main characteristics of the internal market remain the same as for the common market: it is “a space without internal borders in which there is freedom of movement of goods, persons, services and capital” (Clause 2 of Article 26 of the Treaty on the Functioning of the EU). If, in the opinion of the Commission, in order to ensure the uniform development of the internal market, exemptions are provided for any positions, then they should be temporary and cause as little disruption as possible to the functioning of the internal market.

Currently, in the Treaty on the Functioning of the EU, issues of the internal market are regulated by Art. Art. 26–66 and Protocol No. 27 on the internal market and competition. Competition issues are separately regulated (Articles 101–109 of the Treaty on the Functioning of the EU).

The internal market includes all EU member states without exception. Geographically, the common market regime also applies to 3 of the 4 member states of the European Free Trade Association (EFTA) (Iceland, Norway, Liechtenstein) on the basis of the Agreement on the European Economic Area of 1992. The Lisbon Treaty establishes the scope of the internal market within the framework of joint competence (Article 4 ). At the same time, competition rules are the exclusive competence of the Union (Article 3). Issues of the internal market are given such great importance that they are classified, among the few, among the issues of so-called implied competence under Art. 352 of the Treaty on the Functioning of the EU, by virtue of which the Council of the EU, acting unanimously on a proposal from the Commission and after the approval of the European Parliament, may decide to extend powers if necessary to realize the objectives of the internal market.

In the jurisprudence of the EU Court of Justice, the understanding of the scope of the internal market has been expanded: the internal market also covers issues of liability, including minimum fines for violations of EU law in the area of functioning of the internal market.

More on topic 6.1 Formation of a common, unified, internal market:

- TOPIC V FORMATION OF STRUCTURE AND INFO GROWTH OF THE PRODUCT MARKET STRUCTURE

- 1. European Cooperative Society (ECO) 1.1. General characteristics of ECO

- §1.1. General essence, institutional and legal framework of immigration policies of EU Member States

- §3.2. Providing political asylum and refugee status as a channel of legalization: political and legal difficulties in forming a common approach

By the beginning of the 21st century Russian economy found itself in an extremely unfavorable starting position.

As a result, unprecedentedly deep for peacetime and protracted crisis The economy has been set back several decades in terms of production volume, product competitiveness, level and quality of life, and management efficiency.

Wherein objective reasons and factors combined with major strategic mistakes, miscalculations and other subjective factors.

And yet Russian economy has not lost its viability, potential revival, development and transition to the post-industrial stage of development. The high level of education, qualifications of a significant part of the country’s labor potential, and a developed socio-cultural sphere (primarily science, culture and education), which is becoming key in the formation of a post-industrial society, have been preserved.

The country has a variety of species natural resources- mineral, land, forest, water. For many of them, it continues to be a unique treasure trove of the world for the 21st century and can take advantage of this to extract the world natural rent as a development resource.

Russia favors it geographical position on the shortest transport routes between rapidly developing countries of the East and West, which allows you to receive transport and tourist rents.

Preserved significant volume of the domestic market and its reintegration began, which is the basis for the development and increase in income of domestic producers. Not completely destroyed in the powerful past production potential and developed infrastructure, although they quickly become outdated and require large investments for radical updating.

There are also counteracting factors, preventing the revival of the Russian economy and increasing its role in the world economy. These are primarily unfavorable climatic conditions in most of the country, spatial dispersion of cities and villages, which leads to increased transport costs and people's livelihoods, the generally high level of production costs.

They interfere obsolescence and technical backwardness of the prevailing part of fixed assets, which were almost not updated in the 90s. and are largely unsuitable for the production of competitive goods and services.

In recent years Russia joined the world economy as supplier of fuel and raw materials(whose reserves, by the way, are running out) and the buyer of finished products.

According to World Bank, external debt increased from $59.8 billion in 1990 to $183.6 billion in 1998 and reached 62% of GNP. Debt payments with interest burdened the state budget. However, as of September 1, 2013, Russia’s external public debt decreased to $49.54 billion.

Very low investment attractiveness of the Russian economy for both domestic and foreign investors. Direct foreign investment in 2000 amounted to only $4.4 billion, but in 2012 year they increased to $51.4 billion.

Integration processes have positive and negative consequences for the countries participating in these processes.

When considering them, it is necessary to take into account that the part of national production that is sent for sale outside the country is increasingly increasing, i.e. for export. As the prosperity of countries grows, domestic consumption, covered by imported foreign goods, also increases. External factors of economic development that are gaining strength (the impact of export and import operations) will increasingly influence the development of domestic markets of national economies.

First of all, the competitive national industries and enterprises of the countries participating in the integration processes benefit.

New markets are opening up for the products of such industries, and the industry has the opportunity to increase production and achieve additional profits mainly by reducing costs and increasing production volumes.

At the same time, the opportunity opens up to end the monopoly position of national firms and enterprises due to the entry of foreign manufacturers - competitors - into the national market. This contributes to the growth of competitive trends; the national market is forced to react to the situation in other markets.

In almost every economy, to one degree or another, there are shortages of national factors of production, such as labor, capital, investment goods, etc. Integration helps solve these problems by moving these factors of production from other countries, which are no longer hampered by national borders.

At the same time, the problem of attracting international capital is simplified. The deeper a country is involved in the integration process, the more chances it has to attract global capital flows and accelerate its development with the help of resources attracted from outside.

All of the above makes national markets more dynamic, since in general the dynamically developing world market forces national markets to take conscious actions aimed at their entry into the world market on a full basis.

The positive aspects of international integration flows coexist with inevitable losses. One of the main losses may be due to the sharp pressure of the competitive environment and the need to quickly regroup resources. This process, as a rule, is accompanied by the bankruptcy of inefficient producers (and this is, in general, good) and often mass unemployment (which is bad, since social tensions are exacerbated). At the same time, the emergence of new vacancies is usually not able to compensate for the number of lost jobs.

Due to the fact that the state has to take on a number of obligations in order to comply with certain international standards (ecology, living environment, etc.), the level of taxation may increase.

If the integration process reaches a wide scale, then changes in business practices may occur in countries, many established everyday traditions disappear, which causes some discomfort among some segments of the population, especially among those who have lost a stable income as a result of these changes. Therefore, an almost ideal option is the integration union of countries with similar levels of economic and social development. It is no coincidence that, for example, the European Union sets conditions for countries wishing to join it to achieve a certain level of economic development.

The second serious loss may be the aggressive “offensive” of foreign capital, which seeks to occupy the most profitable business niches, leaving the markets of medium and small businesses to local producers.

Since, in the context of globalization, the national market becomes the place where international information and financial flows take place, i.e. turns into an integral part of the world market structure and international global networks pass through it, weakening the counterbalance to the onslaught on national markets from successful foreign businesses.

The removal of borders, for its part, leads to an outflow of resources, including human resources, to more successfully and intensively developing regions. The danger of this lies in the fact that the country sharply loses the opportunity to modernize the real sector, its “intellectual efficiency” falls, and therefore its ability to be an equal member of the integration association.

Import dependence is another threat to the national market. In this case, domestic producers are pushed out of the leading positions of the national market, which practically makes the country dependent on imported goods supplies, and the economic security of the country is lost.

A serious problem for the country can be created by its dependence on the movement of international speculative financial capital, since the globalization of financial markets has almost completed, and the possibility of rapid inflows and sudden outflows of “hot” money leads to turmoil in the capital market.

Negative factors in integration processes can be mitigated by a number of actions taken at the state level. These include:

orientation of economic growth towards innovative processes;

integration of the country's national market into the global network of TNCs as one of the components of the process of internationalization of production;

finding adequate sales markets, i.e. markets where domestic exports could find demand;

diversification of national production, i.e. simultaneous development of many unrelated technological types of production and other business activities, expansion of the range of goods and services produced;

a well-thought-out policy of attracting foreign investment as a tool for economic diversification;

protection against speculative financial capital through capital account restrictions, or restrictions on the flow of such capital into a country.

Domestic markets of industrialized capitalist countries

The economic development of countries is largely determined by the nature and depth of the social division of labor, during which the development of internal markets occurs. The conditions of their functioning affect the efficiency of production, both its individual types and the economic system as a whole. The internal market, which refers to the system of exchange within the national economy without the export-import sector, is the primary element of the entire system of functioning of the world economy. It includes internal connections that characterize the scale and forms of interaction between various types of production that are part of the national economy. External relations serve the participation of the national economy in the world economy. Analysis of domestic markets shows the driving forces of economic processes in each individual country and, to a certain extent, in the subsystem as a whole.

Volume and level of development of domestic markets

- 1. The scale of the domestic markets of most industrialized countries, measured by GDP, stands out among all countries in the world. They are among the top 50 markets. Only when calculating the gross product on the basis of the purchasing power of currencies, which takes into account the non-market sector of developing countries, the position of Western countries looks somewhat weaker. In this case, the world's ten largest economies include only six Western national economies. Noting the size of GDP as one of the indicators of the volume of the domestic market, it should be noted that a number of small countries are characterized by a high degree of internationalization of their economic activities. Thus, the export quota for Belgium is 70% of GDP, for Ireland - 67, the Netherlands - 52, Austria - 40, Switzerland, Denmark - 37% of GDP. Within these limits, such countries also have an import quota. Consequently, the size of the domestic markets of small countries relative to GDP is small, and they are largely dependent on certain sectors of the world market. In large developed countries, the foreign segment in production and sales of GDP is 20-30%, while in the USA and Japan it is 10-15%.

- 2. Another general indicator of the volume and degree of development of the domestic market is per capita income. In general, this figure for industrialized countries is five times higher than the world average. All countries of the considered subsystem of the world economy are among the 30 leading countries in the world in terms of this indicator. The first places in terms of GDP per capita are occupied by Switzerland, Luxembourg, Japan, Sweden, Norway, Denmark, and the lowest group includes Greece, Spain, Portugal, Ireland, and South Africa.

- 3. The size of the market depends on the number of consumers served. The larger the society for whose needs domestic production is designed, the wider the opportunities for its development, although a certain part of consumers act as producers. Therefore, the population size serves as a certain guideline for the consumer and productive potential of a society, although there is no direct connection between the size of the population and the volume of the domestic market. The role of the number of consumers is usually inversely proportional to the level of development of a country. Most industrialized countries are classified as medium and small countries. Only two countries (USA and Japan) have a population exceeding 100 million people, four have 50 million people, and ten countries have populations that do not exceed 10 million; Iceland and Luxembourg have less than 0.5 million consumers. Small population size, along with a high level of development of productive forces, contributes to the specialization of production and active participation in the international division of labor, encouraging small and medium-sized countries to economic integration. international economic market

- 4. A characteristic feature of the markets of the First World countries is the satisfaction of the demand of almost the entire population with commodity production. This is due to the spread of hired labor and the high-quality nature of hiring. On average, the share of hired workers is about 85% of the self-employed population, including over 90% in Britain and the USA. Informal activities play a minor role in most Western countries. Southern European countries are a definite exception. Accordingly, an important feature of domestic markets is the close relationship between production and consumption.

- 5. The capacity of domestic markets depends on the relationship between divisions and sectors of the economy, on their demand for the main elements of the final product. In the countries under consideration, domestic markets are characterized by a high level of inter-industry and intra-industry supplies, including intermediate products and investment products. The main factor in inter-industry connections is vertical integration, which will lead to increased dependence of reproductive processes in each industry on other industries, both in terms of demand and supply.

- 6. One of the most important indicators of the development of domestic markets is the level of development of market monetary relations, which can be expressed as the ratio of credit obligations within the country to GDP. In the first half of the 90s, loans received in leading Western countries exceeded 100% of GDP, compared to 50-60% in the 50s.

- 7. Along with the general capacity of domestic markets, the composition and nature of consumption, which represents the use of use value, is important. It consists of production and consumer demand. Industrial consumption is part of the production process and includes the production of means of production (tools and objects of labor) and the consumption of labor power, that is, the expenditure of its physical and spiritual energy. Non-productive consumption occurs outside of production. In the process, consumer goods are used or finally consumed. Thus, in the process of productive consumption, products are created, and in the process of non-productive consumption they are consumed.

Manufacturing demand is determined by the state of the production sector, and aggregate consumer demand is determined by the monetary requirements of mainly individuals. In turn, both industrial demand and consumer demand depend on the private and public sectors. In a long historical retrospective, there has been a decline in the share of private consumption of GDP. In 1820, it was obviously about 85%, in the early 90s of the current century - 61% of GDP. In recent decades, private consumption has grown at a faster rate.

Consumption (demand) and production (supply) are stages of the same process. A number of researchers believe that people’s attitude towards means of consumption has become more important than their attitude towards means of production, forgetting that the latter ensures the availability of the former. Ultimately, the level of consumption is determined by the development of production and productive forces.